Indonesia farm-in opportunity - Prima Energi - Northwest Natuna PSC

(Originally published on April 25, 2024)

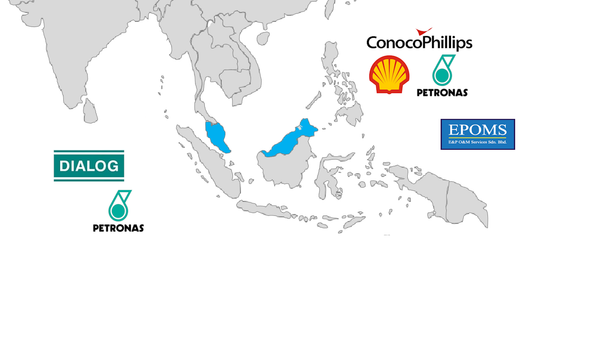

In July 2023, Prima Energi acquired 100% interest in the Northwest Natuna PSC from Mitsui & Co. Since acquiring the PSC, Prima Energi have been progressing options to develop the Ande Ande Lumut (AAL) heavy oil field and, in early-April, they launched tenders for FEED contracts for the key offshore facilities, with a view to awarding these contracts as soon as mid-year.

Whilst this is very positive, I believe that Prima Energi will likely need to find funding options for the development prior to taking FID, with a farm-in partner being one of the potential options. It should be noted that I am not aware of a formal process, I just see this as the logical next step.

Northwest Natuna PSC / Ande Ande Lumut- A long road to here

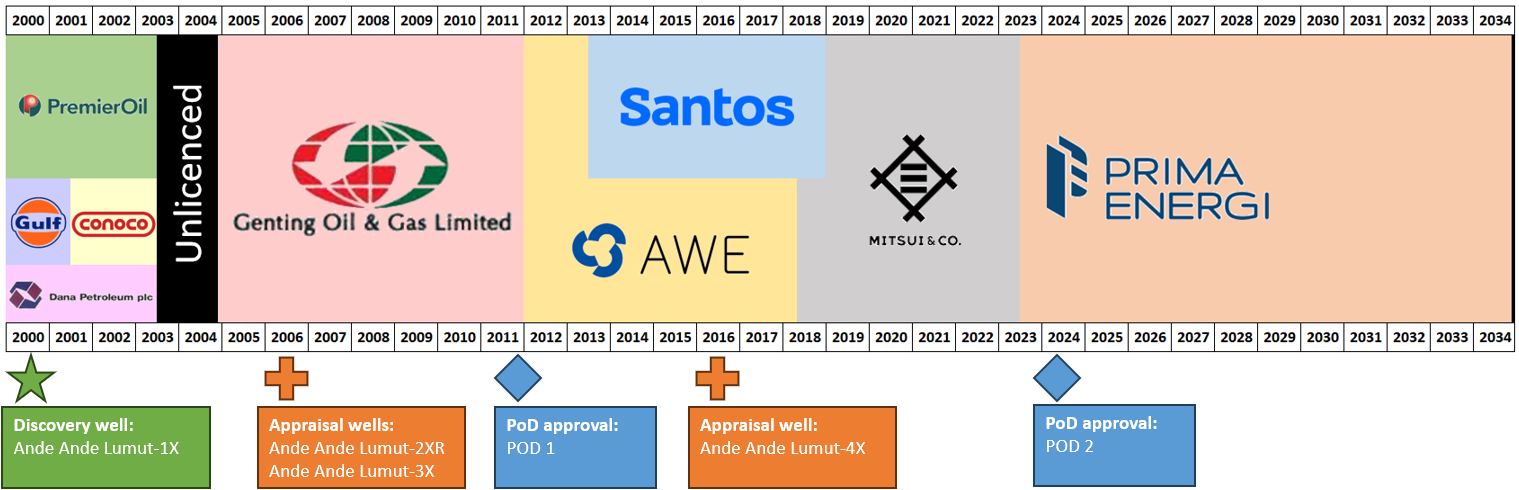

The Northwest Natuna PSC was officially awarded in December 2004 to Genting Oil & Gas (100% + operator). However, the discovery of the Ande Ande Lumut field dates to 2000, and the prior Northwest Natuna Block I. I have summarised the ownership history of the field together with the main events below:

Discovery by Premier Oil

The discovery of the Ande Ande Lumut (AAL) field was announced in mid-May 2000 by the then operator Premier Oil, together with their partners Gulf Indonesia Resources Limited, and Dana Petroleum. The discovery sits in waters about 73m deep and the discovery well was drilled to a depth of nearly 1,300m. Heavy oil was discovered in the K-sands (15°API) and G-sands (12°API). However, the discovery was considered uneconomic, and the partners chose to relinquish the acreage in 2003.

