Australia M&A - JERA agree to acquire 15.1% stake in Scarborough from Woodside

(Originally published on February 23, 2024)

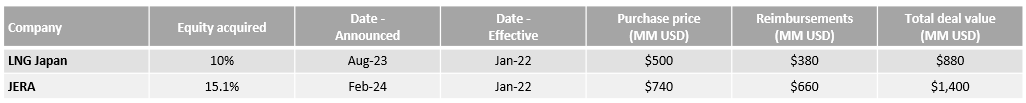

Today, Woodside Energy have announced that they have entered into a binding sale and purchase agreement to divest a 15.1% stake in the Scarborough project to JERA. The deal has an effective date of 1 January 2022 (essentially from FID) and is expected to complete in the second half of 2024.

The purchase price for the deal is US$ 740 million plus historical expenditure from the effective date to the close date, with the estimated total consideration being approximately US$ 1,400 million.

The Scarborough project

The Scarborough field is located approximately 375 km off the coast of Western Australia. Woodside have held an interest in the asset since 2016, when they acquired a 25% stake from BHP (who had held 50%), and became operator when they acquired ExxonMobil's 50% stake in 2018. In June 2022, Woodside announced a deal to merge with BHP's upstream division, giving them 100% interest in Scarborough. In August 2023, Woodside Energy announced that they had entered into a sale and purchase agreement to divest to divest a 10% stake in the Scarborough project to LNG Japan, a 50:50 JV between Sumitomo Corporation and Sojitz Corporation.

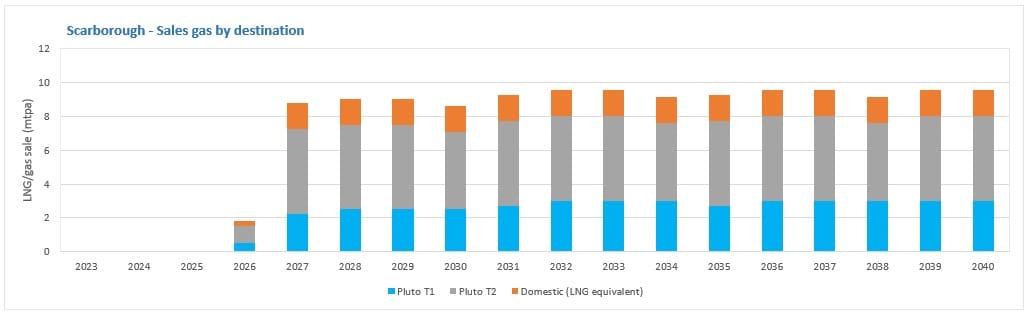

FID for the Scarborough development (which included the Scarborough field and Pluto Train 2) was taken in late-November 2021, with the field being developed using subsea wells and a submersible floating production unit (FPU). From the FPU, the gas will be sent to shore through a 430 km pipeline. Scarborough gas is underpinning the development of Pluto Train 2, where it will provide all of the gas to support the nameplate capacity of 5 mpta. It will also provide backfill for Pluto Train 1, to support up to 3 mpta of LNG exports. Finally, 225 TJ/d will be supplied to the domestic market.

I looked at the gas balances at the various west coast LNG plants in my article on January 3, 2023. The chart below captures this for Scarborough gas, with the addition of the domestic market sales.

Woodside motivation

Woodside had held 100% in both the upstream (Scarborough) and LNG (Pluto T2) elements of the project, exposing them to significant capital risk with a combined estimated CAPEX of US$ 12 billion. To reduce this risk, Woodside launched separate farm-down processes for both Scarborough and Pluto Train 2 in July 2021. In November 2022, Global Infrastructure Partners (GIP) agreed to acquire a 49% stake in Pluto Train 2, leaving Woodside with 51% in Pluto T2 and 100% in the Scarborough project. In August 2023, Woodside Energy announced that they had entered into a sale and purchase agreement to divest to divest a 10% stake in the Scarborough project to LNG Japan, a 50:50 JV between Sumitomo Corporation and Sojitz Corporation, reducing Woodside's stake in Scarborough to 90%.

This latest deal further dilutes Woodside's stake in Scarborough to 74.9%. For Woodside, this provides a nice reduction in the capital risk as well as ties into the Japanese LNG market, which is traditionally the biggest export market for Australian LNG.

Woodside could still look to bring in additional partners at Scarborough or they may be comfortable with their new position.

JERA motivation

JERA was established in 2015 as a 50:50 JV TEPCO and Chubu, with the JV targeted to cover the entire supply chain from upstream fuel investment and fuel procurement through power, and agree the road map for the joint venture’s formation. JERA already have an interest in a number of LNG projects in Australia, plus one in the USA:

- Bayu Undan + Darwin LNG (since 2003) - 6.13%

- Gorgon (2009) - 0.417% - Integrated gas to LNG

- Ichthys (2012) - 0.735% - Integrated gas to LNG

- Wheatstone (2012) - 0.81% in the upstream and 0.649% in the LNG plant

- Barossa (2022) - 12.5% - Upstream only (gas goes to Darwin LNG)

- Freeport LNG (2022) - 25.7%

They also act as an offtaker for these projects, either through offtake agreements or through their equity share in the LNG.

To me, this deal continues to show that Japanese companies recognize that LNG will remain an important energy source for the country, regardless of the pace of the energy transition. This deal provides them with an equity share of the LNG as well as non-binding heads of agreement for the sale and purchase of 6 LNG cargoes per year (approximately 0.45 million tonnes per annum) for 10 years commencing in 2026.

Comparison to LNG Japan deal

The two deals for Japanese companies to acquire a stake in Scarborough have the same effective date, making them easy enough to compare.

Looking at these numbers, it appears JERA got a 2% discount when compared to LNG Japan, but this could just be a rounding error.

My full analysis at the time of the LNG Japan deal can be found here: https://www.linkedin.com/pulse/australia-ma-sumitomo-sojitz-agree-acquire-10-stake-robert-chambers/

Questions and feedback

I have created this article through my own research. If you have any questions or feedback on the article then please drop me a DM.