M&A in Australasia - 2024 Q4

(Originally published on January 7, 2025)

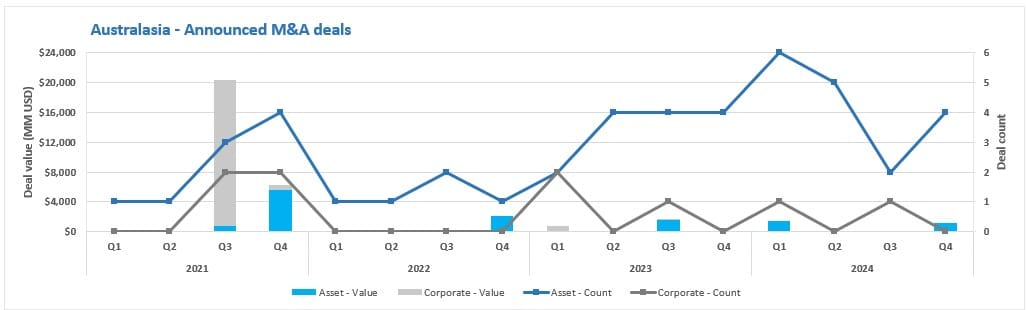

Q4 has seen four new deals announced in Australasia, all of which were in Australia. The transaction value for these four deals was about US $1,140 million.

The totals for 2024 are nineteen deals, with a total deal value of about US $2,760 million. As a comparison, 2023 saw 17 deals with a total value of about US $2,574 million.

New deals announced in Q4

The four deals announced this quarter are:

- In mid-October, Mosman Oil and Gas announced that they had agreed to acquire Greenvale Energy's 75% interest in EP-145 for a consideration of AU $250,000. Completion is subject to normal approvals. Once complete, Mosman will hold a 100% interest in the permit.

- In late-October, Mineral Resources (MinRes) announced that it had agreed to sell their upstream assets to Hancock Prospecting for up to AU $1.13 billion (~US $741 million).Hancock will acquire 100% of the EP 368 and EP 426 permits that contain the Lockyer Gas Project and Erregulla Oil Project. They will also get a 50% stake in new JVs for exploration permits in the Perth and Carnarvon basins. The deal structure sees an upfront fee of AU $804 million (~US $527 million), with potential for further payments of AU $327 million (~US $214 million). The exploration permit sale completed in mid-December, with the JVs for the 50% stake expected to be complete in Q1 2025.

- In early-December, INPEX announced that it had signed an SPA to interests in AC/RL7 (Cash-Maple) interests to CPC (2.625%), Osaka Gas (1.20%), and TOHO Gas (0.42%). The completion of the transaction is conditional on regulatory approvals and will see INPEX stake reduce to 69.755%, with TotalEnergies holding the other 26%.

- In mid-December 2024, Woodside and Chevron announced a swap deal for Western Australia assets. I looked at the deal in more detail here https://www.linkedin.com/pulse/australia-ma-woodside-chevron-agree-asset-swap-nws-lng-chambers-l6u3f/ but in summary: Woodside will take Chevron's stake in NWS related projects (NWS LNG, CWLH, Angel CCS), whilst Chevron will take the Woodside stakes in their Wheatstone related projects (Julimar Brunello, Wheatstone LNG). Chevron will also pay up to $400 million. Completion of the deal is expected in 2026.

Cancelled deals

Q3 saw the cancellation of two announced sales process, both between the same companies:

- In mid-August, Vintage Energy announced that they had agreed an all scrip merger with Galilee Energy with a deal value of AUD 6.1 million (~USD 4.1 million). However, in December, it was announced that the parties had mutually agreed to terminate the deal.

Deals that closed in Q4

In addition to the partial completion of the MinRes / Hancock deal discussed above, there have been three further deals that saw completion this quarter.

- At the start of September 2023, Santos and Kumul announced that a binding agreement had been signed for for Kumul to acquire a 2.6% stake in the PNG project from Santos, with an option to acquire a further 2.4%. At the start of February, a "partial completion" was announced with full completion then announced in early-November.

- In late-February, Woodside and JERA announced that the latter had agreed to acquire a 15.1% stake in the Scarborough project. The deal completed at the end of October.

- In late-May, Twinza Oil announced a deal with the PNG government owned Mineral Resources Development Company (MRDC) for the latter to acquired up to 50% participating interest in PPL 328 that contains the undeveloped Pasca A field. In late-October, it was announced that the deal was approved by the ICCC.

Deals still pending completion

In addition to the new deals announced this quarter, there are some previously announced deals that are yet-to-close, or I have not seen confirmation of closing.

- In late-April, Vintage Energy announced a farmout agreement with Sabre Energy for the latter to acquire a 50% stake in PELA 679. The deal was subject to the exploration licence being formally granted which is waiting on land access permits. The last update was these are still being negotiated.

- In late-June, it was reported that PETRONAS have signed a farm-in agreement to acquire a 50% non-operated stake in PPL 576, offshore Papua New Guinea from TotalEnergies. PPL 576 was previously held 100% by TotalEnergies. The ICCC announced that it started its consultation process in mid-December, so we may see completion in Q1.

- At the start of August, Rey Resources announced that it had executed a Binding Cooperation Framework Agreement with China Guoxin Investment Holdings for the latter to acquire Rey's 100% subsidiary Gulliver Productions. I haven't seen any confirmation that this has completed.

- In early September, Santos announced that the Bayu-Undan Joint Venture (BUJV) and TIMOR GAP have agreed terms of a Sale and Purchase Deed (SPD) to transfer a 16% interest in the Bayu-Undan upstream project to TIMOR GAP. The deed was executed in mid-September, with completion subject to customary closing conditions. I haven't seen any further updates.

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below.

The main changes from Q3 are:

- I have removed the Mineral Resources (MinRes) opportunity following their announced deal with Hancock.

- I have removed the OMV opportunity related to their New Zealand assets following their announcement that they have cancelled the sales process.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.