Warrego-ing crazy for the Perth basin

(Originally published on January 1, 2023)

I will be looking at the 2023 M&A potential in Australia over the next few days. But we can’t get into that until we look at the bidding war that is ongoing for Warrego Energy,

It all started in September, when Strike Energy made an all-scrip offer. This became public in mid-November and has sparked a battle that has seen rival bids from Beach Energy and Hancock Energy. Beach have since dropped out of the battle but Strike and Hancock have continued to post rival bids and state their case for why they should be selected the winner.

- Hancock’s current bid is an all-cash bid of AU$0.28/share, which values the Warrego at AU$342 million.

- Strike’s current bid is all-scrip. Based on Strike’s current share price, this would equate to AU$0.32/share.

The Warrego directors are reported to be split on their preferred bid, but we can expect a decision early in the new year. Whatever the outcome, a number of other Perth basin gas players will like the price point being established.

Why Warrego?

Warrego have assets in Western Australia and Spain but the interest, and value, in acquiring the company is essentially limited to their 50% participating interest in EP469 in the Perth Basin. This permit contains the undeveloped West Erregulla discovery. Of the bidders, Strike Energy and Beach Energy already have direct positions in the Perth basin, with Hancock Energy holding a position through a shareholding.

- Strike Energy holds the other 50% and are operator of EP469. They also hold 100% interest in a number of nearby permits including EP503 that contains the South Erregulla discovery. They also hold a 55% interest in the recently sanctioned Walyering gas project in EP447.

- Beach Energy hold a 50% interest in both the Beharra Springs project (L11/L22) and the Waitsia project (L1/L2).

- Hancock Energy are reportedly the largest shareholder in Mineral Resources (MinRes), who in turn have a shareholding in Norwest Energy. These two companies hold the rights to the Lockyer Deep permits. There is also takeover activity here, but more on that later.

Therefore, all of the bidders can make an argument that an acquisition will allow their position in the basin to grow and that there could be potential to optimize developments and share knowledge around multiple assets.

Why the Perth basin?

There are two main factors driving the current interest in the Perth basin, the first being below-ground and the second being above-ground.

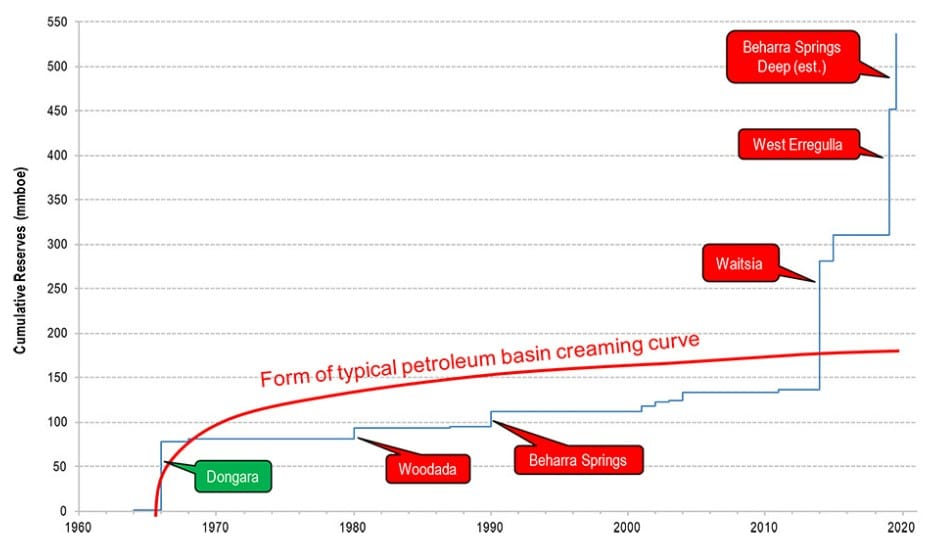

I’m no geologist but……from a below-ground perspective, the resurgence in interest in the Perth has been driven by the opening up of a new deeper play that started with the discovery of the Waitsia field in 2014, with the reservoir being over 3000m below the surface. A number of further discoveries have since been made in the same play including West Erregulla, Beharra Springs Deep, South Erregulla, Walyering and Lockyer Deep. The creaming curve below (from Norwest Energy) shows this nicely.

