Indonesia M&A - Eni to acquire Chevron's remaining upstream assets

(Originally published on July 31, 2023)

Last week's IPA conference in Jakarta was full of positive news. I have already looked at the Abadi deal, which was closely followed by the announcement that the long-rumoured deal for Eni to acquire Chevron's remaining upstream assets in Indonesia has been agreed. Neither a transaction value or an effective date has been published but the closing of the deal will be subject to the governmental and regulatory approvals.

This deal should be considered in relation to the recent announcement that Eni will acquire Neptune Energy, see my previous article on this, and provides Eni with a very strong position in the basin.

What assets are involved?

Chevron's remaining assets in Indonesia are all located offshore Kalimantan, in the Kutei basin and were the basis of the much-vaunted Indonesian Deepwater Development (IDD) project. There are three PSC's involved in the deal, the Rapak PSC, the Ganal PSC and the Makassar Strait PSC. The Rapak and Ganal PSCs have the same ownership structure and so are considered together. Chevron's current stake in these PSCs is:

- Makassar Strait PSC (72% + operator): partners SIPC (18%), and Pertamina (10%). Eni post-close will be 72% + operator.

- Rapak and Ganal PSCs (62% + operator): partners Eni (20%), and SIPC (18%). Eni post-close will be 82% + operator.

There is some production from both the Makassar Strait PSC and the Rapak PSC. From the Makassar Strait PSC production comes from the West Seno field and from the Rapak PSC production is from the Bangka field, that is tied-into the West Seno processing facilities. The combined current gross oil production is likely to be around 1,000 bbl/d, with current gross gas production around 25 MMscf/d.

However, the big potential of the assets is to unlock the undeveloped gas from the fields that form a part of the long-proposed IDD project. There are two hubs of fields involved (North and South).

IDD - Southern hub - Potential fast-track development

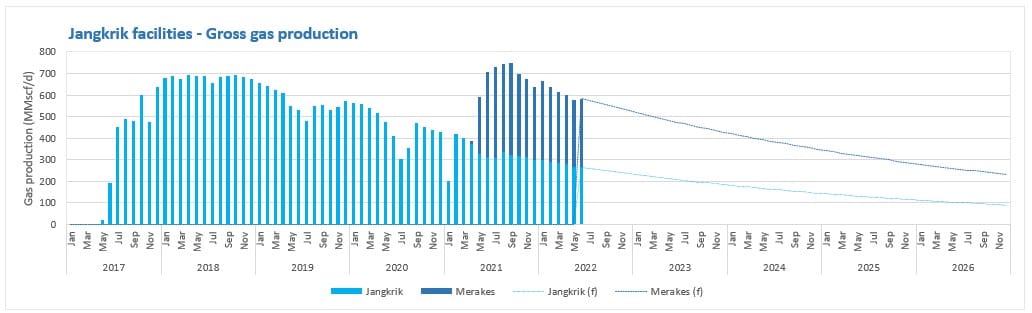

The South fields are Gendalo and Gandang and are located within 25-40km of Eni's existing Jangkrik development in the Muara Bakau PSC and could be fast-tracked into development to backfill production declines from the Jangkrik and Merakes (East Sepinggan PSC) fields that are both currently processed at the Jangkrik facilities. The historical production from these fields is shown in the chart below, together with a simple decline-based forecast I have added.

Eni have other existing options to backfill these facilities, most notably the Maha (West Ganal PSC) and Merakes East (East Sepinggan PSC) fields but it is likely they were waiting on the conclusion of this deal before making a decisions, as the two southern IDD fields offer significantly greater gas resources and are no harder to tie-back into the existing infrastructure. The latest POD (from 2019) for the IDD project was based on the southern hub producing 500 MMscf/d.

IDD - Northern hub - Jangkrik 2?

The northern hub of the IDD project, based on the 2019 POD, would include the development of the Gehem and Ranggas fields, with the POD based on a combined production rate of 420 MMscf/d. There is no existing offshore infrastructure that can be used to develop these fields so we are likely to see a development similar to that at Jangkrik, namely deepwater subsea wells tied-back to a new floating platform unit (FPU). Alternatively, they could look to apply what I believe was Chevron's most recent concept in which the fields were tied-back to a fixed platform on the shelf. The gas would then be sent to shore and on to the Bontang LNG plant. The original nameplate capacity of Jangrkik was 450 MMscf/d (but it has produced at significantly higher rates) so a similar design could easily be applied that would also leave room for the exploration potential around the existing northern fields.

Eni - Kutei basin masters once deals complete

Once the Neptune and Chevron deals close, the rights holdings of the assets involved will be:

From the Neptune Deal:

- Muara Bakau PSC: Eni (88.33% + operator), and Saka Energi (11.67%).

- East Sepinggan PSC: Eni (85% + operator), and Pertamina (15%).

- West Ganal PSC: Eni (70% + operator), and Pertamina (30%).

- North Ganal PSC: Eni (88.26% + operator), North Ganal Energy (11.74%).

- East Ganal PSC: Eni (100% + operator).

From the Chevron deal:

- Makassar Strait PSC: Eni (72% + operator), SIPC (18%), and Pertamina (10%).

- Rapak and Ganal PSCs: Eni (82% + operator), and SIPC (18%).

Potential M&A and farm-in opportunity

Once these two deals are complete, it creates a very tidy ownership structure across these key contracts, with Eni being operater and holding 70% to 100% interest in these contracts. We may see some harmonisation of the ownership structure across these assets to assist with the varying stakeholder priorities and some potential required unitisation of some of the fields across the blocks.

In addition, I can see an opportunity being created here for a potential farm-down of 15-30% in these assets, to bring Eni's stake down to maybe 50-60%. The gas-to-LNG nature (not to mention the low GHG intensity) of the assets should make them attractive to North Asian companies (Korean, Japanese, Chinese) as well as European and domestic companies.

Concluding comments

This deal is hugely positive for Indonesia and has the potential to unlock significant gas resources to help Indonesia move towards its 2030 production targets, with the fast-track development of the southern hub allowing the mitigation of production declines through the Jangkrik facilities.

Whilst it took a while to get here, the deal had the potential to drag out significantly longer given that the current Rapak and Ganal PSCs are set to expire in 2027/2028 and Chevron were in no rush to exit. I would expect to see an announcement shortly that these two PSCs have been extended as a part of the deal.