Indonesia - Reflections on 2023

(Originally published on January 9, 2024)

The last couple of years have seen a much more positive sentiment to upstream investors in Indonesia, and this has been followed-up with some positive actions. However, it is not all sunshine and rainbows, and some of the past issues continue to provide caution to investors.

This is the first of three articles looking at Indonesia. In this article, I will take a look at some of the upstream activities, with a focus on the improving investment environment and the positive actions.

Production targets - A clear driver for progress

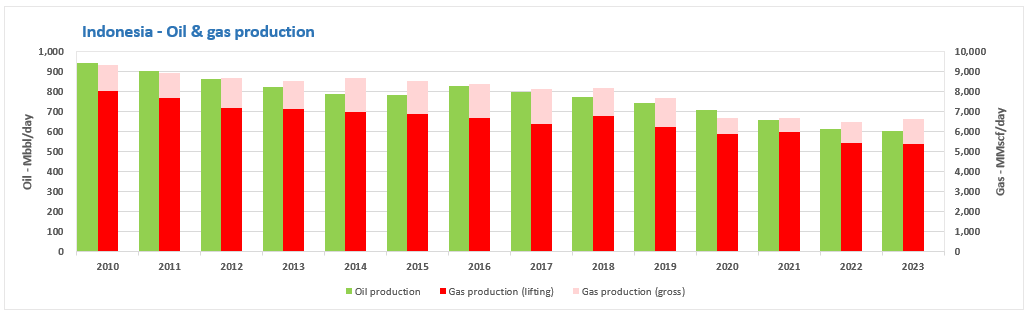

Back in 2019, the Indonesian government set 2030 production targets for oil (1,000 Mbbl/day) and gas (12,000 MMscf/day). These targets are aimed to support the energy demands of a growing economy and boost export revenues.

However, the production trends for both oil and gas show steady declines over the last five years, with oil production now around 600 Mbbl/day and gas production about 6,000 MMscf/d.

Whilst the 2030 targets are unlikely to be reached, they have set a clear intention for decisions to be made to support investment in the industry.

We have already seen positives for production growth in 2023, with some major projects coming onstream, the most significant of which is Tangguh Train 3, which shipped its first cargo in October and resulted in a flattening of gas production and will likely result in some gas production growth in 2024.

Above-ground improvements

We have seen some very positive steps on the above-ground side, with some clear learning from past mistakes, particularly from the 2010's.

- Fiscal terms progression (regression): I think it is fair to say that the switch to "Gross Split" fiscal terms was not well received by industry and, after hearing this feedback, Indonesia have responded to this. Initially, this response was seen in the terms offered during recent bid rounds, with blocks be offered either with Cost Recovery terms or a choice between Cost Recovery and Gross Split terms. More recently, it seems like Pertamina and MedcoEnergi are coming to the same conclusion, in that the change of terms has created a barrier to investment and challenges to maximising production from assets. December saw an announcement the government have approved MedcoEnergi's request to revert to Cost Recovery terms for the Corridor PSC. We also saw a headline last week that Pertamina want to do the same for at least seven of their blocks.

- Contract extensions: there was a wave of legacy PSCs that expired between 2018 to 2023, including some that contribute significant production volumes such as Mahakam Offshore, Rokan and Corridor. The general approach saw these PSCs awarded to Pertamina and/or a shift in contract type to the Gross Split regime. There is a second wave of PSCs that are due to expire from 2027 but it looks like there is a different approach, with early decisions seeing the contracts extended under the current (Cost Recovery) terms and with the current partners. We have seen this happen recently with PETRONAS' Ketapang PSC and the Pertamina operated Senoro-Toili PSC. There are still some big PSCs to resolve (more on that later) but the signs are certainly more positive.

I hope to see Indonesia continue this momentum, as well further improvements to some of the other areas that cause investors headaches, such as gas pricing, domestic gas and LNG allocation and some of the challenges when dealing with multiple ministries.

Unlocking major undeveloped resources

Indonesia has often struggled to bring major discoveries onstream in a timely manner. We have had major progress this year, with the Pareto Principle (80:20 rule) in full-effect. Two major projects that had been static for years finally seeing progress.

- Masela PSC (Abadi gas project): the development of Abadi seem to finally coming closed with two major ticks to getting the project to FID. The first tick came at the IPA conference, and saw Pertamina and PETRONAS acquire Shell's 35% stake in the project. The second, was the approval of a modified Plan of Development (PoD), which we saw in early-December. This included confirmation that CCS costs will be cost recoverable.

