M&A in Southeast Asia - 2024 Q4

(Originally published on January 6, 2025)

Q4 has been has been quiet, with only one deal involving discovered resource, with this deal being in Indonesia. In addition, we saw the successful farm-down of exploration acreage offshore Malaysia.

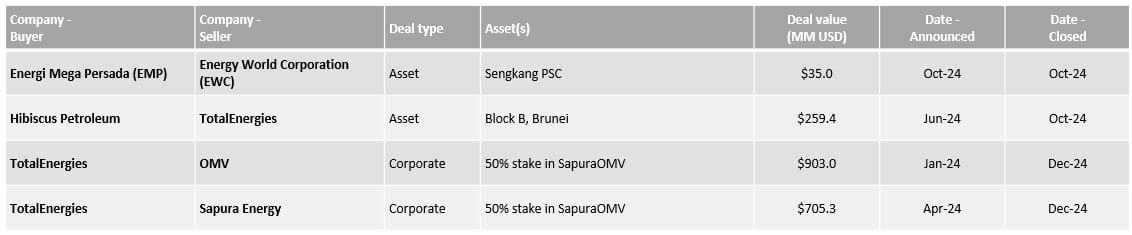

The annual deal count for 2024 is 10 deals with a total deal value of US $1,913 million, with the two major deals for the year being those that saw TotalEnergies acquire the two 50% stakes of SapuraOMV from OMV and Sapura Energy. By comparison, 2023 saw 19 transactions and a total deal value of just over US $840 million.

New deals announced in Q4

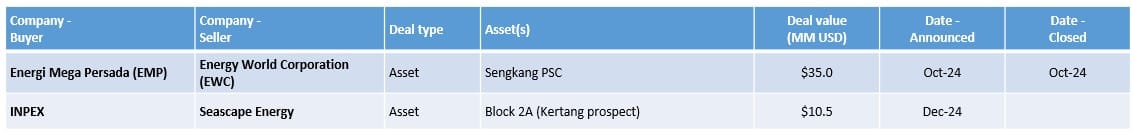

The two deals announced in Q4 were:

- In early October, Energy World Corporation (EWC) announced that they had signed an SPA with Energi Mega Persada (EMP) for the latter to acquire EWC's 51% operated stake in the Sengkang PSC that is located onshore South Sulawesi. The deal is for US $35 million and completion was announced in late October. EMP now hold 100% interest in the Sengkang PSC.

- In December, Seascape Energy announced they had signed a deal with INPEX to to farm-down their interest in Block 2A, located offshore Sarawak, Malaysia. INPEX will take a 42.5% operated interest, with Seascape Energy retaining a 10% interest. Completion is expected at the end of Q1 2025. Once complete, the rights holdings will be INPEX (42.5% + operator), PETRONAS (40.0%), PETROS (7.5%), and Seascape (10.0%). The deal sees Seascape fully carried through the exploration phase, including the planned exploration well. In addition, they will receive US$10 million in cash and reimbursement of about US$0.5 million in historic costs. A further contingent payment of US$10 million will be payable on a commercial discovery.

Regional round-up

This quarter has seen new awards from the bid round in Malaysia and the signing of previously announced awards in Indonesia.

New awards - Malaysia

The first new award in Malaysia came in October, with the award of the final DRO offering from the MBR+ bid round that was launched in 2023:

- DEWA Complex cluster: was awarded to EnQuest (42% + operator), Seascape Energy (28%), and Petros (30%), with the PSC to be operated under SFA terms. The cluster includes 12 gas fields & discoveries located offshore Sarawak. These discoveries could be developed as a cluster through nearby infrastructure at D35 or Bayan.

Then in early-December, MPM announced the results of the MBR 2024 bid round with three DROs and one exploration block awarded. I covered this is more detail here: https://www.linkedin.com/pulse/malaysia-mbr-2024-awards-robert-chambers-r4s4e/ but a summary of the four awards is below:

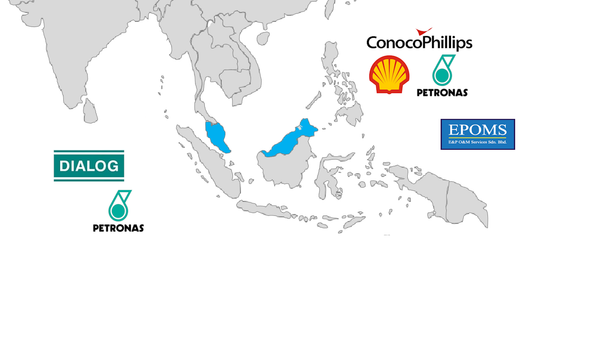

- PM-515: was awarded to PETRONAS Carigali / EPMV , with the PSC to be operated under Enhanced Profitability terms (EPT). This is the exploration block and is located offshore Peninsular Malaysia.

- Raja Cluster: was awarded to Dialog Resources, with the cluster will be operated under the SFA terms and is located offshore Peninsular Malaysia.

- Erb South: was awarded to EPOMS, with the field to be operated under the SFA terms and is located offshore Sabah.

