Malaysia: MBR 2024 awards & MBR 2025 launch

(Originally published on February 20, 2025)

Monday saw the launch of 2025 Malaysia Bid Round, along with announcements of further awards from the 2024 bid round.

If you wanted a brief summary, fantastically successful, with new companies entering and most blocks awarded. A longer summary below.

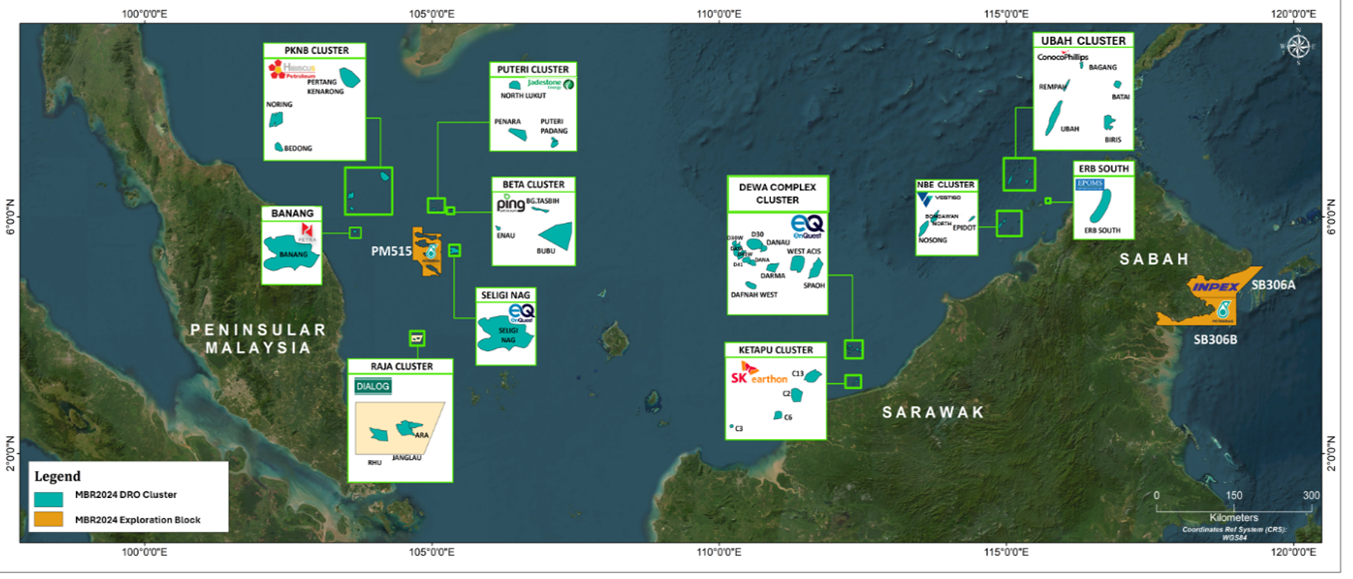

MBR+ & MBR 2024 - Awards

The MBR+ bid round was launched in October 2023 and saw six DROs offered. MBR 2024 was launched in January 2024 and, at the time, included five exploration blocks and five DROs, with a further late-life asset (LLA) later included.

MBR+ awards

We have seen the MBR awards announced steadily announced through the year, with all six of the offered DROs eventually awarded:

- In late-June, the NBE Cluster was awarded to Vestigo Petroleum (100%). The cluster consists of the Nosong, Bongawan North and Epidot (predominantly gas) fields. The cluster was reportedly offered as a part of the MBR+ bid round that was launched in October 2023, although no DROs in Sabah were mentioned at the time of launch. The award is under the Small Field Asset (SFA) terms.

- In late-July, the Puteri Cluster was awarded to Jadestone Energy (100% + operator). The cluster includes the Penara, Puteri-Padang and North Lukut fields, assets in which Jadestone previously held a 50% non-operated interest through the PM-318 PSC and is also surrounded by PM-428, in which Jadestone hold a 60% operated stake. The Puteri cluster will be operated under the small fields asset (SFA) terms.

