Malaysia M&A - TotalEnergies to acquire OMV's 50% interest in SapuraOMV

(Originally published on January 31, 2024)

Earlier today, TotalEnergies announced that they have agreed to acquire OMV's 50% interest in SapuraOMV. The transaction is for a consideration of US$ 903 million (including the transfer of a US$ 350 million loan granted by OMV to SapuraOMV) and is subject to customary conditions precedent, in particular the receipt of regulatory approvals. Closing is expected by the end of first half of 2024.

This is a big move for TotalEnergies. They had a limited exploration position in deepwater Sabah and this deal gives them anchor production and a number of development opportunities to allow them to both remain and grow in Malaysia.

TotalEnergies existing Malaysia assets prior to this deal were:

- Block SB-N (34.9% + operator) was awarded back in 2007, with the Tepat-1 discovery drilled in 2018. Appraisal was delayed by COVID but the Tepat-2 appraisal well was finally drilled in late-2022.

- Block SB-2K (same ownership as SB-N) was awarded in October 2022.

It is also great news for the upstream industry in Malaysia. With TotalEnergies having previously been a candidate to exit the country. Keeping a major IOC is a great result!

SapuraOMV's producing assets are all in Malaysia, and they also hold interests in exploration licenses in Malaysia, Australia, New Zealand and Mexico. I have provided a detailed view of the Malaysia assets below, together with a summary of the other assets.

Malaysian assets

OMV hold a 50% stake in SapuraOMV Upstream Sdn. Bhd., a company that was created in 2019 when the 50:50 JV was formed by OMV acquiring a 50% interest from Sapura for US$ 540 million. Sapura had previously acquired their upstream assets from Newfield in 2014 for US$ 898 million. The portfolio was subsequently trimmed when Jadestone acquired SapuraOMV's interest a number of assets in Peninsular Malaysia for a headline consideration of US$ 9 million. SapuraOMV continue to hold an interest in two shallow-water assets offshore Sarawak; SK-310 and SK-408, as well as exploration acreage.

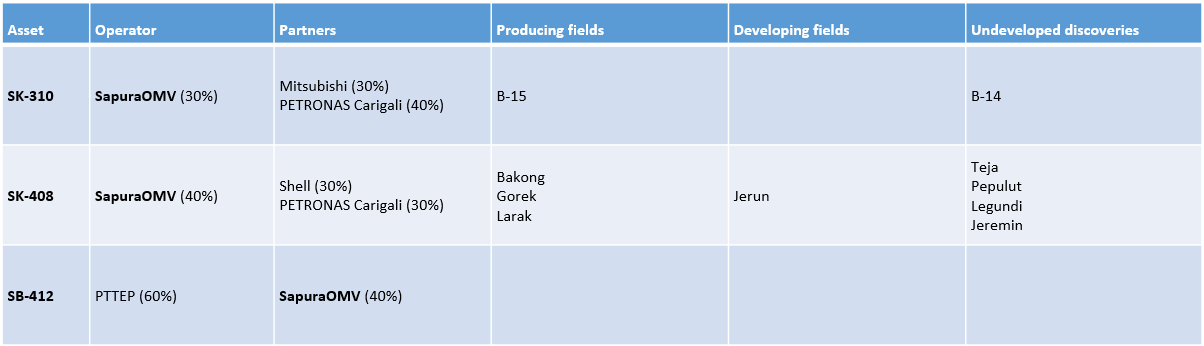

- SK-310: SapuraOMV are the operator with a 30% working interest. Their partners are Diamond Energy (a Mitsubishi subsidiary, 30%) and Petronas Carigali (40%).

- SK-408: SapuraOMV are the operator with a 40% working interest. Their partners are Shell (30%) and Petronas Carigali (30%).

- SB-412: SapuraOMV hold a single exploration asset in Malaysia, SB-412 in Sabah. This was only awarded in March 2022. PTTEP are the operator with a 60% working interest, with SapuraOMV holding the remaining 40%.

