M&A in Southeast Asia - 2023 Q4

(Originally published on January 2, 2024)

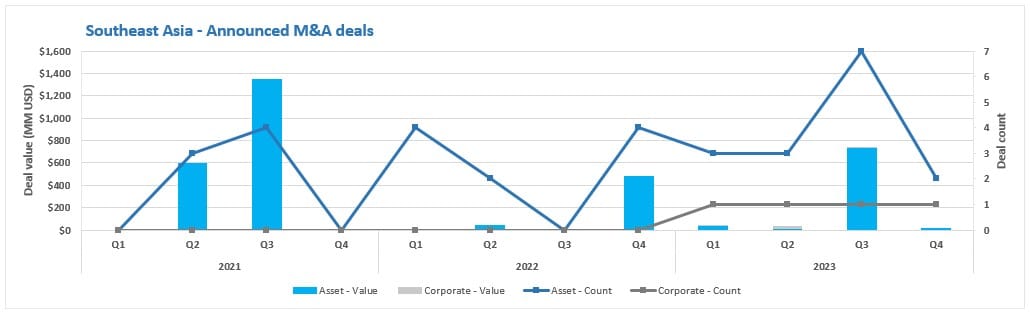

Q4 has seen three deals, one each in the Philippines, Thailand and Indonesia. A transaction value was announced for two of these deals, with a total deal value for these two deals of about US $21 million.

The annual deal count for 2023 is now 19 transactions, with a total deal value of just over US $840 million.

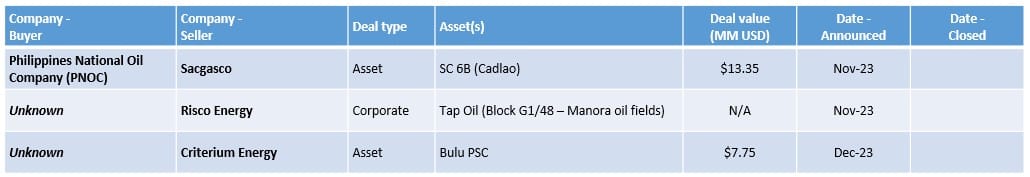

New deals announced in Q4

The three deals announced in Q4 are below:

- The first came in mid-November and involved a formal farm-in agreement being signed between Sacgasco and Philippines National Oil Company PNOC for the latter to farm-into Service contract 6B that contains the Cadlao field. This follows a LOI that was announced back in June. The total deal value is US $13.35 million, with $3.34 million paid with the signing of the formal agreement and the remaining $10.01 million coming as cash calls are made on future operations. Completion is still subject to a number of approvals.

- The second deal came in late-November and saw a change of ownership of Tap Oil, with Risco Energy divesting their 100% ownership. Tap Oil hold a 30% interest in the G1/48 licence in Thailand that contains the Manora oil field, partner Valeura Energy. Limited details have been published on the deal but I understand it is another private investor. No details of the transaction value have been published but I believe the deal is complete.

- The third deal came in mid-November and saw Criterium Energy announce that they have signed an LOI to divest their 45% stake in the Bulu PSC in Indonesia that contains the Lengo field, partners KrisEnergy (or their administrators), PT Energindo, and PT Wisma. The transaction value is US $7.75 million. No details of the buyer have been announced but I have heard a couple of names suggested.

In addition to the above, we also saw an amendment to a deal announced in July between Sacgasco and Blue Sky Resources Limited. The amendment saw a change in a number of the commercial terms, with the effective date also pushed out to 1st December 2023.

Finally, Q4 also saw the announcement that Chevron have agreed to acquire Hess. Whilst the deal is clearly driven by Hess' assets in North American and Guyana, they do have production in Southeast Asia. I looked at the potential for this to create new opportunities in this article: https://www.linkedin.com/pulse/ma-chevron-acquire-hess-what-means-region-robert-chambers-ew6xe/

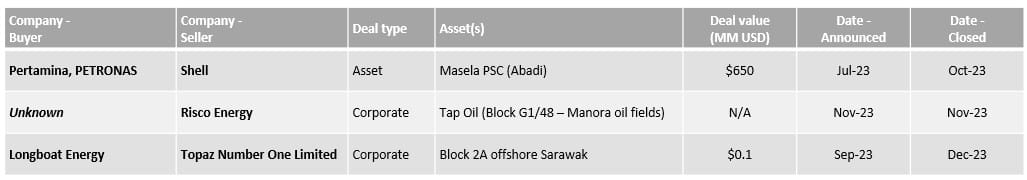

Deals that closed in Q4

From what I can see, there are two deals that had previously been announced that closed in this quarter.

- In mid-October, we saw completion announced of the deal for Pertamina and PETRONAS acquire Shell's 35% stake in the Masela PSC that contains the Abadi gas field. The initial deal was announced in late-July,

- In late-December, we saw completion announced for Longboat Energy's acquisition of Topaz Number One. The two were partners in their only acreage in the region, Block 2A in Malaysia that was awarded in February 2023. The deal was announced in mid-September, with Longboat now holding a 52.5% operated stake in the block.

In addition, I believe the Risco sale of Tap Oil is also complete.

Previously announced deals - Yet-to-complete

In addition to the Criterium deal from this quarter, there is a growing list of deals previously announced that are yet-to-complete. The first dating from December 2022, the second from Q1 and the third from Q2.

- From December 2022, it is BitExco's acquisition of MedcoEnergi's stake in Block 12W in Vietnam. I hear that MedcoEnergi are being cautious to ensure full compliance but expect the deal to close.

- Then from Q1 of this year, is MTI Energy's acquisition of Chevron's 41.1% stake in the Yadana asset in Myanmar. Very little detail has been provided but November saw a Reuters report highlighting that this deal had yet-to-complete, with no timeline for completion given.

- In June, Criterium Energy announced a deal to acquire Mont D'Or. These were my thoughts when the deal was announced: https://lnkd.in/er6RjD_4. After some issues, a restructured deal was announced in September. I believe all is going well and we should see completion early next year.

- The first Q3 deal that is yet-to-complete is Eni's acquisition of Chevron's remaining upstream assets in Indonesia. This was announced in late-July but the timeline to completion is unclear. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/indonesia-ma-eni-acquire-chevrons-remaining-assets-robert-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D

- The next deal came at the end of July, with Energi Mega Persada (EMP) announcing the acquisition of a 90% stake in the Siak and Kampar PSCs from Pertamina. As of 20th December, they are still awaiting approval from MEMR.

- The next deal came in mid-August, with Harbour Energy announcing that they have signed an SPA with Big Energy for the latter to acquire Harbour's stake in Block 12W in Vietnam. My full analysis of the deal can be found here: https://www.linkedin.com/pulse/vietnam-ma-big-energy-bitexco-agree-acquire-harbour-robert-chambers/?trackingId=5kdexUN0SdGZi51lmCYxaA%3D%3D. Completion is going slowly but should happen early next year.

- The next deal came in early September and saw PTTEP acquire TotalEnergies last remaining upstream interest in Thailand through the acquisition of TotalEnergies 33.33% stake in block G12/48 (Bongkot South). At the time, they said completion was expected by the end of 2023 but I am yet to see this confirmed.

The table below summarises the deals in the region that have been announced but are yet-to-close.

In addition to the above. We are also waiting for Eni's acquisition of Neptune to close. Current guidance is for completion by the end of Q1 2024.

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below:

There were no significant changes from Q3.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.