M&A in Southeast Asia - 2023 Q3

(Originally published on October 2, 2023)

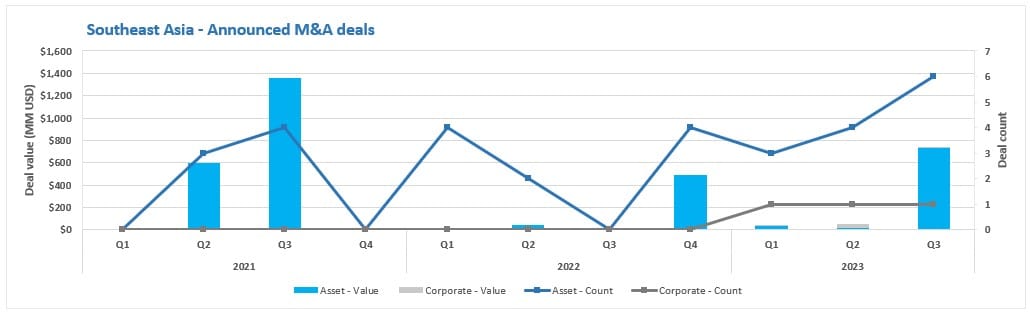

Q3 has seen seven deals, three in Indonesia, and one each in the Philippines, Vietnam, Thailand and Malaysia. A transaction value was announced for four of these deals, with a total deal value for these four deals of almost US $735 million.

New deals announced in Q3

The seven deals announced in Q3 are below, with the first two coming during a busy IPA conference in Jakarta:

- The first deal came on the first day of the IPA conference in late-July and saw the long awaited announcement that both Pertamina and PETRONAS were acquiring Shell's 35% stake in the Masela PSC that contains the Abadi gas field. My full analysis sits across two articles, one published just before the announcement: https://www.linkedin.com/pulse/indonesia-ma-eternal-wait-abadi-over-robert-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D, and one just after: https://www.linkedin.com/pulse/indonesia-ma-pertamina-petronas-acquire-shells-stake-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D.

- The second deal was announced later the same day and again involved a significant asset in Indonesia. This time it was Eni acquiring Chevron's remaining upstream assets in Indonesia, which were dominated by the Rapak and Ganal PSCs that contain the fields outlined to support the the long-awaited IDD development. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/indonesia-ma-eni-acquire-chevrons-remaining-assets-robert-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D

- The next deal came the next day, but this time it was the Philippines, with Sacgasco announcing a deal to sell their assets in the country to Blue Sky International Holdings Inc. The deal covers a number of service contracts including 6B where Sacgasco had been planning to drill a well into the Cadlao structure with monetization through an EWT. The upfront deal value is US $0.7 million with the completion subject to the confirmation of a farm-out agreement that Sacgasco signed with PNOC in Q2.

- The next deal came at the end of July, with Energi Mega Persada (EMP) announcing the acquisition of a 90% stake in two producing PSCs onshore central Sumatra from Pertamina. The two PSCs; the Siak PSC and the Kampar PSC, currently produce a combined 2,200 - 2,600 barrels per day.

- The next deal came in mid-August, with Harbour Energy announcing that they have signed an SPA with Big Energy for the latter to acquire Harbour's 53.125% operated stake in Block 12W in Vietnam. Big Energy are a newly established, dedicated oil and gas business in Vietnam and has been active as Bitexco Group. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/vietnam-ma-big-energy-bitexco-agree-acquire-harbour-robert-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D

- The next deal came in early September and saw PTTEP acquire TotalEnergies last remaining upstream interest in Thailand through the acquisition of TotalEnergies 33.33% stake in block G12/48. The block, also known as Bongkot South, was awarded in 2015 for a period of 30 years. The acquisition will give PTTEP full control of all the Bongkot fields.

- The next deal came in mid-September, with the announcement that Longboat Energy have agreed to acquire Topaz Number One. The two were partners in their only acreage in the region, Block 2A in Malaysia that was awarded in February 2023. Once complete, Longboat will hold a 52.5% stake and be operator. The deal value is for an initial US $0.1 million, with further contingent payments dependent on future activities and success at the acreage.

