OMV to divest Asia Pacific assets - New Zealand assets

(Originally published on March 3, 2023)

Following on from my previous article, today I will take a look at the New Zealand assets held by OMV, either directly or through their 50% interest in SapuraOMV.

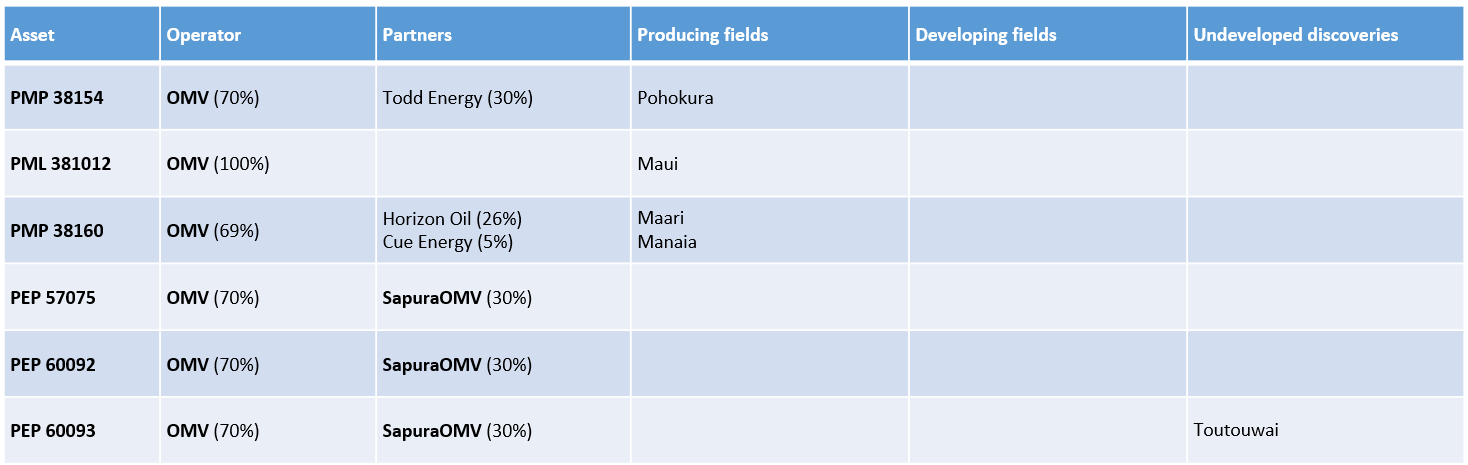

New Zealand asset summary

OMV are the largest acreage holder and producer in New Zealand, operating a number of key assets. They have been in New Zealand for at least 20 years and strengthened their position in 2019 when they acquired Shell's New Zealand portfolio.

They hold an interest, and are operator, of three key assets:

- PMP 38154 (Pohokura): OMV are the operator with a 70% working interest, with Todd Energy holding the remaining 30%.

- PML 381012 (Maui): OMV are the operator with a 100% working interest.

- PMP 38160 (Maari/Manaia): OMV are the operator with a 69% working interest. Their partners are Horizon Oil (26%) and Cue Energy (5%).

In addition, OMV (both directly and through SapuraOMV) hold an interest in three exploration permits, all having the same participating interests:

- PEP 57075 / PEP 60092 / PEP 60093: OMV are the operator with a 70% working interest, with SapuraOMV holding the other 30%.

The fields and discoveries in these permits and licences are summarised below:

Further details on each of the fields is provided below together with production forecasts, which are based on data published by the New Zealand Ministry of Business, Innovation and employment (MBIE).

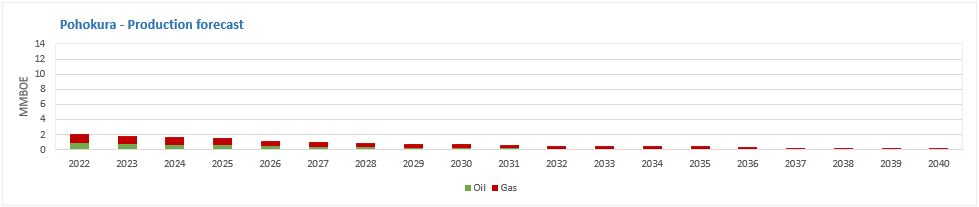

PMP 38154 (Pohokura)

The Pohokura field development came onstream in 2006, with the development based on a combination of extended reach wells drilled from shore and wells drilled from an offshore wellhead platform. The produced fluids are processed onshore with the gas sold into the domestic market and the condensate transported to Port Taranaki for export.