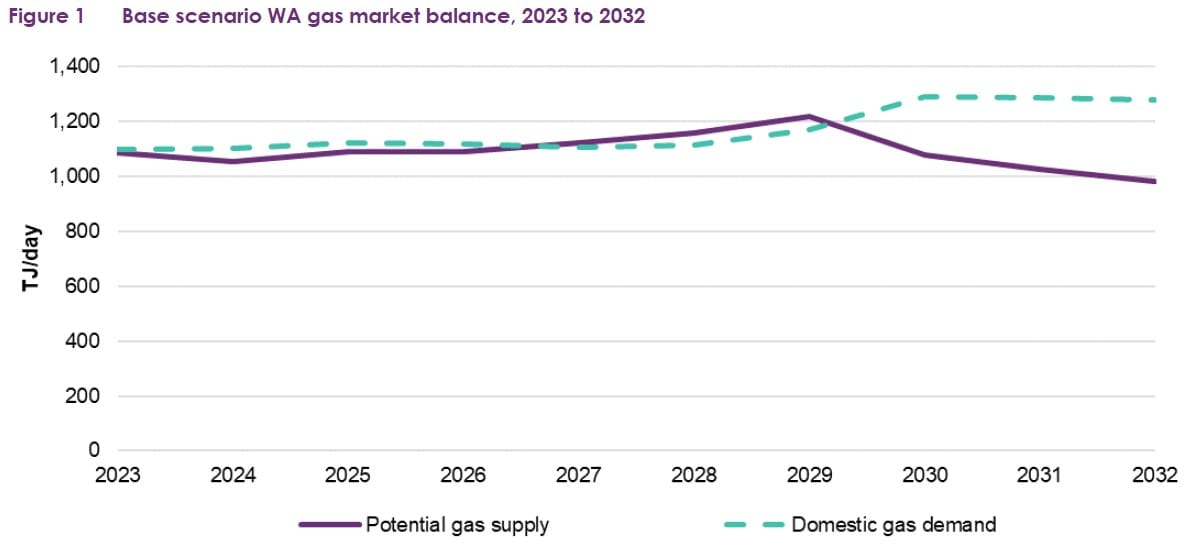

The above-ground side of things is driven by the gas market in Western Australia. I remember being at a SEAPEX meeting many moons ago where the presenter was taking up the sub-surface. However, the most common comment when chatting to folks in the room was that, whilst the geology may work, the economics would struggle due to the oversupply of gas into the WA market, making it a struggle to find a gas buyer and the price would be low. Well, many years on, and we now have a fundamental shift in the WA gas market as domgas supply from the Karratha Gas Plant (NWS LNG) has decreased from the largest domestic supplier to almost zero, leaving the supply and demand situation very tight, and forecast to remain tight. The chart below is from AEMO’s 2022 Western Australia Gas Statement of Opportunities.

This tight market has resulted in domestic gas prices increasing in WA and there is certainly potential for further price upside. The Perth basin players would also love to be able to provide backfill to some of the LNG plants, but this would require a reversal of a policy that restricts onshore production to the domestic market.

Warrego – Base valuation

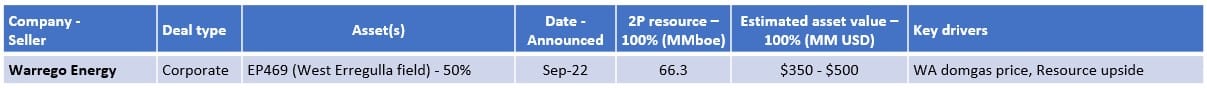

To provide a valuation, I have undertaken DCF analysis, limited to West Erregulla. The basis of my valuation is the current 2P reserve estimate and published development plans

- Updated 2P reserve estimates were published in July 2022 of 422PJ (about 398 Bcf or 66.3 MMboe).

- I have assumed the gas will be sold into the domestic market in WA, with a price assumption of AU$5.5 for 2023, then flat in real terms.

This gives a base valuation of about US$400 million for 100% for the asset, or about AU$300 million for the 50% stake held by Warrego.

