M&A in Australasia - 2024 Q2

(Originally published on July 1, 2024)

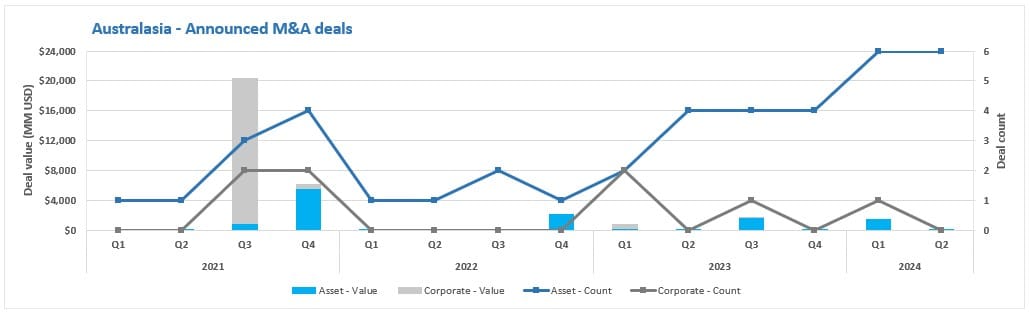

Q2 has seen six new deals announced in Australasia, four in Australia and two in Papua New Guinea. The transaction value of this one deal was about US $168 million.

The running totals for 2024 (H1) are thirteen deals, with a total deal value of about US $1,625 million. As a comparison, H1 2023 saw 8 deals with a total value of about US $830 million.

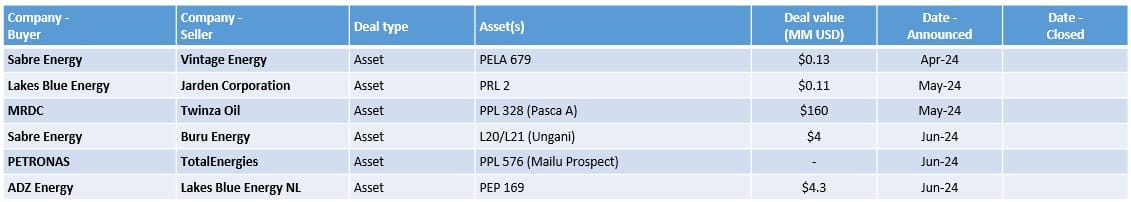

New deals announced in Q2

The six deals announced this quarter are:

- In late-April, Vintage Energy announced a farmout agreement with Sabre Energy for the latter to acquire a 50% stake in PELA 679. In return, Sabre will fund 100% of a 150km2 3D seismic survey and pay Vintage AU $200k (~US $130k) as reimbursement for past costs. PELA 679 is located on the western flank of the Cooper basin.

- In early-May, Lakes Blue Energy announced deal with Jarden Corporation (not 100% sure I have the correct Jarden logo) for the former to acquire full ownership of PRL 2. Jarden had held a 42.5% stake in the Trifon/Gangell gas fields, with the remainder of the licence (including the Wombat field) already held 100% by Lakes Blue. There is no cash consideration but the deal sees Lakes Blue forgive AU $170k (~US $110k) owed to them by Jarden. PRL 2 is located onshore Victoria in the Gippsland Basin and contains the undeveloped Wombat and Trifon/Gangell gas fields.

- In late-May, Twinza Oil announced a deal with the PNG government owned Mineral Resources Development Company (MRDC) for the latter to acquired up to 50% participating interest in PPL 328 that contains the undeveloped Pasca A field, currently 100% Twinza Oil. The deal is reported to be costing MRDC US $160 million, with the agreement only becoming effective once approvals are granted, including from the PNG Independent Consumer & Competition Commission (ICCC). The Pasca A field is an undeveloped gas condensate field located in shallow water in the Gulf of Papua. Twinza have plans to develop the field through a phased development: the first phase would focus on stripping the liquids for sale and re-injecting the gas, with the second phase then focusing on commercialising the gas.

- In mid-June, Buru Energy announced a farm-in agreement with Sabre Energy for the latter to acquire a 70% stake in the L20 and L21 Petroleum Production Licenses in the Canning Basin, onshore Western Australia, that contain the Ungani oil field. The deal structure is based on a AU $6 million (~US $4 million) farm-in carry, with AU $1.0 million of this going towards the cost of restarting production from the Ungani Oilfield, and the remaining AU $5 million towards the drilling of the high potential Mars exploration well. The deal is subject to government approval. Production was suspended from the Ungani oil field in August 2023 owing to issues with the trucking export route.

- In late-June, it was reported that PETRONAS have signed a farm-in agreement to acquire a 50% non-operated stake in PPL 576 from TotalEnergies. PPL 576 was previously held 100% by TotalEnergies and is located offshore Papua New Guinea. The licence contains the undrilled Mailu prospect that sits in waters about 2000m deep, with the current plan being to drill the prospect in 2025.

- In late-June, ADZ Energy announced a binding agreement to acquire an additional 49% of exploration permit PEP 169 from Lakes Blue Energy. PEP 169 is located onshore Victoria in the Otway basin. Once complete, ADZ Energy will hold 100% of the permit. The transaction is for a cash consideration of AU $6.5 million (~US $4.3 million) that will be paid in three installments plus royalty revenue from future petroleum sales.

In addition to the above deals, we also saw the acquisition by TotalEnergies of Sapura Energy's stake in SapuraOMV. Whilst the focus of this deal was their Malaysian assets, the deal also included exploration acreage in New Zealand and Australia.

