M&A in Australasia - 2023 Q1

(Originally published on April 3, 2023)

Q1 had been looking pretty quiet for Australasia, with focus firmly on the power struggle for the discoveries in the Perth Basin. However, the final week of the quarter saw a binding deal signed for the much-discussed takeover of Origin by Brookfield asset management and EIG and a follow-up deal for APLNG.

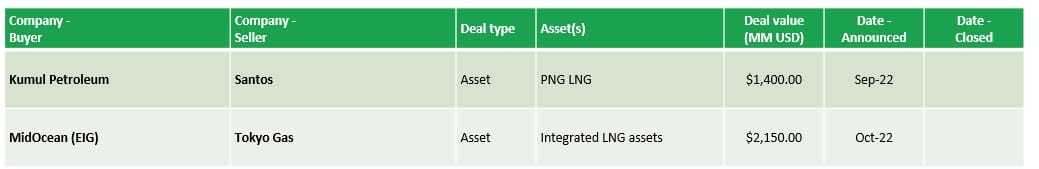

Major gas-to-LNG deals still pending completion

With all the recent excitement, it would be easy to forget that there are still a couple of key deals that are yet-to-complete, all involving gas-to-LNG projects.

- The first of these is EIG's (through MidOcean Energy) deal to acquire Tokyo Gas’ stake in four major integrated gas-to-LNG projects, namely Pluto + Pluto LNG T1, Gorgon LNG, QC LNG, and Ichthys. I haven't heard anything about this closing and there has been some discussion about the potential for Woodside to pre-empt at Pluto, although I see this as unlikely.

- The second is Kumul Petroleum's deal to acquire an additional 5% interest in PNG LNG from Santos. In late-December, it was announced that the exclusivity period for the deal was extended until 30 April 2023.

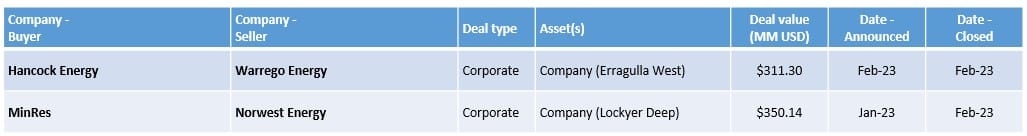

Deals announced in Q1 - Perth basin

The market got a little excited about the Perth basin in the second half of 2022, with consolidation activities driving prices upwards. There had been a number of bids and counter-bids around these assets in late-2022, but it took until Q1 for the victors to emerge.

- After a six-month battle, Hancock Energy finally manage to gain control of acquire Warrego Energy, with Beach and Strike admitting defeat. The all-scrip deal for AU $0.36/share was accepted in early-February, with a total deal value of AU $440 million (~US $311). .

- Along similar timelines, we saw MinRes take over Norwest Energy, who were their partners at the Lockyer Deep discovery. The all-scrip deal for AU $7.41/share was accepted by Norwest in late-January, with a total deal value of AU $497 million (~US $350).

- We have also seen interest in the exploration side, with both Talon Energy and New Zealand Oil & Gas (NZOG) each taking a 25% stake from Triangle Energy in Production Licence L7 and Exploration Permit EP437 where several prospects have been identified and reportedly analogous with other significant discoveries in the basin such as Waitsia and Erregulla West.

We will have to wait and see if there are further potential deals here but Strike Energy shareholders certainly aren't complaining, with their current market cap close to AU $1 billion.

