Malaysia - Reflections and insights

(Originally published on February 2, 2024)

Since COVID, Malaysia has become a bit of a poster child, not only for the region but across the global upstream industry, for how governments, regulators and industry can work collaboratively to achieve mutually beneficial outcomes.

This is the first of two articles looking at the upstream industry in Malaysia. In this article, I will take a look at some of the positive changes and results we have seen as well as the focus for each of the core producing areas. In the second article, I will look at the company landscape.

Production

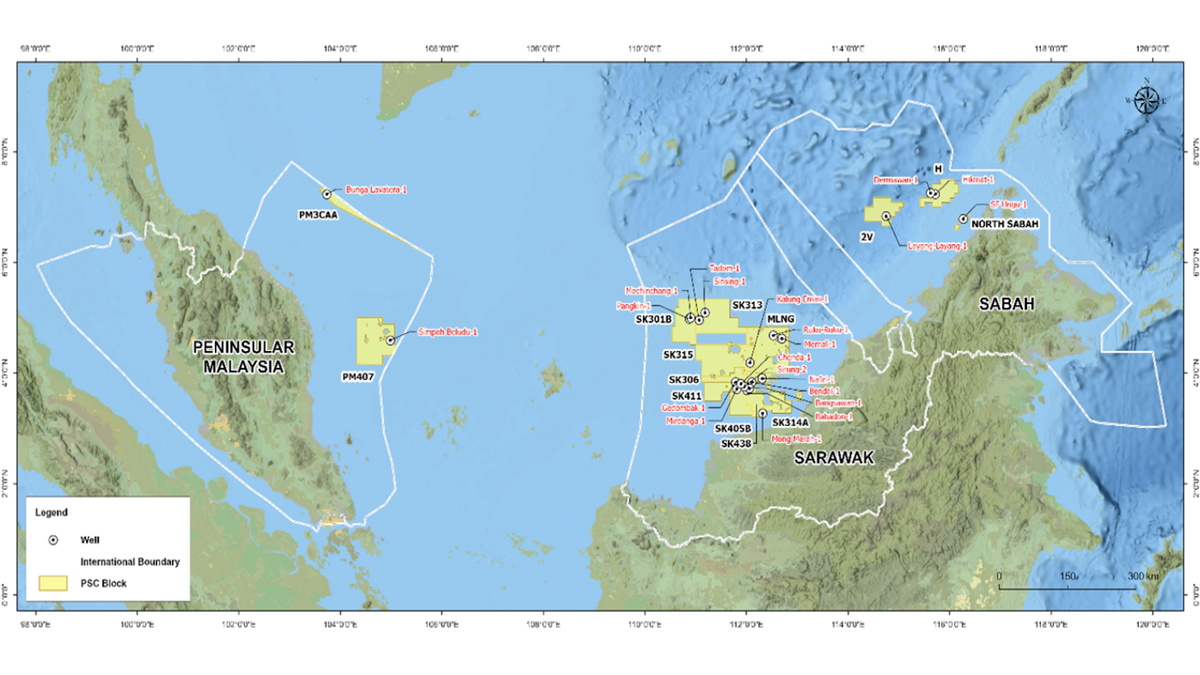

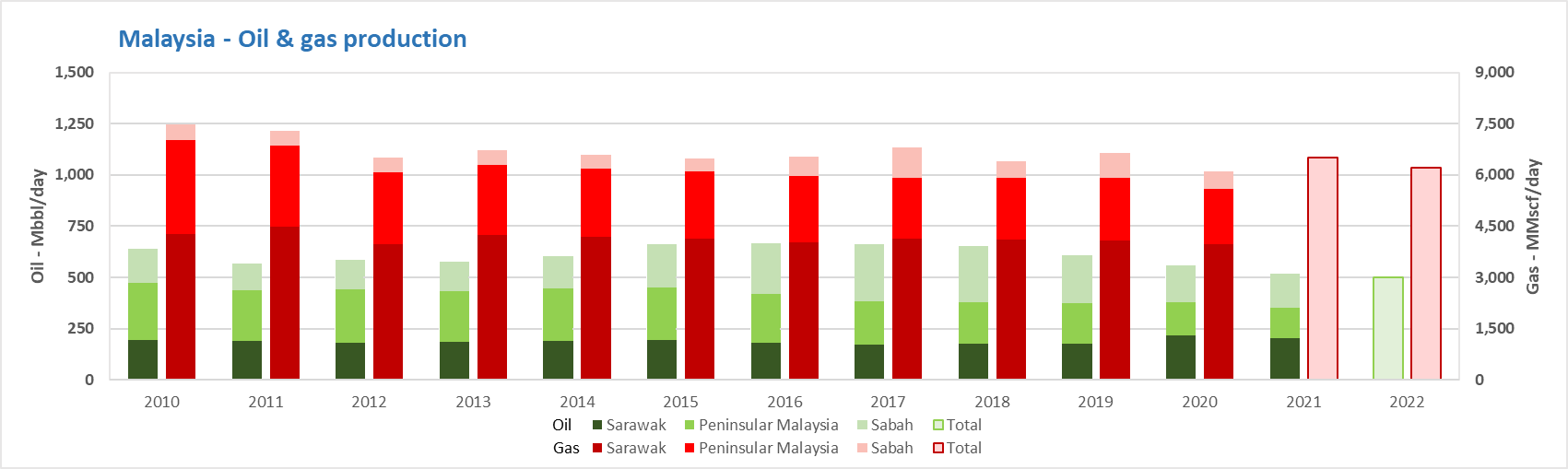

The oil and gas opportunities in Malaysia can be delineated into three core regions, Peninsular Malaysia, Sarawak and Sabah. The production of oil and gas is shown below, split by these three regions where possible. The data is from a couple of different public sources, so it may not be perfect but paints a good picture.

Peninsular Malaysia, Sarawak and Sabah vary in their histories and present different opportunity sets and challenges. Therefore, when considering Malaysia, it is best that I focus on them individually. But before doing that, I will take a look at some of the above-ground improvements and recent bid round results.

Above-ground improvements

Over the last few years the Malaysian government, through the regulator MPM, have worked really hard to improve the investment environment in the upstream industry. They have understood the types of opportunities that Malaysia can offer, the types of investors they would want to attract and the reasons these investors would choose / not choose to invest in Malaysia. From this, they have adjusted fiscal terms and policies, been consistent with their approach, and looked to continually review and improve based on industry feedback. The result is companies investing, be that in new acreage, in exploration activities or through developments.

Fiscal term evolution

