M&A: Chevron to acquire Hess. What it means for the region

(Originally published on October 31, 2023)

Last week, we saw the announcement that Chevron have agreed to acquire Hess in an all-stock deal valued at US$ 53 billion. Whilst the deal is clearly driven by Hess' assets in North American and Guyana, they do have production in Southeast Asia, offshore Peninsular Malaysia and the MTJDA. In this article, I will review the assets held in the region by both companies and consider what the deal could mean for these assets.

I have not looked at Chevron's assets in Australia in this article as I don't believe the acquisition will see any change in strategy for these assets.

Chevron assets in Southeast Asia

Chevron (as Union Oil Company / Unocal Ltd / Chevron) have a long history in Southeast Asia, particularly in Indonesia and Thailand. However, in recent years we have seen the expiry and subsequent loss of key upstream assets in these countries. Resulting in Chevron's position shrinking significantly. I reviewed Chevron's position at the start of the year: https://www.linkedin.com/pulse/2023-ma-opportunities-southeast-asia-part-1-majors-robert-chambers/?trackingId=3PeYPOGeS6C4Zot2h5dAGw%3D%3D, since which we have seen them announce a sale of Yadana in Myanmar and their remaining upstream assets in Indonesia, both these deals are still to complete.

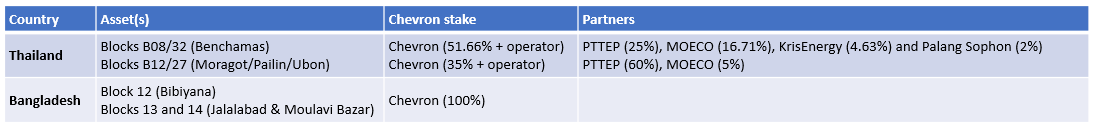

This leaves them with a minor position in Thailand and a larger position in Bangladesh, as summarised below:

- Thailand: with the loss of the Erawan concessions to PTTEP, Chevron’s upstream position is now limited to a couple of the smaller concessions that provide some production. There is potential to develop the Ubon project in B12/27, but FID would only be taken once the future of the concession post-expiry (in 2028) is resolved.

- Bangladesh: Chevron has a major role in Bangladesh, holding three producing assets in Bibiyana, Jalalabad and Moulvibazar, that produce over 50% of domestic gas production. In 2017, they announced the divestment of these assets to a conglomerate of Chinese companies. However, the sale was blocked and Chevron cancelled the sale.

Hess assets in Southeast Asia

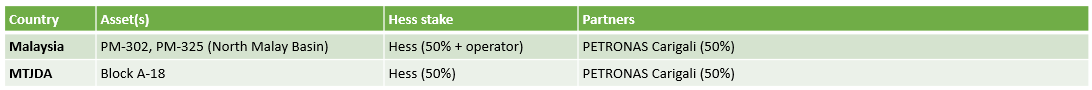

Hess (as Triton Energy / Amerada Hess / Hess) also have a long history in Southeast Asia and, over the years, have held positions in Brunei, Indonesia, Malaysia, Philippines and Thailand as well as the Malaysia-Thailand Joint Development Area (MTJDA). Their current position is limited to Malaysia and the MTJDA, as summarised below:

- Malaysia: Hess operate the North Malay Basin (NMB) project that is based onthe development of 10 gas fields with the PM-302 and PM-325 PSCs offshore Peninsular Malaysia. The first phased on the NMB development came onstream in 2017, with the latest phase (4) coming onstream in 2022. The gas is sent to shore in Peninsular Malaysia for sale into the domestic market.

- MTJDA: Carigali Hess Operating Company (CHOP) in which Hess holds a 50% stake operates Block A-18. The first development came onstream in 2005 and the second phase in 2008/2009. The gas is sold to PTT and PETRONAS for use into the domestic markets in Malaysia and Thailand.

Potential for divestment

Looking at the combined assets of Chevron and Hess, it would be easy to suggest that all of the assets have the potential to be divested once the deal is closed.

From the Chevron side,

- Thailand: an exit from the upstream business in Thailand seems pretty inevitable after their issues with Erawan asset, combined with the not-so-smooth handover. Their remaining concessions are due to expire in 2028 (B12/27) and 2030 (B08/32) so they may just look to maximise value until these points as their downstream business may limit any desire to divest.

- Bangladesh: Chevron had agreed to sell these assets in 2017 but the deal was blocked. It now seems likely that they will remain in the country.

