M&A in Australasia - 2023 Q2

(Originally published on July 2, 2023)

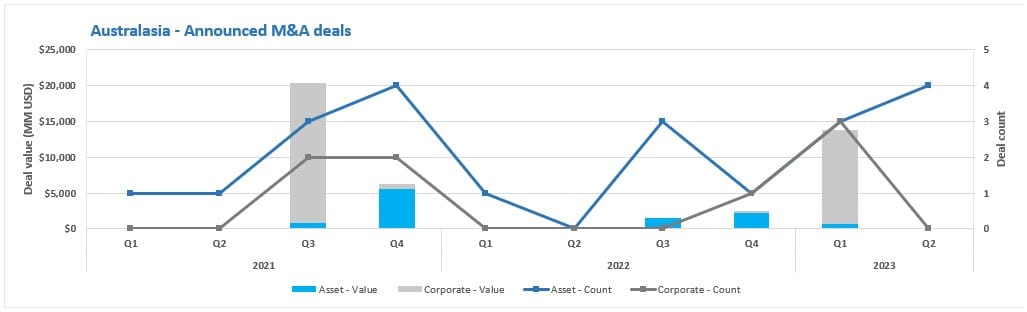

After a Q1 that saw more action than the cast of an Expendables movie, Q2 has been much more aligned with the underlying trend with four asset deals in the region. Two in Australia, one in New Zealand and one in PNG. A transaction value was only announced for the first deal.

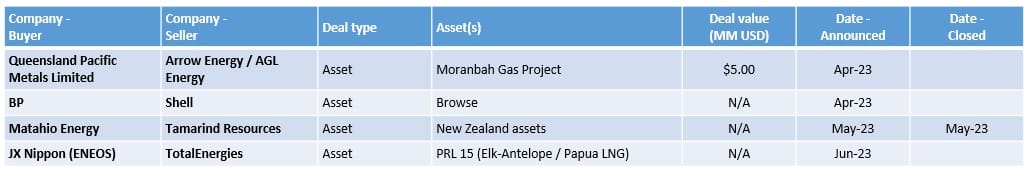

Deals announced in Q2

The four deals announced in Q2 are:

- The first deal came in early-April, with Queensland Pacific Metals Limited (QPM) announcing that they had entered into a conditional agreement to acquire 100% of the Moranbah Gas Project from Arrow Energy and AGL Energy, who currently hold the assets through a 50:50 JV. The deal is for $ 5 million and is expected to complete in June/July of this year. The key driver for the deal is to insulate QPM's Townsville Energy Chemicals Hub (TECH) project from gas price uncertainty.

- The second deal came in late-April, when Shell announced that they had agreed to sell their 27% stake in the Browse JV to BP. The Browse JV holds seven permits that form the Browse project that is based on the potential development of Brecknock, Calliance and Torosa gas fields. Prior to the deal, the Browse JV consisted of Woodside (30.60% and operator), Shell (27%), BP (17.33%), Japan Australia LNG (MIMI Browse) (14.4%) and PetroChina International Investment (Australia) Pty Ltd. (10.67%). Once complete, the BP's stake will increase to 44.33%. The Browse project is still a long way from FID, with concerns over costs, economics and the GHG intensity, but the most likely development plan involves it being developed as backfill for NWS LNG. The deal simplifies the JV a bit, particularly if Shell were a "hard no" for development and it may also be a signal that Shell could look to exit the NWS LNG JV.

- The third deal was announced in late-May, and saw Matahio Energy continue its acquisition of the assets held by Tamarind Resources. This time, the deal involved all of the assets that Tamarind held in New Zealand with no value announced for the deal. The assets comprise six onshore licences, namely PMP 38156 (Cheal and Cardiff fields, 100%), PMP 60291 (Cheal East, 70%), PMP 53803 (Sidewinder, 100%), PMP 60454 (Supplejack, 100%), PEP 51153 (100%), and PEP 57065 (100%). The Cheal, Cardiff and Cheal East fields currently produce through the Cheal facilities, with the Sidewinder field a standalone development. There may be some potential to develop the Supplejack field through the Sidewinder facilities. Matahio had previously acquired the Philippines assets of Tamarind and a number of the previous Tamarind management team have been involved in setting up Matahio. I'm not sure the reasoning behind this but, for New Zealand at least, the deal may help to distance Matahio from the well publicised issues relating to the Tui field.

- The fourth deal came in early-June and saw JX Nippon acquire a 2.58% stake in the Papua LNG project from TotalEnergies with no value announced for the deal. The asset is based on the potential development of the Elk-Antelope field in PRL 15 together with new LNG liquefaction trains at the current PNG LNG site. On completion, the interests in PRL 15 (and the Papua LNG project) will be TotalEnergies (37.55% + operator), ExxonMobil (37.04%), Santos (22.83%), and JX Nippon (2.58%). The stakes will all be reduced when the PNG government, through Kumul Petroleum, back-into the project, with the final JX Nippon stake expected to be 2%.

In addition to these regional deals, we also saw Eni agree to acquire Neptune Energy. I published a dedicated article on this but, for Australasia, the deal involved the undeveloped Petrel field in the Bonaparte basin.

Deals that closed in Q2

The only deal to close in Q2 was the Matahio / Tamarind deal discussed above. This leaves a large number of previously announced deals that are yet-to-close, see below.

