OMV to divest Asia Pacific assets - Malaysian assets

(Originally published on March 1, 2023)

On Monday (27th February), OMV confirmed that it had launched a sales process for the potential divestment of its 50% stake in SapuraOMV Upstream Sdn. Bhd. in Malaysia, and 100% of OMV New Zealand Limited. A formal sales process should generate significant interest beyond the previously reported interest from Carlyle Group (for OMV's upstream business).

It is not clear if this is a single sales process, or if there are separate processes divided by company or geography. A single process might offer the simpler solution to OMV but there would likely be more potential buyers if the processes were separated.

For this article, I will focus on the Malaysian assets and will look at the remaining assets later in the week. It should that in addition to the Malaysian assets discussed below, SapuraOMV also hold exploration assets in Australia (Bonaparte basin) and New Zealand (Taranaki basin).

Malaysian asset summary

OMV hold a 50% stake in SapuraOMV Upstream Sdn. Bhd., a company that was created in 2019 when the 50:50 JV was formed by OMV acquiring a 50% interest from Sapura for US$ 540 million. Sapura had previously acquired their upstream assets from Newfield in 2014 for US$ 898 million. The portfolio was subsequently trimmed when Jadestone acquired SapuraOMV's interest a number of assets in Peninsular Malaysia for a headline consideration of US$ 9 million. SapuraOMV continue to hold an interest in two shallow-water assets offshore Sarawak; SK-310 and SK-408, as well as exploration acreage.

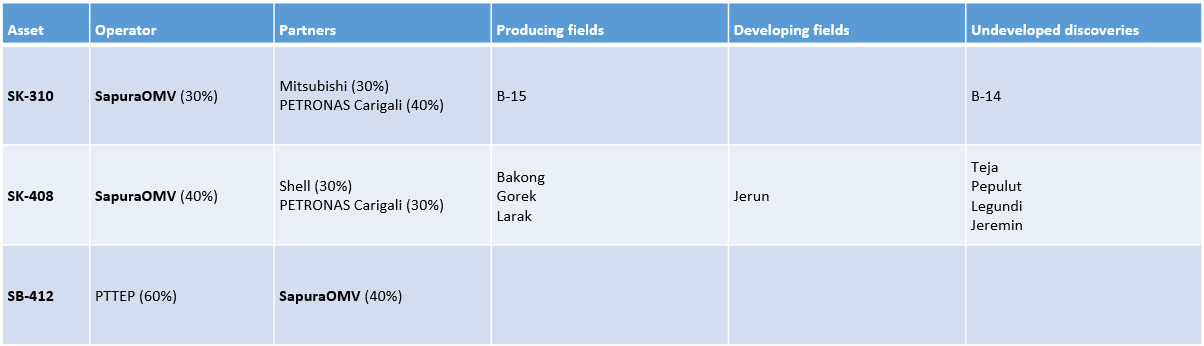

- SK-310: SapuraOMV are the operator with a 30% working interest. Their partners are Diamond Energy (a Mitsubishi subsidiary, 30%) and Petronas Carigali (40%).

- SK-408: SapuraOMV are the operator with a 40% working interest. Their partners are Shell (30%) and Petronas Carigali (30%).

- SB-412: SapuraOMV hold a single exploration asset in Malaysia, SB-412 in Sabah. This was only awarded in March 2022. PTTEP are the operator with a 60% working interest, with SapuraOMV holding the remaining 40%.

The Sarawak assets will drive the value of any acquisition, with producing fields in each of the two asset, as well as fields being developed and undeveloped discoveries. These are summarised below:

SK-310 fields

The B-15 field was discovered in 2010 and was brought onstream in 2017 using a new CPP, with the produced gas tied-into existing infrastructure about 35km away. The produced gas is ultimately sent to MLNG for export into international LNG markets. PETRONAS acquire the gas prior at MLNG, with the price likely linked to the LNG sales price.

The B-14 field was discovered in 2013 and is about 10 times the size of the B-15 field. However, it has not been developed due to the high H2S content of about 3000 ppm, the gas also has a CO2 content of about 9%. The current development plan focuses on the field being developed through future facilities at PTTEP's Lang Lebah field as a second phase of the proposed Sarawak Integrated Sour Gas Evacuation System (SISGES) that could also include Shell's Rosmari-Marjoram development in SK-318. Again, the gas would ultimately be sent to MLNG for export into international LNG markets.

SK-408 fields

The first phase of development focused on three fields: Bakong, Larak and Gorek that were brought onstream in 2019 and 2020. The three independent developments all had similar concepts, using wellhead platforms and tie-backs into existing processing infrastructure. The produced gas is ultimately sent to MLNG for export into international LNG markets.

FID on the development of the Jerun field was taken in 2021, with the development expected onstream in 2024. The development is understood to be based on a new CPP, with a tie-in to existing infrastructure. The produced gas is ultimately sent to MLNG for export into international LNG markets.

There are a number of smaller discoveries that have the potential to be developed, these include Teja, Pepulut, Legundi and Jeremin. However, there are no visible plans that I have seen.

The gas from all of these fields contain typical acid gas contents for the basin, with about 5-10% CO2 and no significant H2S issues.

Exploration assets

SapuraOMV hold a single exploration asset in Malaysia, SB-412 in Sabah. This was only awarded in March 2022 so is unlikely to hold any significant value.