One key element has been the continual evolution of the fiscal terms, with a focus on matching the terms against the opportunities. Since 2018, MPM have introduced specific terms for Deepwater assets, Late-life assets and small fields, with 2021 seeing the introduction of "Enhanced Profitability Terms".

State involvement in upstream

One legacy issue that seems to have now be resolved is the role of the Sarawak and Sabah state governments in their upstream industry. This issue began shortly after the 2018 general election and at its peak saw the Sarawak state government impose a 5% export tax on oil and gas. The resolution involved the establishment of state oil companies; PETROS for Sarawak and SMJ for Sabah, which are now taking direct stakes in their upstream assets, generally it has been PETRONAS creating space for them.

Emissions / CCUS / Energy transition

Malaysia has taken a balanced approach to managing emissions and transitioning away from oil and gas, with a goal to be net zero by 2050. As a part of this goal, their roadmap states the aim to install 70% renewable capacity and phase out coal power plant completely by 2050. From an upstream perspective, they have continued to invest, promoting gas as a way to displace coal for power generation and undertaken a number of initiatives to look at CCUS and alternative energy options such as hydrogen. This has included partnerships with a number of international partners as well as taking FID on the CCS element of PETRONAS' Kasawari project in late-2022.

Discoveries

2023 was a bumper year for discoveries in Malaysia. According to a November press release: https://www.petronas.com/media/media-releases/malaysia-records-over-1-billion-barrels-oil-equivalent-exploration-discoveries, over 1 billion barrels of oil equivalent were discovered in the year.

Whilst the scale of individual discoveries wasn't provided, it certainly shows there is plenty of potential left in the Malaysian basins. It also shows that, if the right investment environment is created, then companies are still happy to invest in exploration.

