M&A in Australasia - 2024 Q3

(Originally published on October 1, 2024)

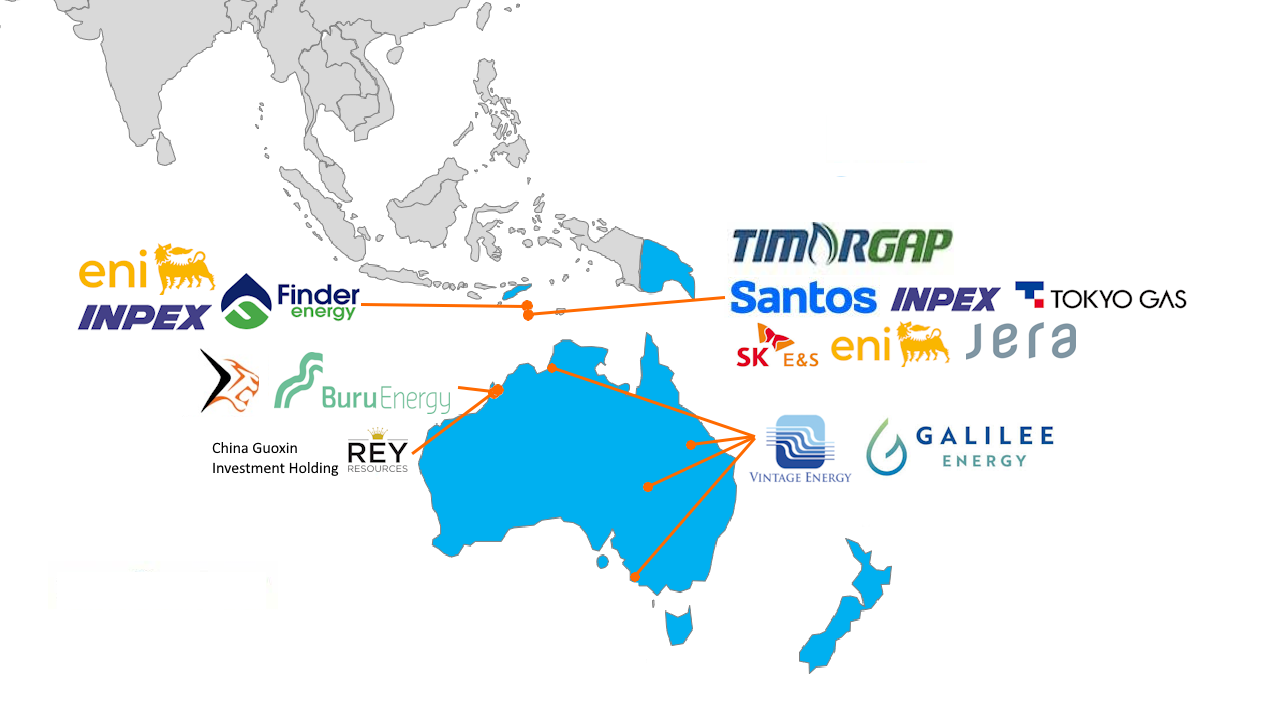

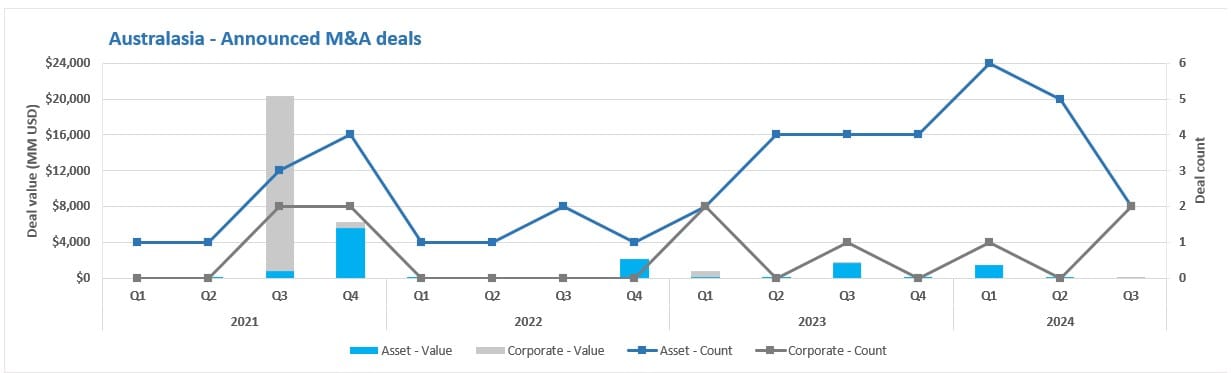

Q3 has seen five new deals (one of which was later cancelled) announced in Australasia, three in Australia and two in Timor-Leste. The transaction value for these five deals was about US $12.3 million. Excluding the cancelled deal, we have four deal, with a value of US $6.4 million.