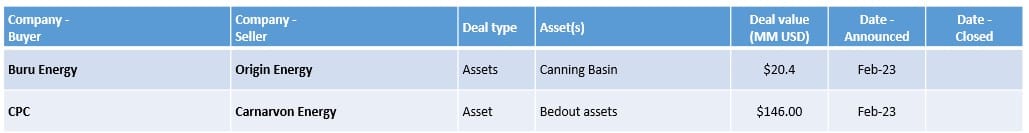

Deals announced in Q1

- In February, it was announced that Origin Energy would be withdrawing from a number of permits in the Canning basin, including EP 428 that holds the Rafael discovery. Buru Energy will take on the majority of Origin's interest, with Rey Resources also taking on some of the interest in a couple of permits. As a part of the withdrawal, Origin have agreed to fund up to AU $4 million for a survey at Rafael. In return, they will get up to AU $34 million in payments based on milestones on the field development. Completion is expected in Q2.

- Also in February, a deal was announced that will see Taiwan's CPC acquire a 10% stake of Carnarvon Energy's Bedout assets, including the Dorado discovery. Carnarvon had held 20-30% in these assets and so maintain a 10-20% stake, including a 10% stake in Dorado. The total deal value was US $146 million (initial cash consideration of US $56 million + carry of US $90 million on future expenditure). Completion is expected by the end of Q2.

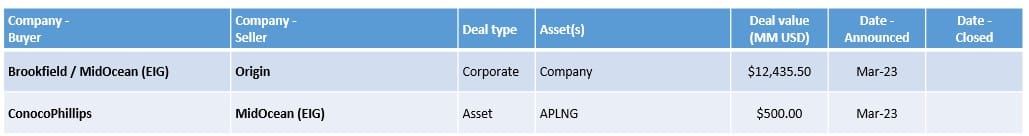

Deals announced in Q1 - Boom goes the dynamite

The final week of the quarter saw a binding deal signed for the acquisition of Origin Energy, with a follow-up deal for APLNG. The acquisition of Origin by Brookfield and EIG was first tabled in August 2022, so we have taken a while to get here and there were a few bumps along the way.

- On Monday (27th March), it was announced that a binding deal had finally been signed for Brookfield Asset Management and EIG (through MidOcean Energy) to acquire Origin Energy. The agreed price is AU $8.91 per share, giving an enterprise value of AU $ 18.7 billion (~US $12.4 billion). The deal is only likely to complete in 2024 but, once complete, EIG will take on Origin’s gas and LNG business, whilst Brookfield (together with institutional partners Temasek and GIC) would take on their retail business.

- In parallel with the above deal, it was announced that ConocoPhillips would acquire a further 2.49% of the APLNG assets from MidOcean for US $500 million. Completion will take place with the above deal, with an effective date of 1 July 2022. Once complete, ConocoPhillips will hold a 49.99% stake in APLNG and likely take over operatorship, with MidOcean holding 25.01%, and Sinopec (25%).

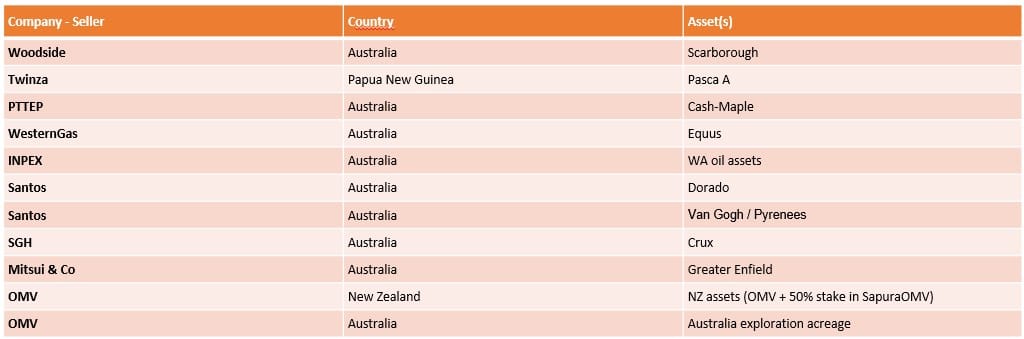

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below:

If you have any questions on any of these opportunities then please drop me a DM.

Corrections / errors

As always, if there is anything I have missed or if you have any questions, then drop me a DM, thanks. :)