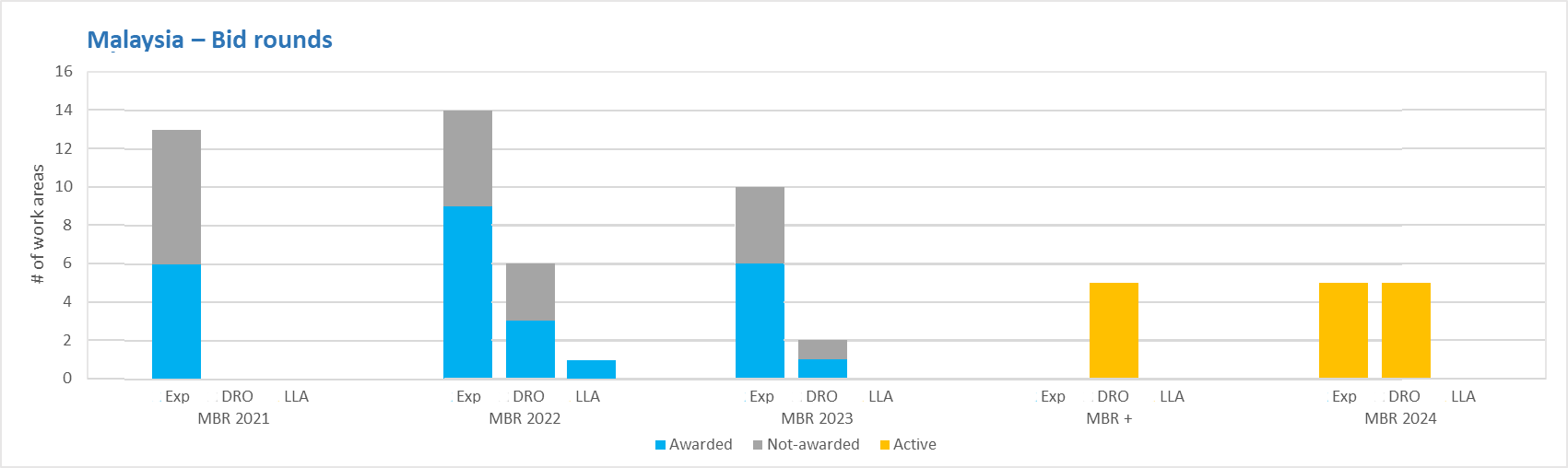

Bid rounds

Malaysia have really upped their game when it comes to bid rounds over the last few years, with consistent and well thought out offerings and very professional launches combined with good data availability and evolving terms. They have generally launched the round early in the year, with offerings for exploration, discovered resources (DRO) and late-life assets (LLA). The chart below summarizes the offers and awards from the last few bid rounds. In addition, technical study opportunities have also been offered.

More detailed analysis can be found in my articles on the last two bid rounds. For MBR 2022 awards and 2023 launch: https://www.linkedin.com/pulse/malaysia-mbr-2022-awards-2023-launch-robert-chambers/. And for MBR 2023 awards and 2024 launch: https://www.linkedin.com/pulse/malaysia-mbr-2023-awards-2024-launch-robert-chambers-go8ye/.

The only challenge for future bid rounds is that lack of available acreage, with all exploration blocks offshore Sarawak and in the Northwest Sabah Basin fully licensed.

Focus - Peninsular Malaysia

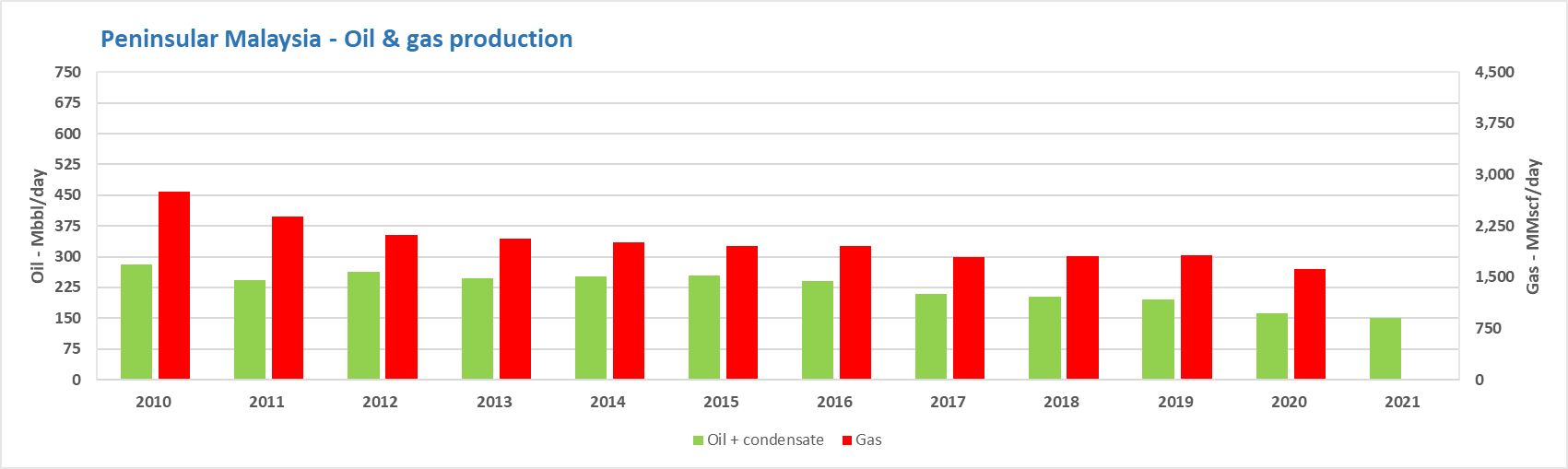

Peninsular Malaysia (PM) is pretty mature and has declined from its glory days. The oil and gas produced is generally exported through existing pipeline infrastructure to Peninsular Malaysia, where it feeds domestic gas demand, refineries and industry.