- Also in late-July, the BETA Cluster was awarded to Ping Petroleum (90% + operator) and Duta Marine (10%). The cluster includes the Bubu, Bunga Tasbih, and Enau fields that are located between 4km to 8km from Ping’s existing Abu Custer asset, providing significant synergy potential for an Area Development. The BETA cluster will be operated under the small fields asset (SFA) terms.

- Also in late-July, the PKNB Cluster was awarded to Hibiscus Petroleum (65% + operator) & PETRONAS Carigali (35%). The cluster includes the Pertang, Kenarong, Noring and Bedong gas fields that could be tied-back to the fields in the Hibiscus Petroleum operated PM-03 CAA PSC. The fields are also surrounded by the PM-327 exploration block, in which Hibiscus have taken a 30% stake (see above) allowing further potential synergies. The PKNB cluster will be operated under improved R/C terms.

- In early-September, the Ketapu Cluster: was awarded to SK Earthon (85% + operator) and PETROS (15%). The cluster contains the C13, C2, C6 and C3 fields. The fields are surrounded by the SK-427 exploration block that was awarded to the same partners back in December 2021. I have not seen any details of the Ketapu cluster terms, but understand it may have been offered under PSC terms rather than SFA terms.

- In late-October, the DEWA Complex Cluster was awarded to EnQuest (42% + operator), Seascape Energy (28%), and PETROS (30%), with the PSC to be operated under SFA terms. The cluster includes 12 gas fields & discoveries located offshore Sarawak. These discoveries could be developed as a cluster through nearby infrastructure at D35 or Bayan.

MBR 2024 awards

The first award related to the MBR 2024 round was not strictly offered under the round, and came before the main awards:

- In mid-June, the Banang field (Peninsular Malaysia) was awarded to Petra Energy (100%) under a new Late Life Asset (LLA) contract. Petra Energy had been operating the field on behalf of PETRONAS since June 2020 under a Technical Services Agreement (TSA).

In early-December, MPM announced the results of the MBR 2024 bid round with three DROs and one exploration block awarded:

- PM-515: was awarded to PETRONAS Carigali / E&P Malaysia Ventures, with the PSC to be operated under Enhanced Profitability terms (EPT). This is the exploration block and is located offshore Peninsular Malaysia.

- Raja Cluster: was awarded to Dialog Resources (100%), with the cluster will be operated under the SFA terms and is located offshore Peninsular Malaysia.

- Erb South: was awarded to EPOMS (100%), with the field to be operated under the SFA terms and is located offshore Sabah.

- Ubah Cluster: was awarded to ConocoPhillips (30% + operator), Shell (30%) and PETRONAS Carigali (40%). The award mirrors the ownership of the Kebabang Cluster, which could also offer potential for development synergies. The cluster will be operated under the Deepwater R/C terms and is located offshore Sabah.

MPM have also stated that an additional contract award from December came under the MBR 2024 bid round:

- In mid-December, the non-associated gas and condensate resources at the Selegi field were annexed into the existing PM-08 PSC that currently excluded these volumes. The PM-08 PSC is held by EnQuest (50% + Operator), PETRONAS Carigali (40%), and E&P Malaysia Ventures (10%). This annexation is reported to allow the development of 155 Bscf of additional gas resource at the field.

Then on Monday, we saw two more awards, together with some unexpected technical evaluation agreements. The two exploration awards were:

- SB-306A: was awarded to INPEX (50% + operator), PETRONAS Carigali (42.5%), and SMJ Energy (7.5%). The exploration block and is located offshore East Sabah.

- SB-306B: was awarded to PETRONAS Carigali (50% + operator), INPEX (42.5%), and SMJ Energy (7.5%). The exploration block and is located offshore East Sabah.

The two significant technical evaluation agreements (TEA) were:

- Langkasuka Basin: the TEA was awarded to BP, Eni, PETRONAS Carigali, TotalEnergies, PTTEP, and Pertamina. The basin sits offshore Western Peninsular Malaysia in the Straits of Malacca.

- Layang-Layang Basin: the TEA was awarded to INPEX, PETRONAS Carigali, and TotalEnergies. The basin sits offshore Sabah.

The awards are very encouraging and see country entry (re-entry after a 20+ year break) for Eni and BP. Their interest in the Langkasuka Basin may be driven by recent success in the Andaman Sea in Indonesia.