In addition to these upstream deals, we also saw progress at the Cliff Head field in WA-31-L. In mid-June, the application to declare a Greenhouse Gas Storage Formation over the licence area was approved by the Commonwealth Minister for Resources. This approval triggers the sale of Triangle Energy’s 78.75% interest in the Cliff Head project to Pilot Energy in a deal that was first announced in April 2022, with the current terms detailed in July 2023. The approval also triggers the first payment of AU $ 3 million (~US 2 million). Triangle will now focus their attention on drilling the Booth-1 well in the L-7 licence that is located onshore in the Perth basin, with the well due to spud in July.

Cancelled deals

Q2 saw the cancellation of an announced sales process as well as the cancellation of a previously announced deal.

- In mid-April, Woodside Energy announced that they had cancelled the sales process for their Macedon and Greater Pyrenees assets offshore Western Australia. The process was first reported in August 2023, with reports in January 2024 stating that Jadestone Energy, Hibiscus Petroleum, and Carlyle Group were all involved in the final stages.

- Also in mid-April, Lakes Blue Energy announced that a deal for Cooper Energy to acquire a 25.1% stake in PEP 169 had been discontinued following the receipt of two unsolicited competing offers, both reportedly better than Cooper's. No further details of the new offers or bidders has been provided.

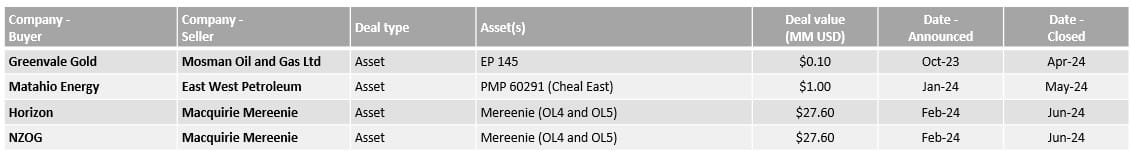

Deals that closed in Q2

Four previously announced deals closed in Q2:

- In mid-October 2023, Greenvale Gold announced a deal to acquire a 75% interest in EP 145 from Mosman Oil and Gas Ltd. The deal was approved and completed in late-April.

- In January, Matahio Energy announced a deal to acquire East West Petroleum’s 30% stake in the PMP 60291 (Cheal East) permit. The deal was completed at the end of May and gives Matahio 100% in the permit.

- In mid-February, Macquarie Mereenie announced two deals to divest their 50% interest in in the Mereenie field. Both deals were for 25%, with the buyers being Horizon and NZOG (both taking 25%). Both of these deals were completed in mid-June.

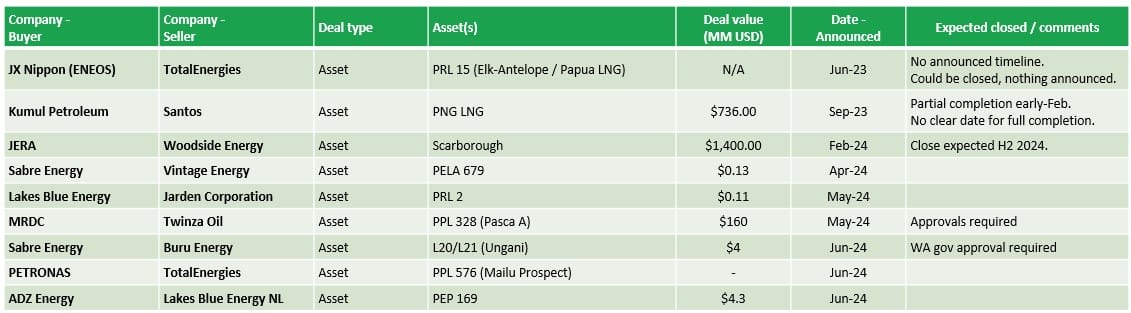

Deals still pending completion

In addition to the new deals announced this quarter, there are some previously announced deals that are yet-to-close, or I have not seen confirmation of closing.

- The first is JX Nippon's acquisition of a 2.58% stake in the Papua LNG project from TotalEnergies that was announced in early-June. There has been little further news, but the deal could already be complete or be pending approvals.

- At the start of September, Santos and Kumul announced that a binding agreement had been signed for for Kumul to acquire a 2.6% stake in the PNG project from Santos, with an option to acquire a further 2.4%. At the start of February, a "partial completion" was announced, with Kumul having paid US$352 million to Santos (equivalent to a ~1.6 per cent interest). However, there has been no further news on when full completion is expected.

- In late-February, Woodside and JERA announce that the latter had agreed to acquire a 15.1% stake in the Scarborough project. The deal is expected to complete in the second half of 2024.

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below.

The main changes from Q1 are:

- I have removed the Buru Energy opportunity for L20/L21 (Ungani) licences following the announced deal with Sabre Energy. However, their opportunity at Rafael (EP 428) remains.

- I have removed the Sapura Energy opportunities for both Australasia and New Zealand related to their 50% stake in SapuraOMV following the acquisition by TotalEnergies.

- I have removed Woodside's cancelled sales process for their Macedon and Pyrenees assets.

- I have added a new opportunity for Carnarvon Energy following reports that they are looking at options ranging from selling its remaining Dorado stake to a corporate sale or merger. JP Morgan reported to be advising Carnarvon.

- I have added a new opportunity with Santos following reports that they are in discussions with Carlyle Group about divesting their mature gas assets in Western Australia. This includes the gas plants at Varanus Island, Devils Creek and Macedon together with their associated fields.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.