Potential upside

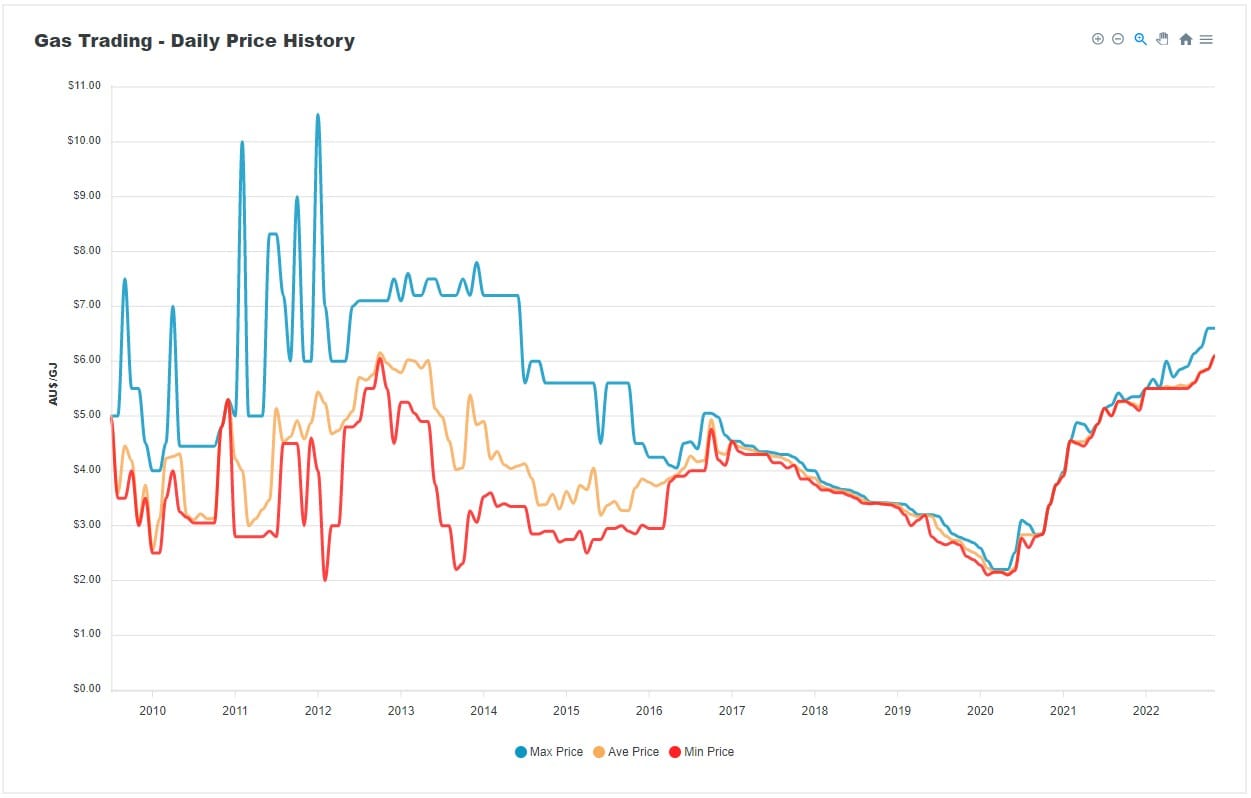

Gas in Western Australia is generally sold through bilateral agreements. Whilst some companies will publish the volumes and durations of these contracts, the price is rarely provided. However, gasTrading publish details about the spot market, including pricing, as shown below.

What next in the Perth basin

We haven’t had to wait long for the next move in the Perth basin, with Mineral Resources (MinRes) making an all-scrip offer for Norwest Energy in mid-December. Norwest hold a 20/22% stake in the EP368/EP426 permits that contain the Lockyer Deep discovery and the offer implies a price of AU$0.06/share, giving a valuation of Norwest of AU$403 million. The question coming into the new year is whether or not a rival bid will appear.

Outside of this, we could see further consolidation in the basin. The major assets will be held between a number of companies including Beach Energy, Mistui E&P and Strike Energy. There are minority partners in some of these assets with Talon Energy being the obvious choice given that they hold a 45% interest in the Walyering permit as well as another permit in the basin.

Then, depending on the outcome of the Warrego deal, there could be a number of potential future permutations for these companies.

- Win or lose, Strike Energy could be the target for a takeover by one of the other players in the basin, or a new entrant that brings capital for development.

- If Hancock Energy don’t win, then will they actively pursue other options in the basin?

- Do Beach Energy have further growth aspirations in the basin or did they spot value?

Let me know what you think.

Update - 5th January 2023

The battle of the billionaires has heated up further, with Chris Ellison and Gina Rinehart turning this into a personal battle for control in the basin.

- First, it was reported that Chris Ellison’s Mineral Resources (MinRes) had acquired a 15% of Warrego shares for AU$0.35/share.

- Then Hancock increased their bid to an all-cash bid of AU$0.36/share (up from AU$0.28/share), which values the Warrego at AU$440 million.

- Hancock also stated that they now hold more than a quarter of Warrego shares.

Where is this going to end? Where does this leave Strike Energy?