The running totals for 2024 (Q3) are sixteen deals, with a total deal value of about US $1,640 million. As a comparison, by the end of Q3 in 2023, we had seen 13 deals with a total value of about US $1,637 million.

New deals announced in Q3

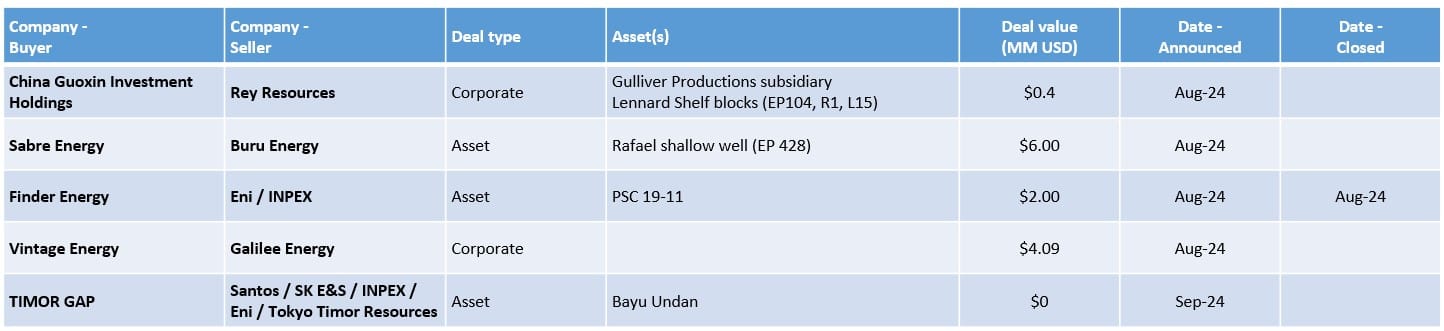

The five deals announced this quarter are:

- At the start of August, Rey Resources announced that it had executed a Binding Cooperation Framework Agreement with China Guoxin Investment Holdings for the latter to acquire Rey's 100% subsidiary Gulliver Productions. The deal is for a total cash consideration of AU $0.4 million (~US $0.27 million). Gulliver holds a 100% in three permits: EP104, R1, and L15 that are located in the Canning Basin.

- In early August, Buru Energy announced that it had entered into a Farm-in agreement with Sabre Energy for the drilling of the high impact Rafael Shallow oil target in EP 428 in Western Australia’s onshore Canning Basin. Under the agreement, Sabre will carry Buru for $6 million of the costs associated with the drilling and testing of the exploration well to earn a 50% interest in a commercial discovery and subsequent production licence. It is estimated that Sabre’s $6m will provide Buru with a full carry of the well. Subject to a commercial discovery being declared over the well, Sabre will pay Buru a further $1.5m in recognition of prior exploration expenditures incurred. However, this deal was cancelled at the end of September, together with a previous farm-in deal for the Ungani field, and has therefore not been included in the quarterly analysis.

- Also in early August, Finder Energy announced that they had agreed to acquire the interests held by Eni (40.53% + operator) and INPEX (35.47%) in PSC 19-11 offshore Timor-Leste. Once complete, the rights holdings will be Finder Exploration (76% + operator), and Timor Gap (24%). The stated deal value was for US$2 million on close plus contingent payments, with completion of the deal announced in late-August.

- In mid-August, Vintage Energy announced that they had agreed an all scrip merger with Galilee Energy with a deal value of AUD 6.1 million (~USD 4.1 million). The deal is still pending relevant approvals including Galilee Energy raising at least AUD 2.5 million from capital raising. Galilee Energy brings CSG assets in Queensland including the Glenaris gas project, whilst Vintage Energy brings production from the Odin and Vali gas fields in the Cooper basin as well as exploration interest in the Otway, Galilee and Bonaparte basins.

- In early September, Santos announced that the Bayu-Undan Joint Venture (BUJV) and TIMOR GAP have agreed terms of a Sale and Purchase Deed (SPD) to transfer a 16% interest in the Bayu-Undan upstream project to TIMOR GAP, with an economic date of 1 July 2024. The Bayu-Undan Joint Venture consists of Santos (43.44% + operator), SK E&S (25%), INPEX (11.38%), Eni (10.99%) and Tokyo Timor Sea Resources (9.19%). The deal is expected to be formalised in mid-September and, once complete, the rights holdings will be Santos (36.5% + operator), SK E&S (21%), TIMOR GAP (16%), INPEX (9.6%), Eni (9.2%), Tokyo Timor Resources (7.6%). In addition, it was announced that the PSC has been further extended, with the new expiry being 30 June 2026. The deed was executed in mid-September, with completion subject to customary closing conditions.