The field continues to produce, with about 20-25% of the reserves remaining. OMV have continued to invest in the field to maintain production, with both a compression project and infill drilling recently undertaken. 2019 saw an unexpected decline in production and it is not clear if the reasons for this are fully understood, this had a direct impact on industry in New Zealand owing to the tight gas market. The government forecast shows a slow decline in production but at least another 15 years of field life.

PML 381012 (Maui)

The Maui field came onstream in 1979, with the development based on wellhead platforms and an FPSO, as well as an onshore processing plant. The FPSO has since been removed as oil production declined. The gas is sold into the domestic market and the condensate is sent for export.

The field continues to produce, with less than 10% of the reserves remaining. It is he largest producer for OMV and they have continued to invest in the field, with recent activities focused on infill drilling. However, the government production forecast shows a steep decline, with production ceasing in 2028.

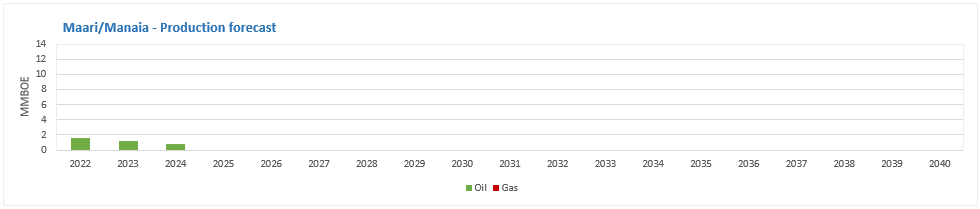

PMP 38160 (Maari/Manaia)

The development of the Maari and Manaia oil fields came onstream in 2009, with the development based on an FPSO and a wellhead platform. The field is forecast to stop production in 2024 but their may be some potential to extend this through well workovers or other brownfield works. However, the facilities approaching the end of the certified lifespan (in 2023) and may require investment to extend this. Essentially, the acquirer would be taking on some minimal late-life production and the decommissioning liability (the FPSO is operator owned).

In November 2019, OMV announced a deal to divest their 69% operated stake in the Maari-Manaia asset to Jadestone Energy for a total cash consideration of US$ 50 million, with an effective date of 1st January 2019. However, the deal was never approved by the government and both parties agreed to terminate the process in October 2022. Given the time passed and the decommissioning liability, I would now expect the asset to have a negative valuation.

PEP 60093 (Toutouwai)

The Toutouwai-1 discovery was made in April 2020, making it the first new discovery in New Zealand since 2014. However, the testing of the well had to be curtailed due to restrictions related to the COVID-19 pandemic. It seems unlikely that OMV will perform further appraisal work prior to any divestment.

Reasons to acquire

- OMV are the largest acreage holder and current producer, therefore a buyer has a great opportunity to acquire a dominant position in the country.

- The assets offer production, an undeveloped discovery and plenty of exploration acreage, giving a nice rounded and diverse portfolio.

- The assets are gas weighted and would thus fit most companies' emissions narratives.

- The gas volumes are sold into the domestic market, with bilateral contracts negotiated directly into the market. The New Zealand domestic gas market is tightening as supply declines and there is talk that LNG imports may be required. This could see an increase in gas prices.

Challenges

- Two of the three producing fields are coming towards the end of their life. Whilst there may be some upside potential, the buyer will need to carefully balance this against the decommissioning liability.

- The decommissioning regulations are pretty untested and present some challenges when it comes to maximising production vs maximising value vs recovering decommissioning costs.

- The government (and in-turn the taxpayer) have already been burnt by the collapse of Tamarind Taranaki Ltd in 2019. They had acquired 100% interest in the Tui field but went into administration after infill drilling issues. This left the government to foot the cost of decommissioning the field. They won't want a repeat and so the buyer will need to show they can cover the decommissioning liabilities.

- New Zealand public opinion is against the oil and gas industry and the government has taken a number of steps to accelerate the energy transition and limit future oil and gas activity. This included a 2018 decision to grant no new offshore oil and gas exploration permits.

- Continuing the theme of public sentiment, OMV's 2019/2020 offshore exploration campaign saw some public protests outside their New Zealand office and the boarding of a supply vessel by protestors.

Potential buyers

Unlike the Malaysian assets, I see very few companies showing an interest in the New Zealand assets. I don't see any of the existing players being of sufficient scale to take on all of these assets, and New Zealand isn't a great proposition for new entrants.

Any buyer will not only have to see value in the assets, but will also need to be of sufficient stature that they can convince the government that they can cover the decommissioning liabilities as well as invest in field life extension activities. This would rule out some of the traditional late-life players in the region.

Maybe we could see some kind of special purpose company get set up, with a focus on maximising production from the producing assets but not pursuing the exploration.