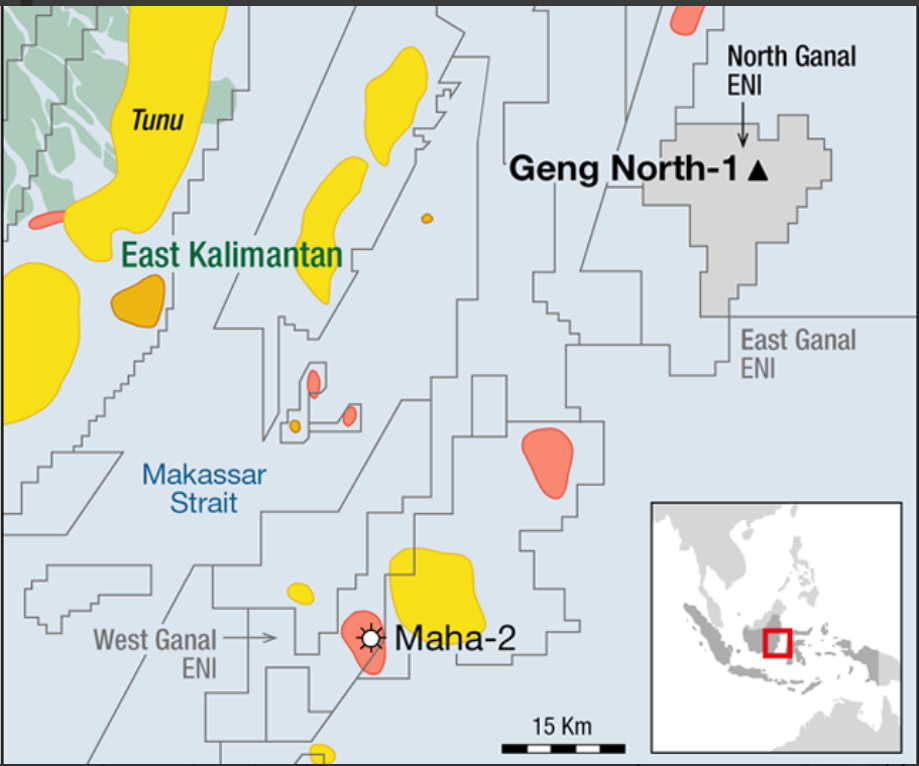

- Rapak & Ganal PSCs (IDD project): the IDD project is long-awaited, with Chevron reluctant to develop the project for a number of reasons. Again, we saw big movement this year, with Eni acquiring Chevron's remaining upstream assets in Indonesia which should allow them to bring the fields to development through existing and new facilities in the Kutei basin.