The Sarawak assets will have driven the acquisition value, with producing fields in each of the two assets, as well as fields being developed and undeveloped discoveries. These are summarised below:

SK-310 fields

The B-15 field was discovered in 2010 and was brought onstream in 2017 using a new CPP, with the produced gas tied-into existing infrastructure about 35km away. The produced gas is ultimately sent to MLNG for export into international LNG markets. PETRONAS acquire the gas prior at MLNG, with the price likely linked to the LNG sales price.

The B-14 field was discovered in 2013 and is about 10 times the size of the B-15 field. However, it has not been developed due to the high H2S content of about 3000 ppm, the gas also has a CO2 content of about 9%. The current development plan focuses on the field being developed through future facilities at PTTEP's Lang Lebah field as a second phase of the proposed Sarawak Integrated Sour Gas Evacuation System (SISGES) that could also include Shell's Rosmari-Marjoram development in SK-318. Again, the gas would ultimately be sent to MLNG for export into international LNG markets.

SK-408 fields

The first phase of development focused on three fields: Bakong, Larak and Gorek that were brought onstream in 2019 and 2020. The three independent developments all had similar concepts, using wellhead platforms and tie-backs into existing processing infrastructure. The produced gas is ultimately sent to MLNG for export into international LNG markets.

FID on the development of the Jerun field was taken in 2021, with the development expected onstream in 2024. The development is understood to be based on a new CPP, with a tie-in to existing infrastructure. The produced gas is ultimately sent to MLNG for export into international LNG markets.

There are a number of smaller discoveries that have the potential to be developed, these include Teja, Pepulut, Legundi and Jeremin. However, there are no visible plans that I have seen.

The gas from all of these fields contain typical acid gas contents for the basin, with about 5-10% CO2 and no significant H2S issues.

Exploration assets

SapuraOMV hold a single exploration asset in Malaysia, SB-412 in Sabah. This was awarded in March 2022.

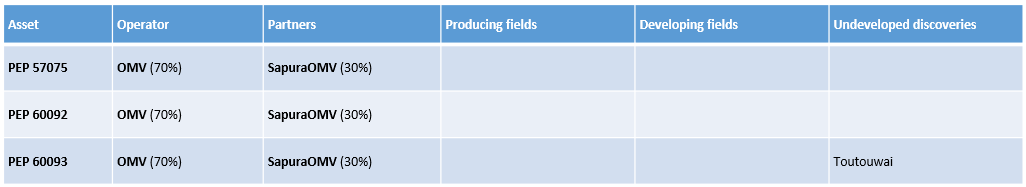

New Zealand assets

OMV are the largest acreage holder and producer in New Zealand, but the deal is only for SapuraOMV and therefore is limited to the SapuraOMV stakes in three exploration permits, all having the same participating interests:

- PEP 57075 / PEP 60092 / PEP 60093: OMV are the operator with a 70% working interest, with SapuraOMV holding the other 30%.

The fields and discoveries in these permits and licences are summarised below:

There is currently only a single discovery across the three licenses.

PEP 60093 (Toutouwai)

The Toutouwai-1 discovery was made in April 2020, making it the first new discovery in New Zealand since 2014. However, the testing of the well had to be curtailed due to restrictions related to the COVID-19 pandemic. It is likely that appraisal will be the next step here, if TotalEnergies choose to keep the assets.

Australia assets

SapuraOMV have held a number of exploration permits in Western Australia, but I believe their is only one remaining permit.

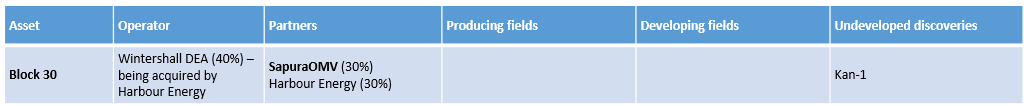

Mexico assets

SapuraOMV hold an interest in a single asset in Mexico; Block 30, where the Kan-1 oil discovery was made in April 2023.