Reasons to acquire

- The assets present a great opportunity in an established basin, with both existing production and plenty of upside potential.

- The assets are all heavily gas weighted and would thus fit most companies' emissions narratives.

- The assets provide exposure to international LNG markets and pricing, without the need to take on the marketing of the LNG.

- There is plenty of existing infrastructure in the area to facilitate the future developments.

- Sapura Energy are also understood to be looking to divest their 50% stake in SapuraOMV. Therefore, there is potential for a bigger opportunity and to become sole operator of the two main assets.

- The partners in the asset are strong, established players with significant experience in the region.

- Malaysia continues to offer exploration potential, allowing a new entrant plenty of scope to expand their position.

- Malaysia is actively pursuing CCUS solutions that could significantly reduce the GHG intensity of the assets.

Challenges

- Development of B-14 is currently reliant on as-yet undeveloped infrastructure. Therefore, there is plenty of risk and uncertainty here.

- Undeveloped fields will be developed into MLNG. Whilst there is some spare capacity, there is no guarantee that this will meet proposed development timelines of the undeveloped fields.

- The CO2 content of the fields is generally in the 5-10% range. Whilst not unusual for the basin or challenging from a technical development perspective, it will give the assets a higher GHG intensity (without CCUS).

- Sapura Energy are also understood to be looking to divest their 50% stake in SapuraOMV. Simultaneous processes could cause a challenge.

Potential buyers

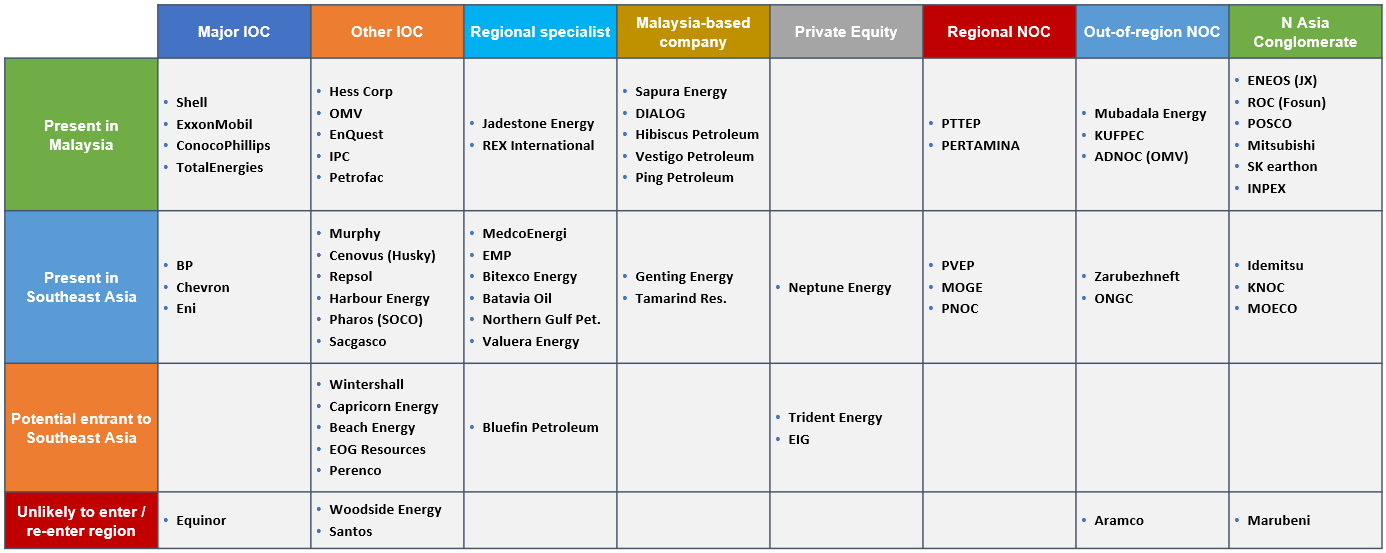

To look at the buyers, I can go back to the table I prepared for my Malaysia overview, with a few updates:

- Major IOCs: Shell could be tempted to bid if they see value in these assets and already have interest in SK-408. Again, ConocoPhillips could take a pragmatic view of this opportunity.

- Other IOCs: This could be the perfect opportunity for Harbour Energy to commit to the region and expand. Wintershall have often been discussed as a potential entrant to Malaysia too.

- Regional specialists / Malaysian-based companies: this opportunity is likely to be too large for the majority of these players, with MedcoEnergi the main exception but I see them as unlikely buyers.

- Private equity: these Malaysian assets present a great opportunity for PE money to come into the region.

- Regional NOC: PTTEP could also consider these assets to further increase their position in Malaysia. However, they have a lot of CAPEX commitments both at home and in Malaysia that may limit their ambitions.

- Out-of-region NOCs: Middle Eastern players could also be an option, with KUFPEC having a stake in Lang Lebah and ADNOC having recently acquired a 24.9% stake in OMV from Mubadala.

- North Asian conglomerates: If the Malaysian assets were ring-fenced, then I could see this being a perfect opportunity for Japanese and Korean conglomerates, who have shown renewed interest in Southeast Asia, particularly gas-to-LNG. Front runners could include INPEX (re-entered Malaysia through 2022 bid round), SK Earthon and POSCO (both also recent entrants on the exploration side).