Blocks / DROs not awarded

All of the DROs offered in MBR+ were awarded. However, there were three DROs and three exploration blocks that weren't awarded during MBR 2024.

The three DROs were:

- Tembakau Cluster: an award of the Tembakau Cluster to IPC was announced but then they pulled out after changing their minds before signing. The cluster is being recycled in MBR 2025 as the Temaris Cluster.

- Korbu Cluster

- Kerisi Cluster

The three exploration blocks were split between Peninsular Malaysia and Sabah.

- PM-320, PM-321: offshore wester Peninsular Malysia. Likely to form a part of the TEA for the Langkasuka Basin.

- SB-304

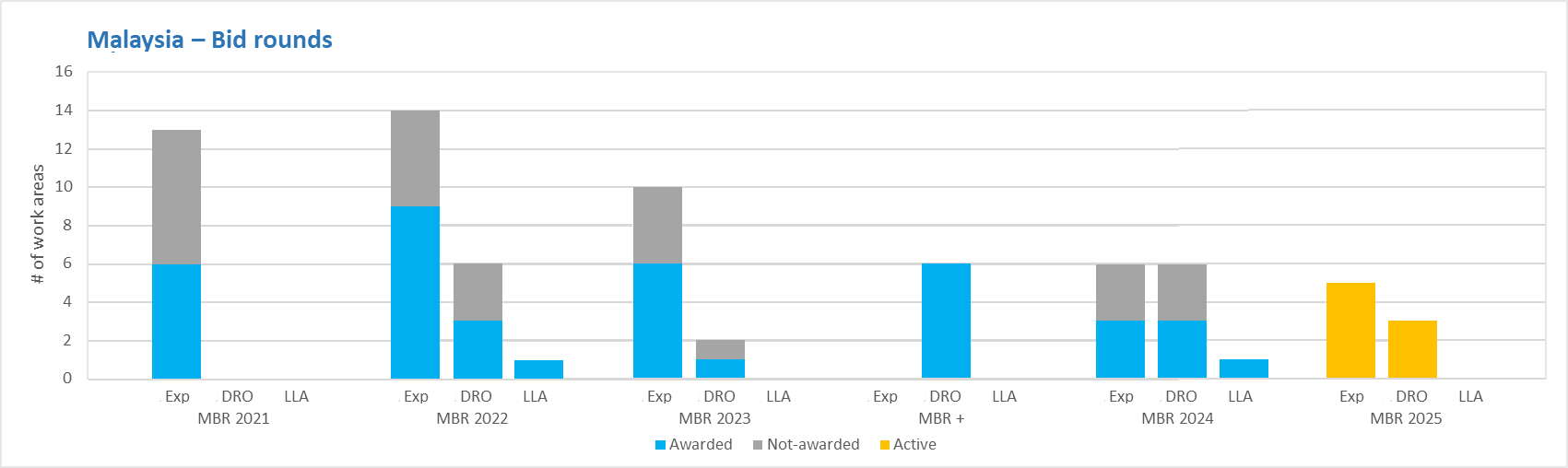

Trends in recent awards

The chart below summarizes the blocks offered and awarded over the last 4 years' rounds.

The success (awards / offered) for each of the rounds was:

- MBR 2021: 46%,

- MBR 2022: 62%,

- MBR 2023: 58%,

- MBR+: 100%,

- MBR 2024: 58%.