From the Hess side, rumours have bounced around for a number of years now about the potential for Hess to divest to divest their Southeast Asia assets. In 2018, it was reported by Reuters (and others) that the assets were attracting interest with a potential value of US$ 4-5 billion reported. However, Hess spokeswoman Lorrie Hecker said in a statement: "JDA and North Malay Basin are significant long-term, low-cost cash generators, producing stable production and free cash flows, which provide funding for our compelling, long-term opportunities in Guyana and the Bakken."

Chevron shouldn't have any of the same funding challenges, so the assets could be looked at for divestment.

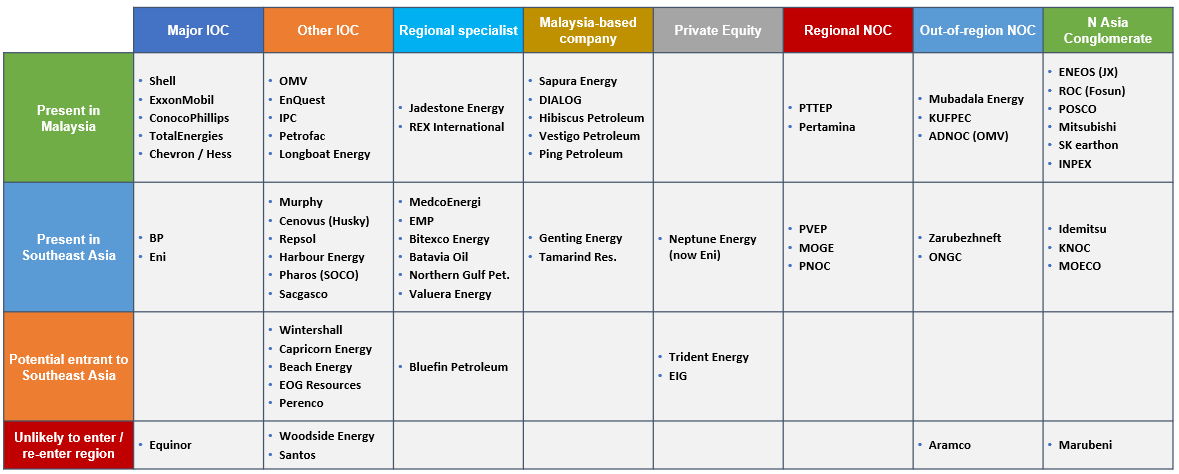

Potential buyers

Back in 2018, PTTEP and OMV were mentioned as potential buyers. PTTEP remain an obvious candidate, particularly for the JDA but OMV are now in the process of exiting the region. Looking at the pool of potential buyers:

From an international perspective, Trident Energy would be a good fit as they have previously shown interest in mature assets in Peninsular Malaysia. On the domestic side Hibiscus Petroleum would be a good fit to build on their 2021 acquisition of Repsol's assets. And who could forget MedcoEnergi and their continuing regional growth.

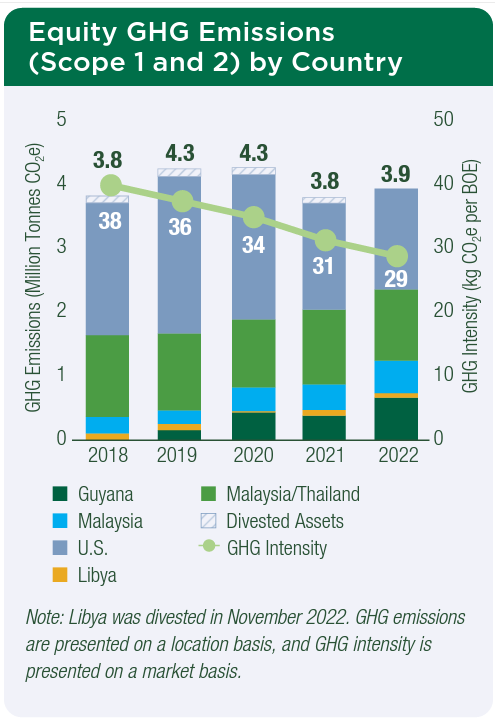

GHG emissions considerations - Hess assets

One complication for any potential buyer is the scope 1 and 2 emissions related to the Hess assets, in particular the MTJDA assets. The chart below is from Hess' 2022 sustainability report.

The combined production from the Malaysia and MTJDA assets made up about 18.6% of Hess production in 2022. However, these two assets contributed over 41% of the GHG emissions. I have estimated the MTJDA asset has an emissions intensity of about 78kg CO2e/boe and the Malaysian assets about 55kg CO2e/boe. Any potential buyer would have to be comfortable with what these assets would do to their emissions targets.