Oil production in Peninsular Malaysia hovered around 450 Mbbl/day in the late-1990's to the early 2000's but has steadily declined to just about a third of this and will likely continue to decline. Historical production for Peninsular Malaysia is provided below:

The focus will be ensuring maximum recovery from the legacy assets, development of the remaining undeveloped fields (including DROs) and encouraging (likely nearfield) exploration.

The major legacy producing assets are mature and either controlled by PETRONAS but international investors such as ExxonMobil, EnQuest and IPC continue to hold mature assets, with specific projects highlighted by PETRONAS including redevelopment projects at the Bekok, Tabu and Seligi fields. The government will want to incentivize these companies to continue to invest in these assets to maximize production, or divest them to a late-life specialist as we have seen with the entry of Jadestone Energy and Hibiscus Petroleum.

The DRO and LLA awards have seen new entrants in Rex International and Ping Petroleum, whilst the recent bid rounds have seen exploration awards to PTTEP, EnQuest, POSCO International and Jadestone Energy.

On the exploration side, there were two discoveries in 2023, with PTTEP and Hibiscus Petroleum having successes.

Focus - Sarawak

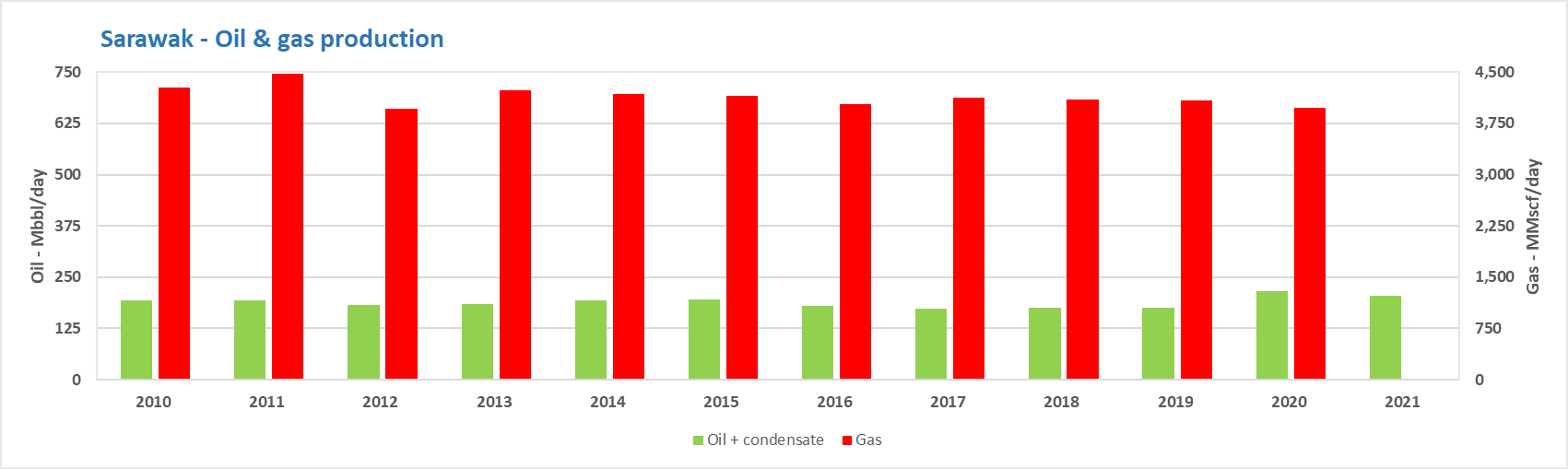

Sarawak production in predominantly gas, the majority of which is sent to the MLNG complex in Bintulu for export to international markets, with some gas also sent to domestic markets and downstream industries in Sarawak. Historical production for Sarawak is provided below:

The focus will be on maintaining feedstock to MLNG through the timely development of gas projects as well as developing downstream industries to increase domestic gas demand. This requires a steady stream of both new field developments and discoveries to keep the supply coming.

The most recent major fields to come onstream was Pegaga (Mubadala) in June 2022 and Timi (Shell) in August 2023. This coming year, we should see the Kasawari (PETRONAS) and Jerun (SapuraOMV) fields come onstream. We then have a decent looking pipeline with the development of the Lang Lebah and Paprika fields (PTTEP) expected to take FID this year, with the potential to develop either/both Rosmari-Marjoram (Shell) or B-14 (SapuraOMV) shortly after.