In addition to the above, Criterium Energy also announced a restructured deal for their acquisition of Mont D'Or. The original deal, announced in June, looked to be at-risk in late-August when Criterium terminated a previously announced marketed public offering. However, they recently announced a restructuring of the deal that should allow it to proceed, with the differences in the payment terms summarised below.

For my quarterly numbers, I have left this as a Q2 deal.

Previously announced deals - Completed

None of the previously announced deals completed in Q3. However, I did get confirmation of the completion at the end of Q2 that I had not previously reported.

- On 31st May, SMJSB (the Sabah State Oil Co) acquisition of a 50% interest in the Samarang PSC from PETRONAS Carigali completed. The HOA for the deal was announced in February and the deal signed in April. The completion happened at the end of May, but I didn't see it publicly stated until this quarter.

Previously announced deals - Yet-to-complete

In addition from the deals from this quarter, there are three deals previously announced that are yet-to-complete. The first from December 2022, the second from Q1 and the third from Q2.

- From December 2022, it is BitExco's acquisition of MedcoEnergi's stake in Block 12W in Vietnam. I expect this to close shortly as it appears there is now a path in place.

- Then from Q1, is MTI Energy's acquisition of Chevron's 41.1% stake in the Yadana asset in Myanmar. Very little detail has been provided but it has been reported that a Chevron spokesperson said it is expected that the deal will close in the second half of 2023. However, there is some controversy about the deal given the political situation.

- From Q2, is the PNOC EC's farm-into Service Contract 6B for 20% from Sacgasco. The deal had been expected to close in July, then mid-August but continues to linger.

- In June, Criterium Energy announced a deal to acquire Mont D'Or. These were my thoughts when the deal was announced: https://lnkd.in/er6RjD_4. The restructuring of the deal and funding should hopefully see the deal now proceed.

The table below summarises the deals in the region that have been announced but are yet-to-close.

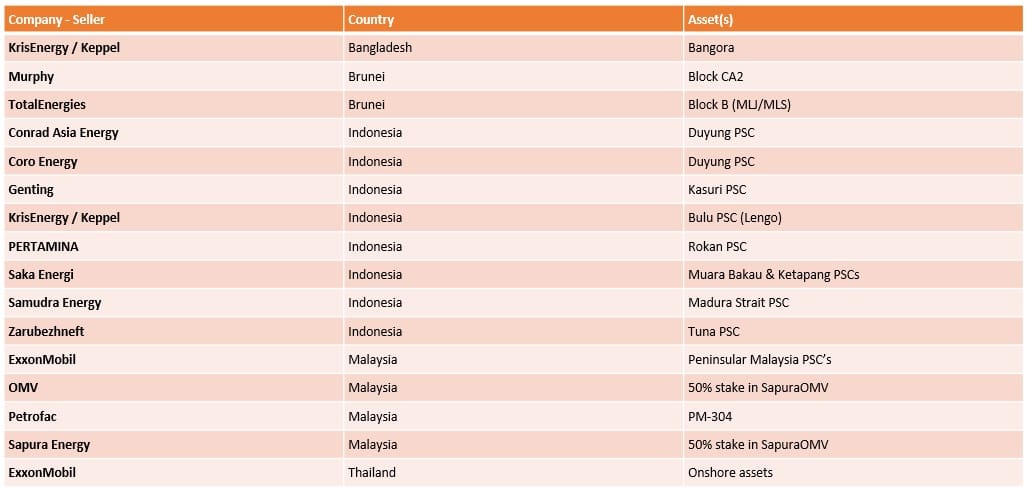

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below:

The main changes from Q2 are:

- The removal of the Chevron (Rapak & Ganal PSCs) and Shell (Masela PSC) assets in Indonesia due to the announced deals

- The addition of Zarubezhneft's 50% stake in the Tuna PSC in Indonesia where international sanctions on the Russian company are complicating the path to FID for partner Harbour Energy.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.