We also saw the announcement in mid-September that Saudi Aramco will increase its stake in MidOcean Energy to 49%, with no deal value announced. This is relevant given MicOcean's 2022 acquisition (2024 completion) of minority stakes in three integrated LNG projects in Australia from Tokyo Gas.

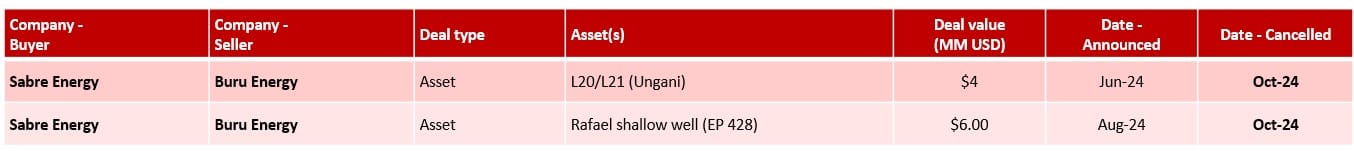

Cancelled deals

Q3 saw the cancellation of two announced sales process, both between the same companies:

- In mid-June, Buru Energy announced a farm-in agreement with Sabre Energy for the latter to acquire a 70% stake in the L20 and L21 Petroleum Production Licenses in the Canning Basin, onshore Western Australia, that contain the Ungani oil field. It looks like the change to the title is still pending.

- In early August, Buru Energy announced that it had entered into a Farm-in agreement with Sabre Energy for the drilling of the high impact Rafael Shallow oil target in EP 428 in Western Australia’s onshore Canning Basin.

In late-September, Buru Energy announced that Sabre Energy had failed to meet their financial obligations under the Rafael Shallow farm-in agreement and the companies had therefore executed agreements to terminate both the Rafael Shallow and Ungani farm-in agreements. Buru also announced a new agreement with two entities associated with long-term Buru shareholders for these entities to provide funding for Rafael shallow in exchange for a 25% interest in the Rafael Shallow 1 well.

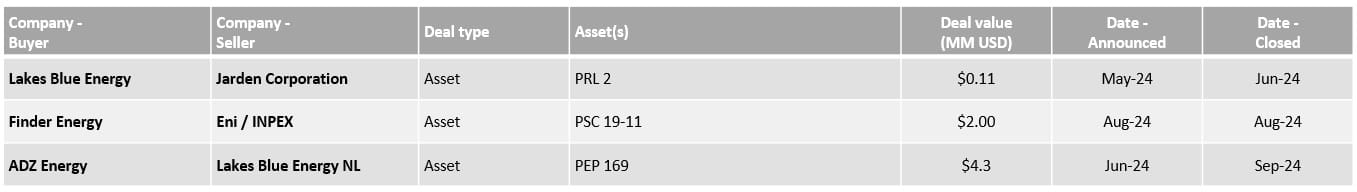

Deals that closed in Q3

In addition to the Finder Energy announced this quarter, there were two further deals that closed this quarter.

- In early-May, Lakes Blue Energy announced deal with Jarden Corporation for the former to acquire full ownership of PRL 2. Jarden had held a 42.5% stake in the Trifon/Gangell gas fields, with the remainder of the licence (including the Wombat field) already held 100% by Lakes Blue. This was completed by their quarterly report at the end of June.

- In late-June, ADZ Energy announced a binding agreement to acquire an additional 49% of exploration permit PEP 169 from Lakes Blue Energy. The deal was executed in early-September.

Deals still pending completion

In addition to the new deals announced this quarter, there are some previously announced deals that are yet-to-close, or I have not seen confirmation of closing.

- At the start of September, Santos and Kumul announced that a binding agreement had been signed for for Kumul to acquire a 2.6% stake in the PNG project from Santos, with an option to acquire a further 2.4%. At the start of February, a "partial completion" was announced, with Kumul having paid US$352 million to Santos (equivalent to a ~1.6 per cent interest). However, there has been no further news on when full completion is expected.

- In late-February, Woodside and JERA announced that the latter had agreed to acquire a 15.1% stake in the Scarborough project. The deal is expected to complete in the second half of 2024.