One of the challenges for a number of the Sarawak gas developments is the acid gas content (both CO2 and H2S). My very talented former colleague David Ooi put together some concise analysis on this back in 2020: https://www.spglobal.com/commodityinsights/en/ci/research-analysis/malaysia-lng-feedstock-gas-supply-faces-headwinds.html.

On the exploration side, 2023 was a bumper year with 15 discoveries plus a successful appraisal announced. These were dominated by PETRONAS, Shell and PTTEP. There could be potential for a few of these to be fast-tracked for development ahead of some of the existing discoveries.

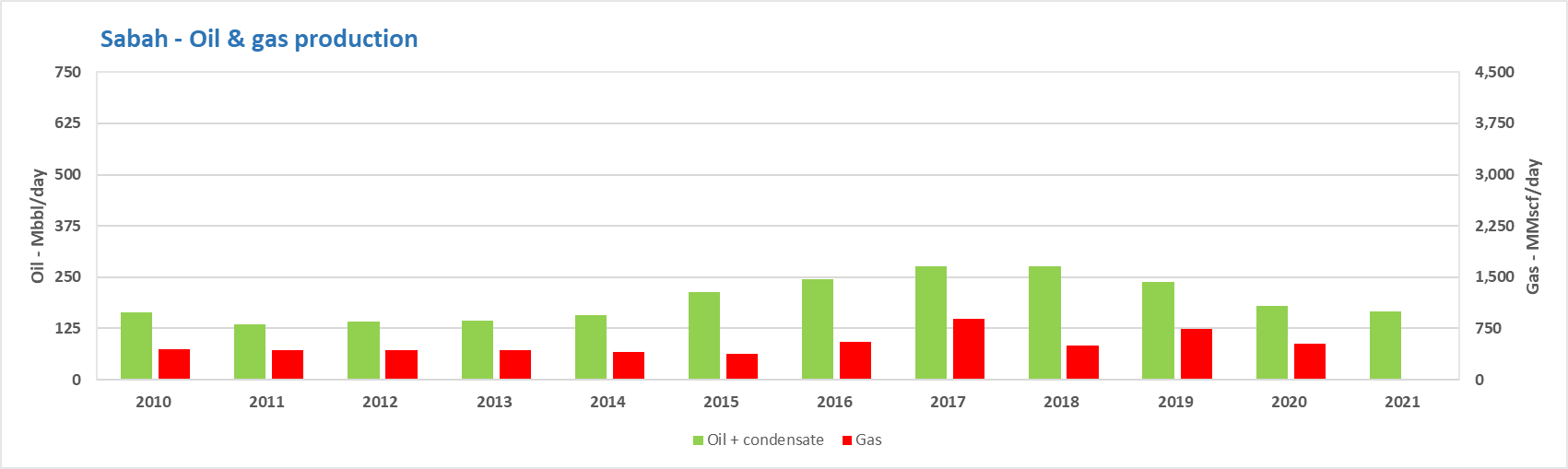

Focus - Sabah

Sabah is the smallest of the three regions when it comes to existing production but could hold the most exploration potential, particularly in the deepwater. Historically, the developments focused on oil, with fields such as Samarang, Tembungo, Kinabalu, Kikeh, Malikai, and Siakap North-Petai brought onstream, not to mention the Malaysian share of the Gumusut-Kakap unitized field development. More recently, the focus has turned to gas, particularly in the deepwater, with developments such and the Kebabagan Cluster and Rotan brought onstream. However, issues with the Sabah Sarawak Gas Pipeline have caused challenges in the planned route-to-market.

I put together a good summary of the SSGP issues for my former employer in late-2021: https://www.spglobal.com/commodityinsights/en/ci/research-analysis/pflng-tiga-another-sticking-plaster-or-a-long-term-solution.html.

This year saw PETRONAS permanently close a section of the pipeline, effectively ending the prospect of any gas coming to Sarawak from Sabah through the line. However, they have been working hard on alternatives by committing to a third FLNG vessel (ZLNG) that will be located nearshore as well as growing domestic industrial demand onshore Sabah and will need to continue to look for solutions to this problem if there is going to be a market for new gas discoveries.

On the exploration side, we saw three new discoveries in 2023 through PETRONAS and PTTEP. In addition, 2022 saw successful appraisal at the Tepat-2 well (TotalEnergies).

Questions and feedback

I have created this article through my own research. If you have any questions or feedback on the article then please drop me a DM.