- Ubah Cluster: was awarded to ConocoPhillips, Shell and PETRONAS Carigali. Likely with the same ownership structure as the Kebabang Cluster, which could offer potential synergies. The cluster will be operated under the Deepwater R/C terms and is located offshore Sabah.

MBR 2024 was launched in January and included five exploration blocks and five DROs, meaning four off the offshore exploration blocks and two of the DROs weren't awarded.

New awards - Indonesia

No new awards were announced in Indonesia, but we did see the signing of the three awards announced in September that were offered in the first bid round. December also saw the launch of the second bid round, with 6 blocks offered.

Deals that closed in Q4

From what I can see, three previously announced deals closed this quarter in addition to the EWC/EMP deal that was announced and closed in October.

- In mid-June and saw Hibiscus Petroleum and TotalEnergies announce an agreement for the former to acquire the latter's 37.5% operated stake in Block B in Brunei. The transaction completed in mid-October.

- The next two deals to complete are the two separate deals that saw TotalEnergies acquire the interests of OMV and Sapura Energy in SapuraOMV. The two deals were both announced as complete in mid-December.

Previously announced deals - Yet-to-complete

In addition to the new deal this quarter, we still have three announced deals waiting for completion.

- The first deal was announced in early September 2023, with PTTEP acquiring TotalEnergies last remaining upstream interest in Thailand through the acquisition of TotalEnergies 33.33% stake in block G12/48 (Bongkot South). At the time, they said completion was expected by the end of 2023. However, in their 22nd November 2024 investor presentation they stated the completion of the SPA was still in progress.

- The next deal was initially announced in December 2023 when an LOI was signed, with the formal agreement coming in May of this year. The deal sees Criterium Energy divest their 45% stake in the Bulu PSC in Indonesia to an as-of-yet unnamed buyer. As of early-September, Criterium announced that they had received some payments from the buyer and that the transaction is expected to close early Q4 2024, with closing still contingent upon the Buyer's ability to secure the necessary financing. There has been no further update.

- The next deal came in late-August 2024 and saw Hibiscus Petroleum announce a deal for them to take a 30% stake in the PM-327 exploration block from PETRONAS Carigali. The deal is subject to normal approvals.

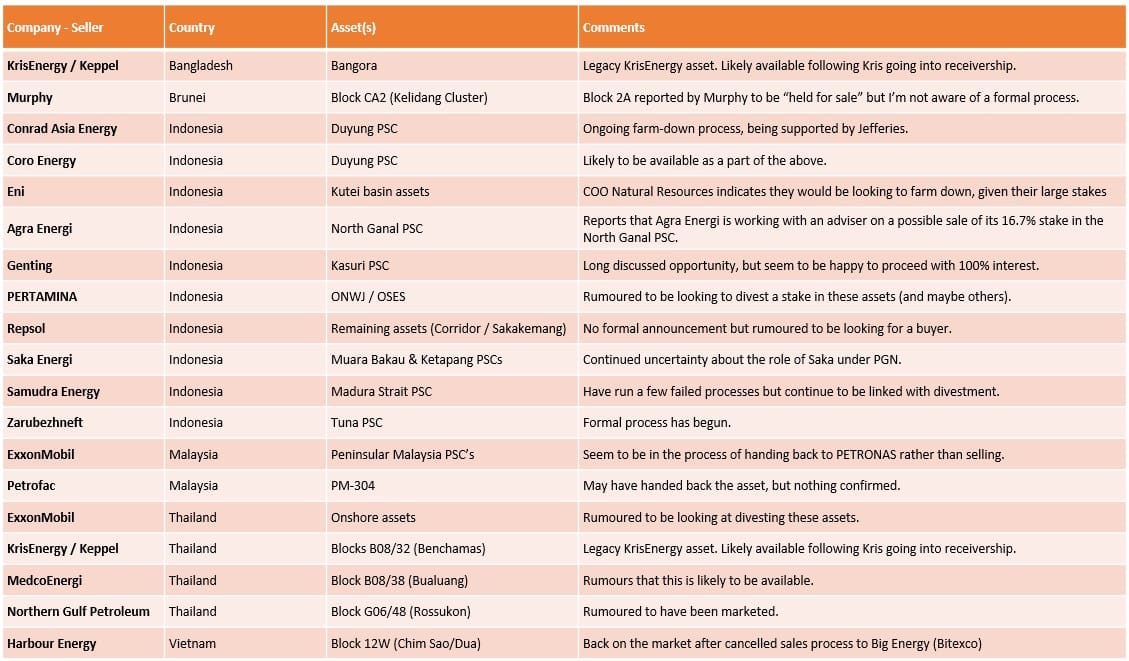

Assets on the market

I have been keeping track of the assets on the market, with these summarised in the table below:

The main changes from Q3 are:

- I have added Agra Energi's stake in the North Ganal block in Indonesia following press reports that they could be looking for a buyer.

- I have removed Seascape Energy's process for Block 2A in Malaysia following the successful farm-down.

Questions and feedback

If you have any questions or feedback on the article then please drop me a DM.