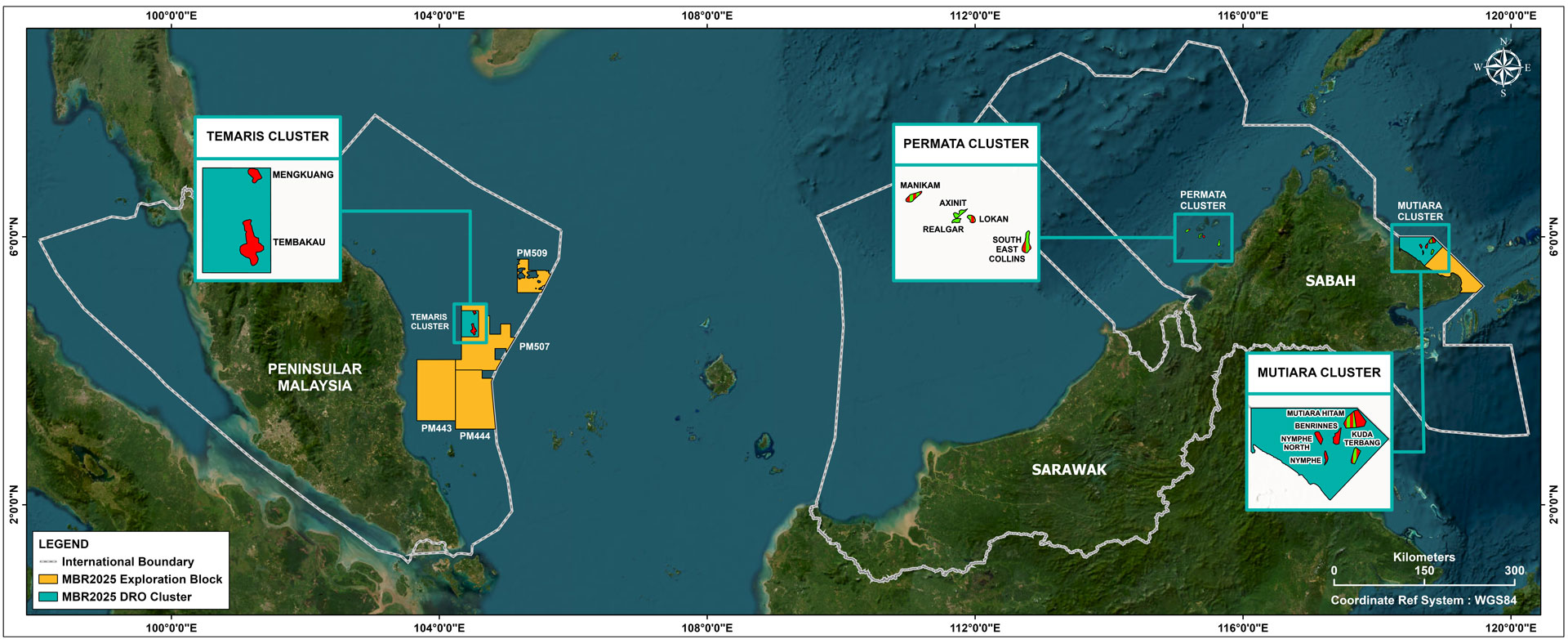

MBR 2025 launch

MBR 2025 was also launched on Monday and included five exploration blocks and three DROs. We continue to see the absence of Sarawak acreage being offered.

Exploration - Peninsular Malaysia

Four exploration blocks were offered in Peninsular Malaysia:

- PM-507: located offshore the Peninsular Malaysia, in the Malay Basin. The block is offered under Enhanced Profitability terms (EPT).

- PM-509: located offshore the Peninsular Malaysia, in the Malay Basin. The block is offered under Enhanced Profitability terms (EPT).

- PM-443: located offshore the Peninsular Malaysia, in the Penyu Basin. The block is offered under Enhanced Profitability terms (EPT).

- PM-444: located offshore the Peninsular Malaysia, in the Penyu Basin. The block is offered under Enhanced Profitability terms (EPT).

Exploration - Sabah

A single exploration block was offered in Sabah:

- SB-505: located offshore the north-east coast of Sabah, in the Sandakan Basin. The block is offered under Enhanced Profitability terms (EPT).

DROs

Three DROs have been offered, one offshore Peninsular Malaysia and two offshore Sabah.

- Temaris Cluster: located offshore Peninsular Malaysia and offered under SFA terms. The cluster contains the Temabakau and Mengkuang discoveries, making it the same as the Tembakau Cluster DRO that was offered in MBR 2024. An award of the Tembakau Cluster to IPC was announced but it would appear there was a last minute change of heart.

- Mutiara Cluster: located offshore Sabah and offered under SFA terms. The cluster contains the Nymphe, Nymphe North, Kuda Terbang, Mutiara Hitam, and Benrinnes discoveries.

- Permata Cluster: located offshore Sabah and offered under SFA terms. The cluster contains the South East Collins, Lokan, Realgar, Axinit, and Manikam discoveries.