Exploration success

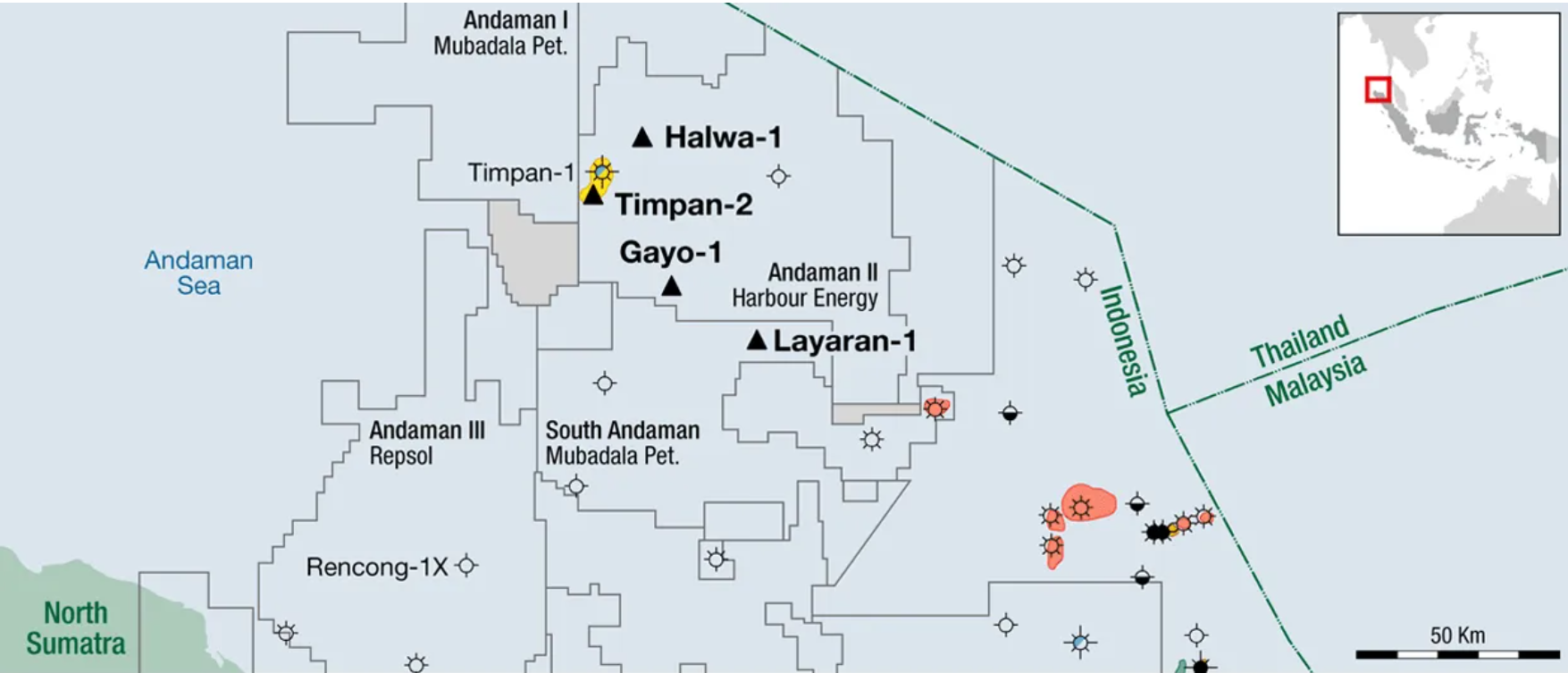

The last 18 months has been very exciting for exploration in Indonesia, with global-scale gas discoveries announced in the Andaman and Kutei basins:

- Andaman: the much discussed potential of Andaman is finally starting to mature. It stared in July 2022, when a discovery was announced at the Timpan-1 well in the Andaman II PSC (Harbour 40% + op, BP 30%, Mubadala 30%). Then, in December 2023, a second discovery was announced on the same play at the Layaran-1 well in the South Andaman PSC (Mubadala 80% + op, Harbour 20%). The mid-case resource for Timpan is 1 TCF, with a 6-12 TCF target volume across the entire play. For Layaran. the discovery has potential for over 6 TCF of gas-in-place. The Andaman drilling campaign continues, with the Gayo and Halwa prospects now being drilled in the Andaman II PSC, with an appraisal well at Timpan also expected. It should be noted that we also saw a dry well in Andaman, with Rencong-1X announced as dry in December 2022, although this was targeting a different play.

- Kutei basin: in October 2023 a discovery was announced at the Geng North-1 well in the North Ganal PSC (Eni 50.22% + op, Neptune 38.04%, Agra Energi 11.74%). The discovery is estimated to have more than 5 Tcf of gas in place, with 400 MMbbl of condensate.

All of these wells have been drilled using Aquadrill's (West) Capella drillship. With the same rig now back in Andaman to drill the Gayo and Halwa prospects.

Bid rounds

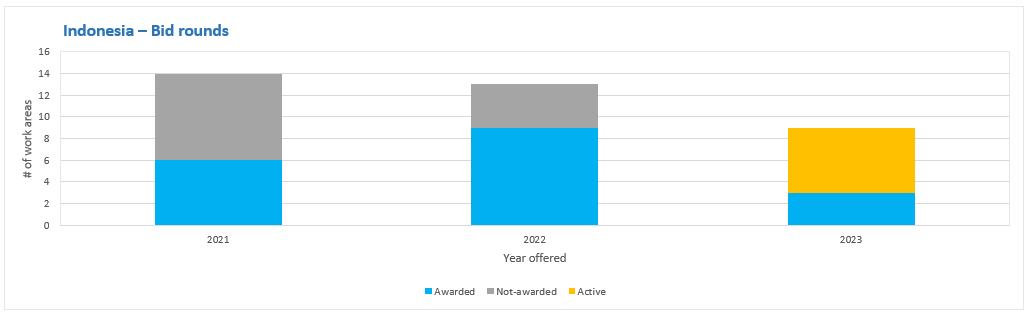

Following two (understandably) barren years in 2019 and 2020, Indonesia has consistently offered acreage through bid rounds in the last three years. There were two formal rounds in both 2021 and 2022 and three formal rounds in 2023, with direct awards also seen.

One key change for these rounds has been the a shift away from the Gross Split fiscal terms, with these blocks either being offered under Cost Recovery terms or operators given the choice between Cost Recovery and Gross Split terms. The chart below summarises the blocks offered and awarded over the last 3 years' rounds. it should be noted that the areas offered in the second and third bid rounds of 2023 are yet-to-be awarded and that the second round included the Natuna D-Alpha field.

- The 2021 rounds saw blocks awarded to a number of international companies, including BP, Husky (Cenovus) and Petronas Carigali as well a domestic companies such as Energi Mega Persada.

- The 2022 bid rounds saw further blocks awarded to international companies including Eni, POSCO (new entrant) and Conrad Asia Energy as well as a selection of local companies including Saka Energi.

- For 2023, awards have only been announced for the first round, with all three work areas offered seeing awards, with the awardees being MedcoEnergi, Texcal Mahato and a consortium of Bumi Armada and Pexco.

From the data I have, I believe that all 18 of the awards covered in the above analysis are under Cost Recovery terms.

Coming soon

This is the first of three articles focussing on Indonesia. The next (second) article will look at the changing company landscape, with the third looking at some of the big items for 2024.