M&A in Southeast Asia - 2022

(Originally published on December 30, 2022)

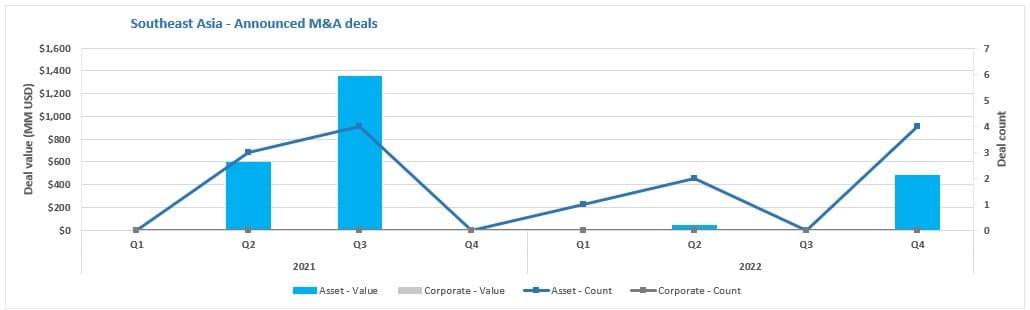

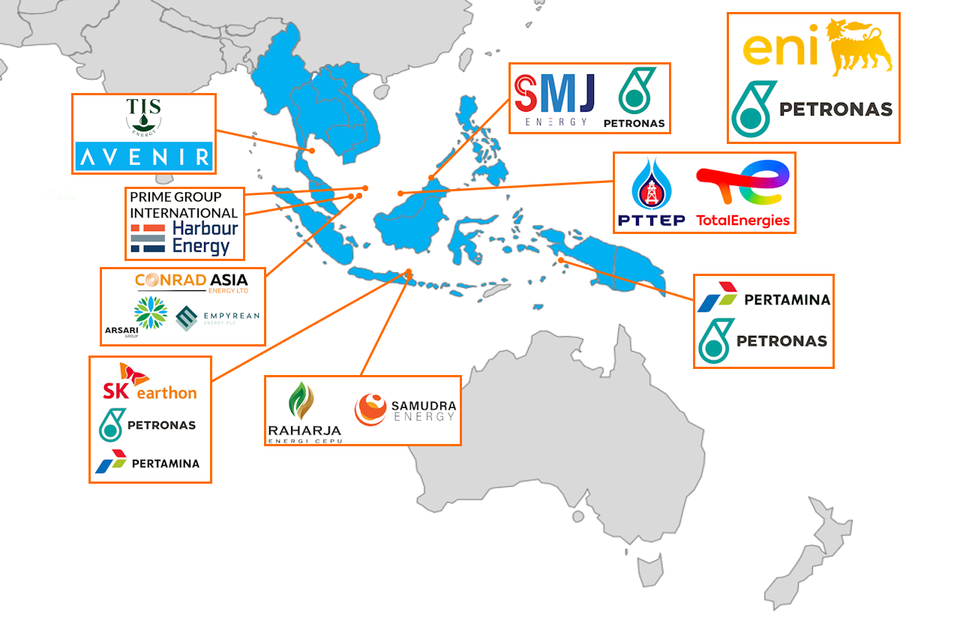

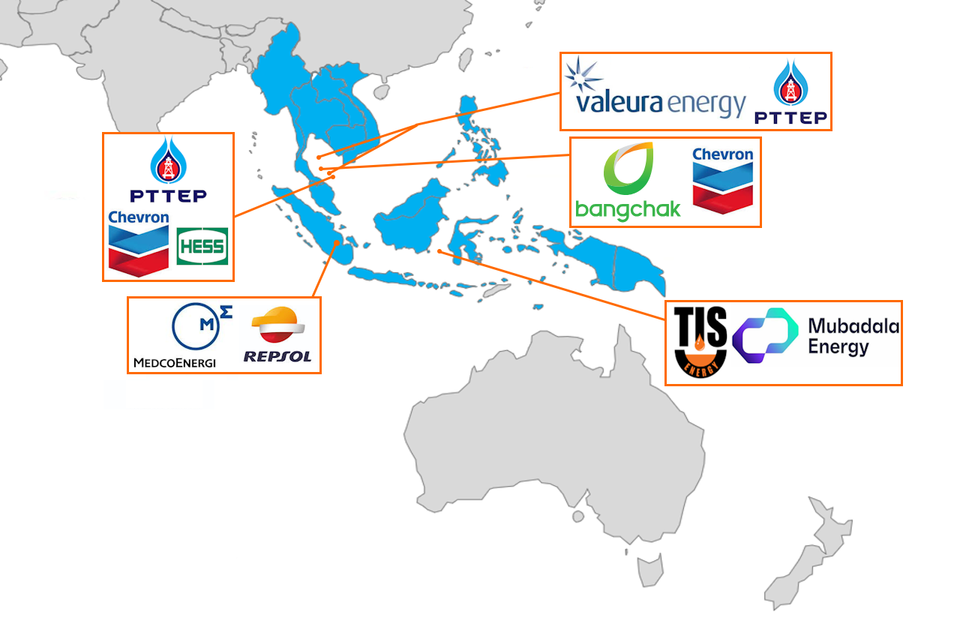

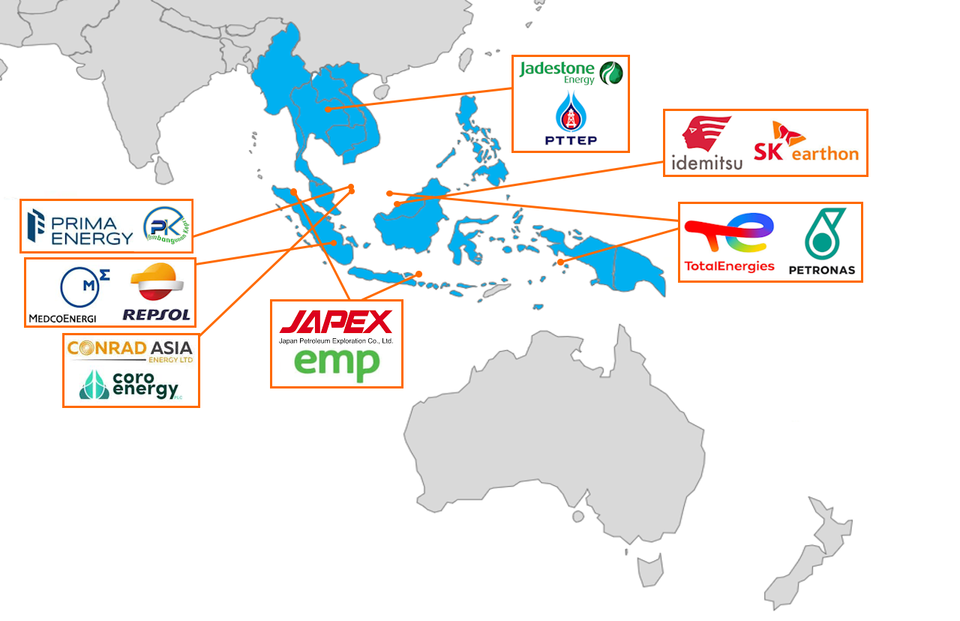

The past year has seen the continuing trend of the larger international oil and gas companies either leaving or looking to leave either countries or the region as a whole. Oil and Gas related M&A transaction value decreased to about a quarter of that seen in 2021.