M&A in Australasia - 2023 Q3

(Originally published on October 2, 2023)

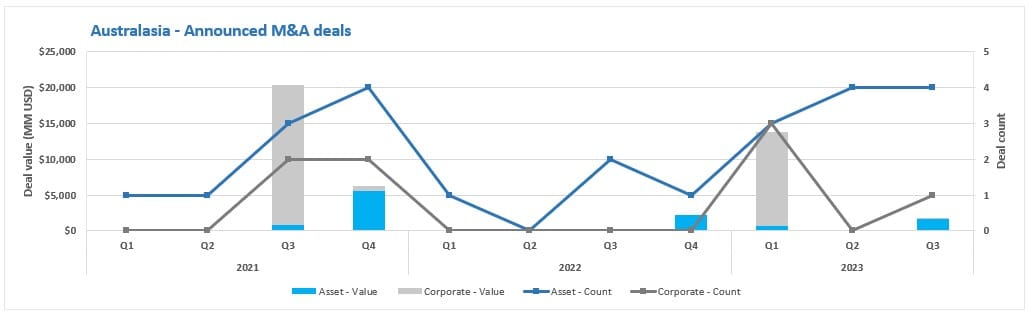

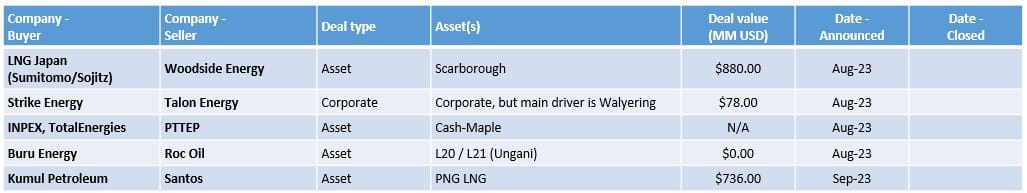

Q3 has seen five deals, four in Australia and one in PNG. A transaction value was announced for three of these deals, with a total deal value for these three deals of almost US $1.7 billion.

Deals announced in Q3

The five deals announced in Q3 are:

- The first deal came in early-August, with Woodside Energy announcing an SPA to divest a 10% stake in the Scarborough project to LNG Japan, a 50:50 JV between Sumitomo Corporation and Sojitz Corporation. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/australia-ma-sumitomo-sojitz-agree-acquire-10-stake-robert-chambers/?trackingId=oFZ1IcvZR4qqLiFtgBIYlw%3D%3D. The recent news that Woodside will need new approvals for planned seismic has the potential to impact the project schedule but it is not clear if it could impact this deal.

- The second deal came in mid-August, with Strike Energy announcing tan agreement for them to acquire Talon Energy. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/australia-ma-strike-energy-acquire-talon-robert-chambers/?trackingId=UCgYMvkwQiC05oQn4NCPkg%3D%3D

- The third deal came in late-August, with INPEX and TotalEnergies announcing that they had agreed to acquire PTTEP's 100% interest in the AC/RL7 permit that contains the undeveloped Cash-Maple gas field. INPEX will acquire 74% and TotalEnergies 26%. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/australia-ma-inpex-totalenergies-acquire-cash-maple-robert-chambers/?trackingId=UCgYMvkwQiC05oQn4NCPkg%3D%3D

- The fourth deal also came in late-August, with Roc Oil agreeing to withdraw from the L20 and L21 production licences that contain the Ungani oil field, with their 50% stake being assigned to Buru Energy who now hold 100% interest in the licences. There was no value for the deal but Roc will remain liable for some future costs.

- The final deal, which is essentially a replacement/restructuring of a deal announced in September 2022, came at the start of September when Santos and Kumul announced that a binding agreement had been signed for for Kumul to acquire a 2.6% stake in the PNG project from Santos, with an option to acquire a further 2.4%. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/png-ma-kumul-acquire-26-stake-lng-from-santos-robert-chambers/?trackingId=UCgYMvkwQiC05oQn4NCPkg%3D%3D. This deal therefore saw a removal of a deal from Q3 2022.

