M&A in Australasia - 2022

2022 – A year of two halves

(Originally published on December 30, 2022)

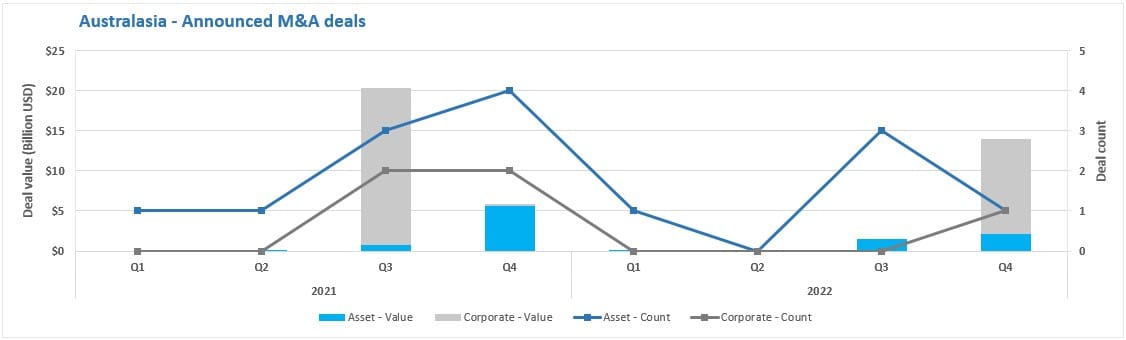

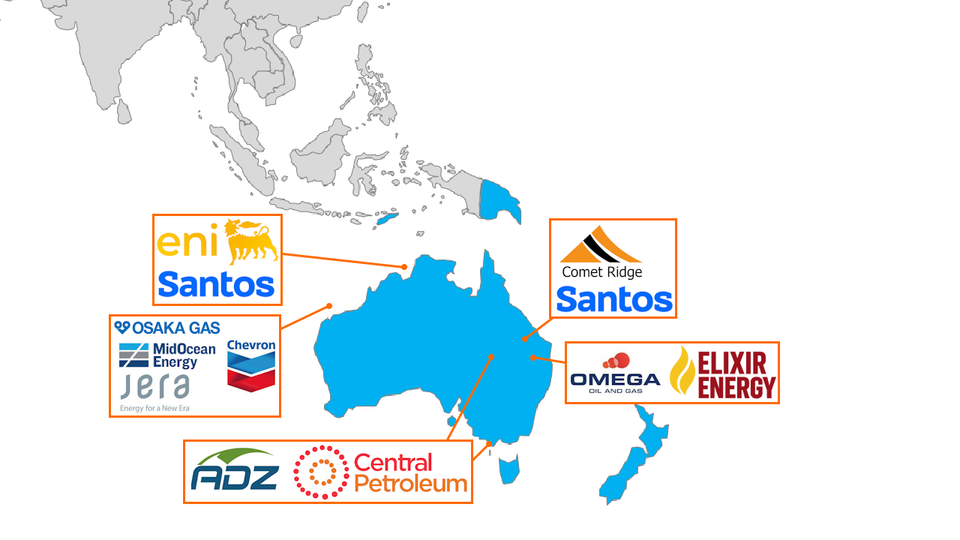

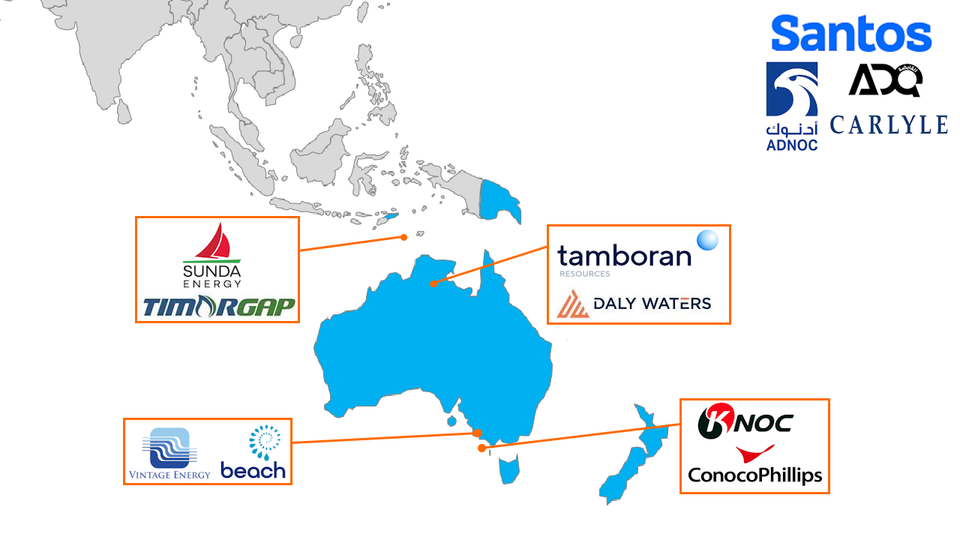

Oil and Gas related M&A transaction value decreased for both asset and corporate related transactions in 2022 vs 2021. However, there was plenty of activity, particularly in the second half of the year, with major transactions around the gas-to-LNG projects.