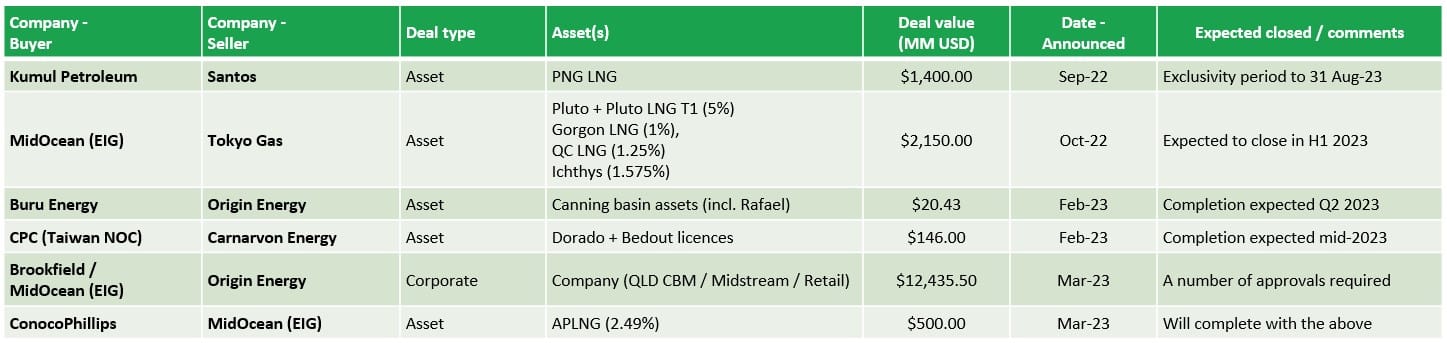

Deals still pending completion

In addition to the Moranbah, Browse and Papua LNG deals above, there are a number of previously announced deals that are yet-to-close.

- The first of these is Kumul Petroleum's deal to acquire an additional 5% interest in PNG LNG from Santos. In late-December, it was announced that the exclusivity period for the deal was extended until 30 April 2023. In May, a further extension was announced, taking the exclusivity period to 31 August 2023.

- The second of these is EIG's (through MidOcean Energy) deal to acquire Tokyo Gas’ stake in four major integrated gas-to-LNG projects, namely Pluto (+ Pluto LNG T1), Gorgon LNG, QC LNG, and Ichthys. When the deal was announced, it was stated that it was expected to close in the first half of 2023 and I would expect it to close soon. There has been some discussion about the potential for Woodside to pre-empt at Pluto, although I see this as unlikely.

- In next is Origin Energy's withdrawal from a number of permits in the Canning basin, including EP 428 that holds the Rafael discovery. Buru Energy will take on the majority of Origin's interest, with Rey Resources also taking on some of the interest in a couple of permits. The last comment was completion is expected in Q2, so should complete soon.

- The third is CPC's deal acquire a 10% stake of Carnarvon Energy's Bedout assets, including the Dorado discovery. The last update stated that completion is expected by the mid-year.

- The next is the biggest deal from Q1, which saw a deal announced Brookfield Asset Management and EIG (through MidOcean Energy) to acquire Origin Energy. In parallel with the above deal, ConocoPhillips have agreed to acquire a further 2.49% of the APLNG assets from MidOcean. The scale of this deal means a lot of approvals, and it is not clear when it will complete.

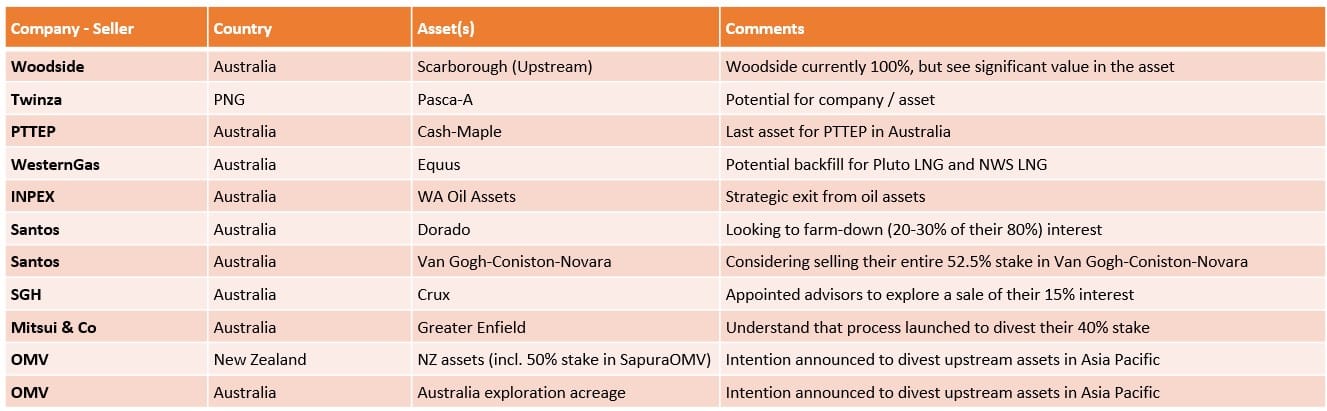

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below:

If you have any questions on any of these opportunities then please drop me a DM.