Deals that closed in Q3

Two deals closed in Q3:

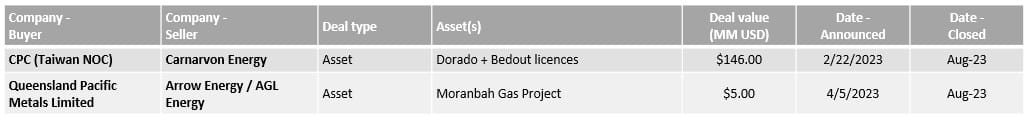

- This was CPC's acquisition of a 10% stake in Carnarvon Energy's Bedout assets, including the Dorado discovery, that was announced in February and closed in mid-August.

- The second was Queensland Pacific Metals Limited's (QPM) acquisition of 100% of the Moranbah Gas Project from Arrow Energy and AGL Energy, The dela was announced in early-April and closed in late-August.

Deals still pending completion

In addition to the new deals announced this quarter, there are a number of previously announced deals that are yet-to-close.

- The first of these is EIG's (through MidOcean Energy) deal to acquire Tokyo Gas’ stake in four major integrated gas-to-LNG projects, namely Pluto (+ Pluto LNG T1), Gorgon LNG, QC LNG, and Ichthys. When the deal was announced, it was stated that it was expected to close in the first half of 2023 but there has yet to be any further news on completion. However, we did see the recent news that Aramco have agreed to acquire a minority stake in MidOcean Energy.

- In next is Origin Energy's withdrawal from a number of permits in the Canning basin, including EP 428 that holds the Rafael discovery. Buru Energy will take on the majority of Origin's interest, with Rey Resources also taking on some of the interest in a couple of permits. The last comment was completion is expected in Q2, so should complete soon.

- The next is the biggest deal from Q1, which saw a deal announced Brookfield Asset Management and EIG (through MidOcean Energy) to acquire Origin Energy. There are some reports in the press that Origin is being under-valued as well as uncertainty over competition issues. Australia's anti-trust watchdog recently pushed out its decision on the deal by two weeks to the 12th October. In addition, the recent news that Aramco have agreed to acquire a minority stake in MidOcean Energy may impact public sentiment. Given these issues, not the mention the scale of this deal, there is a lot of uncertainty about the when the will complete.

- In parallel with the above deal, ConocoPhillips have agreed to acquire a further 2.49% of the APLNG assets from MidOcean. This deal will only complete once the above has completed.

- The next is BP's acquisition of Shell's 27% stake in the Browse JV that was announced in late-April this year. There has been little news on the expected completion date.

- The next is JX Nippon's acquisition of a 2.58% stake in the Papua LNG project from TotalEnergies that was announced in early-June. Again, there has been no timeline published for completion.

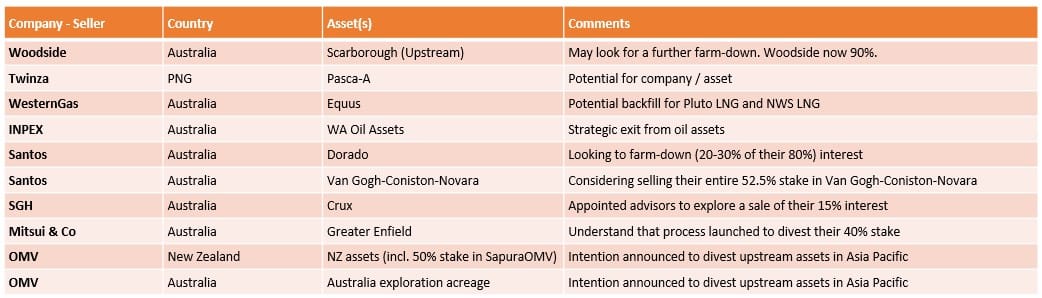

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below.

The main change from Q2 is:

- The removal of Cash-Maple from this list following the announced deal.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.