- In late-April, Vintage Energy announced a farmout agreement with Sabre Energy for the latter to acquire a 50% stake in PELA 679. The deal was subject to the exploration licence being formally granted which is waiting on land access permits. The last update was these are still being negotiated.

- In late-May, Twinza Oil announced a deal with the PNG government owned Mineral Resources Development Company (MRDC) for the latter to acquired up to 50% participating interest in PPL 328 that contains the undeveloped Pasca A field, currently 100% Twinza Oil. The ICCC started its consultation process in mid-September, so it could be a little while before we see completion.

- In late-June, it was reported that PETRONAS have signed a farm-in agreement to acquire a 50% non-operated stake in PPL 576, offshore Papua New Guinea from TotalEnergies. PPL 576 was previously held 100% by TotalEnergies. Again, the ICCC started its consultation process in mid-September, so it could be a little while before we see completion.

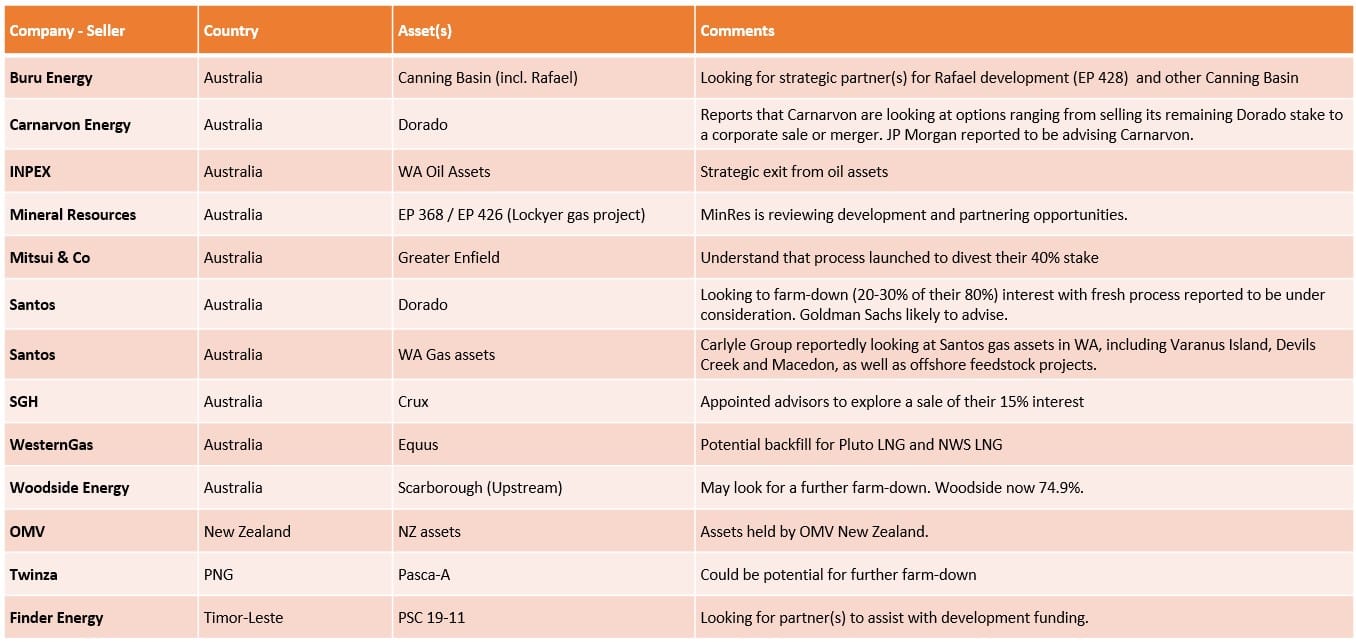

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below.

The main changes from Q2 are:

- I have removed the Santos opportunity related to the Van Gogh-Coniston-Novara oil fields that feed the Ningaloo Vision FPSO. This is following reports that the fields will reach end of life in H1 2025 and that Santos are preparing decommissioning plans.

- I have added the opportunity for Finder Energy in Timor-Leste, given their stated intention to look for a partner to assist with development funding.

- I have added a new opportunity with Mineral Resources (MinRes) following their statement that "In response to inbound queries from a number of domestic and global parties, MinRes is reviewing development and partnering opportunities related to EP 368 and EP 426. As part of this review, MinRes will assess joint venture partnerships, as well as full or partial sale options. MinRes is also considering development financing options through infrastructure funding partners, as noted in April 2024."

In addition, there were some reports, including in The Australian, that Woodside may be a target for some of the majors, although I haven't included this as a formal opportunity.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.