Progress to PoD approval under Genting Oil & Gas

Genting Oil & Gas were awarded the new Northwest Natuna PSC in December 2004. They undertook a 300 km2 3D seismic survey over the Ande Ande Lumut structure in 2005, with two successful appraisal wells then drilled in 2006. They proceeded with a Plan of Development (PoD) that was approved by the Indonesian government in late-2011. This PoD was based on the development of the K-sands, with stated 2P resources of 101 MMbbl. The approved PoD was based on wellhead platform and an FPSO, with 33 horizontal wells planned to develop the K-sand reservoir.

Further progress under AWE Limited & Santos despite low prices

In January 2012, AWE Limited acquired Genting's 100% interest and operatorship. Then, in July 2013, Santos acquired a 50% interest and operatorship from AWE.

The two Australian companies used reprocessed 3D seismic and proceeded to drill an appraisal well in 2016, with the focus being the G-sands. As a result, a revised PoD was submitted for approval in September 2017. The primary revision was the inclusion of the G-sand into the development. The development plan was still based on a wellhead platform and an FPSO, with 22 wells planned for the K-sand and 10 wells planned for the G-sand. I don't believe the PoD was ever approved. A report by RISC dated January 2018 gave a 2C resource of 93MMbbl, excluding economic cut off. However, AWE Limited reported a significantly lower 2C resource of 28.4 MMbbl (50% share, 56.8 MMbbl for 100%) at the end of 2017.

Limited progress under Mitsui & Co.

In May 2018, Mitsui & Co Ltd completed their takeover of AWE Limited and, in January 2019, they acquired Santos' 50% stake and operatorship in the Northwest Natuna PSC.

There were a number of reports about Mitsui looking to adjust to PoD, with subsea wells understood to be considered as well as increasing the production capacity. However, I don't believe any formal PoD revisions were submitted and certainly none were approved.

Prima Energi - A new hope?

Since acquiring the asset, Prima Energi have progressed rapidly, submitting a revised PoD which was approved in early-March 2024. The PoD approval is based on developing the field in two-phases, summarised below:

- Phase 1: would involve installing a Central Production Platform (CPP) and a leased FSO, with seven horizontal wells initially drilled from the CPP. This phase would be used as an early production system to allow Prima Energi to further understand the reservoirs as well as optimise well and completion designs. I understand the expected CAPEX for this phase is about US $300 million.

- Phase 2: would be adjusted based on the learnings from the first phase. The current outlined plan calls for a second platform to be installed in the field, with an additional 18 wells drilled (likely from both the existing CPP and the new platform). Whilst not explicitly stated, it is likely that the second phase would be contingent on the PSC being extended, with this becoming increasingly the case if/when FID and first production get pushed back.

Prima Energi have stated that production from the first phase could start by late-2026, which means FID would need to come pretty quickly

Key facts

- The Northwest Natuna PSC was awarded in December 2004 and is currently valid until December 2034. The PSC is under Cost Recovery terms.

- The current participating interests are Prima Energi (100% + operator).

- The Ande Ande Lumut field was discovered in 2000, with two appraisal wells drilled in 2006. and a further appraisal well drilled in 2016.

- Prima Energi have recently received approval for a revised plan of development (POD).

- The first phase of the approved PoD has an estimated development cost of about US $300 million.

Why invest

- The Ande Ande Lumut field is has an approved PoD, with the potential to have the field onstream by late-2026.

- The recoverable resource estimate that forms the basis of the current PoD is significantly below previous resource estimates. We could therefore infer that there is plenty of scope for upside.

- Further value can be unlocked through a PSC extension.

- Indonesia should want to see the field developed to help them progress towards their production growth goals.

- The Prima Energi team have a wealth of history in the region and in Indonesia. The also have a history with the asset dating back to Genting Oil & Gas days.

- The returns look healthy (based on my assumptions).

The challenges and unknowns

- This is Indonesia. Read my articles on the country for more details.

- The AAL Field is a challenging oil field due to its heavy oil nature (12 - 15°API) with sand production problem due to its unconsolidated sandstone reservoirs.

- This is an oil field, and therefore does little for the energy transition narrative of an investor.

- The current Northwest Natuna PSC is scheduled to expire in December 2034. Making timely development critical to realising value in this timeframe.

- A farm-in partner may need to carry Prima Energi to first oil.

- A local government partner will likely have a 10% farm-in option. This would both dilute the potential stake and could delay FID.

Summary

The Ande Ande Lumut field is one of the largest undeveloped oil discoveries in Indonesia and Prima Energi have shown commitment to quickly push towards FID. They have a team that understand the asset and understand Indonesia and, from my model at least, there is certainly potential to achieve value from developing the field at current oil prices.

If you would like to more about the asset, then drop me a message.